The 5 Day Breakout forex indicator for Metatrader 4 marks the 5-day high and 5-day low price using two red lines.

This is a forex breakout indicator.

Trading the 5 Day Breakout forex indicator is pretty much self-explanatory:

- A breakout buy signal occurs when price breaks and closes above the 5-day high price

- A breakout sell signal occurs when price breaks and closes below the 5-day low price

The default day breakout period is set to 5 but can be easily changed from the indicator’s inputs tab.

For instance, if you like to trade the 14 day breakout period, set the value to 14.

Free Download

Download the “5-day-breakout.mq4” MT4 indicator

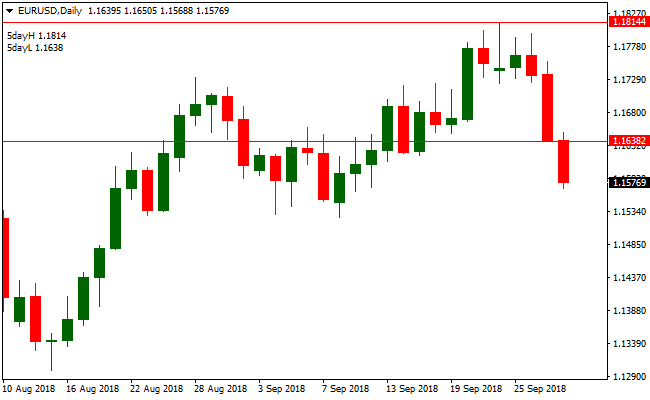

Indicator Chart (EUR/USD H1)

The EUR/USD Hourly chart below displays the 5 Day Breakout Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the 5 Day Breakout MT4 forex indicator are easy to interpret and go as follows:

Buy Signal: Initiate a long trade when price exceeds and closes above the 5-day high price red line.

Sell Signal: Initiate a short trade when price exceeds and closes below the 5-day low price red line.

Trade Exit: Use your own method of trade exit.

5‑Day High/Low Breakout + Trend Predictor MT4 Breakout Strategy

This breakout strategy uses the 5‑Day Breakout MT4 Forex Indicator and the Trend Predictor V1.0 MT4 Forex Indicator to identify high-probability breakout trades.

The 5‑Day Breakout indicator signals a bullish breakout when price closes above the 5-day high red line and a bearish breakout when price closes below the 5-day low red line.

To reduce false breakouts, the Trend Predictor confirms trend direction with blue arrows for buy and red arrows for sell.

By combining breakout signals with trend confirmation, traders can enter trades with more confidence.

This strategy works well on M5 and H1 charts, making it suitable for scalpers and intraday traders who want to catch breakout moves early.

Buy Entry Rules

- Wait until price closes above the 5‑day high red line on your chosen timeframe.

- Confirm there is a blue buy arrow from the Trend Predictor indicator.

- Enter a long trade at the next candle open after breakout and confirmation.

- Set stop loss below the breakout candle low or a few pips below the 5‑day high.

- Set take profit at the next resistance level or use a trailing stop if price continues to move favorably.

Sell Entry Rules

- Wait until price closes below the 5‑day low red line on your chart timeframe.

- Confirm there is a red sell arrow from the Trend Predictor indicator.

- Enter a short trade at the next candle open after breakdown and confirmation.

- Set stop loss above the breakout candle high or a few pips above the 5‑day low.

- Set take profit at the next support level or use a trailing stop if price continues downward.

Advantages

- Combines clear breakout signals with trend confirmation for higher reliability.

- Works well on M5 and H1 charts for intraday breakout opportunities.

- Captures strong trending moves after consolidation periods.

- Simple rules make it easy to follow and implement on multiple pairs.

- Dynamic take profit options allow adaptation to market volatility.

Drawbacks

- Breakouts can fail, and price may revert, causing false signals.

- Patience is required as breakout signals may not occur every day.

- Low volatility periods may produce few or weak signals.

Case Study 1: EUR/USD on M5

On the 5-minute EUR/USD chart, the 5-Day Breakout high line was at 1.1025.

Price closed above it at 1.1030, and a blue arrow appeared on the Trend Predictor confirming a bullish trend.

A buy trade was entered at 1.1032, stop loss set at 1.1020, and take profit at 1.1060 (a nearby resistance).

The price moved up steadily and hit the target, giving a gain of 28 pips within a few hours.

This shows how combining breakout and trend confirmation works on short timeframes.

Case Study 2: GBP/JPY on H1

On the 1-hour GBP/JPY chart, the 5-Day Breakout low line was at 161.50.

Price closed below at 161.40, and a red sell arrow appeared on the Trend Predictor.

A sell trade was opened at 161.35, stop loss at 161.85, and take profit at 160.50 (next support).

The price declined steadily, reaching the take profit for a gain of 85 pips.

Strategy Tips

- Look for breakouts that occur near the beginning of active trading sessions for higher momentum and better follow-through.

- Confirm breakout strength with volume or candlestick patterns, such as strong engulfing candles for extra reliability.

- Use higher timeframe trend direction (H4 or Daily) to filter trades and avoid entering against the major trend.

- Consider waiting for a retest of the breakout line before entering if price initially overshoots, to reduce false breakout risk.

- Set alerts on your indicators to catch breakout setups without needing to monitor the chart constantly.

- Combine the strategy with proper money management rules, such as limiting risk per trade to 1–2% of account balance.

- Be cautious during low liquidity periods, as breakouts may fail or reverse quickly.

- Keep a trading journal to track setups, outcomes, and pip gains/losses, so you can refine your entry and exit rules over time.

- Adjust stop loss and take profit dynamically based on recent volatility to avoid being stopped out prematurely.

Download Now

Download the “5-day-breakout.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Variable (Days) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Breakout