The Keltner Channel With Signals forex MT4 indicator replaces the volatility bands with real trading signals.

This Metatrader 4 indicator makes it very easy for anyone to trade successfully with Keltner Volatility Channels.

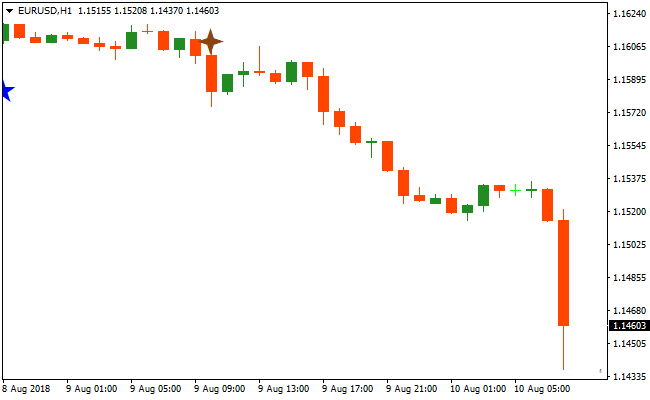

A buy signal: blue star was drawn on the chart.

A sell signal: brown start was drawn on the chart.

Free Download

Download the “keltner-channel-with-signals.mq4” MT4 indicator

Indicator Chart (EUR/USD H1)

The EUR/USD H1 chart below displays the Keltner Channel with Signals forex indicator in action.

Basic Trading Signals

Signals from the Keltner Channel With Signals forex indicator are easy to interpret and goes as follows:

Buy Signal: Open buy trade when a blue star was drawn on the chart.

Sell Signal: Open sell trade when a brown star was drawn on the chart.

Trade Exit: Close the open trade when an opposite signal occurs, or use your own method of trade exit.

Keltner Channel Signals and Vortex Oscillator MT4 Forex Strategy

This MT4 forex strategy combines the Keltner Channel With Signals MT4 Indicator with the Vortex Oscillator Indicator for MT4 to create a trend‑aligned, momentum‑filtered approach for day trading and scalping.

The Keltner Channel indicator prints blue stars for buy trend signals and brown stars for sell trend signals, while the Vortex Oscillator confirms trend direction with its histogram above or below zero.

When both tools align, you take the trade with defined risk and a clear exit plan.

This strategy works well on M5 and M15 time frames and is suited for major currency pairs and liquid cross pairs.

It helps you enter trades when both trend and momentum are aligned, reducing false entries and improving the probability of quick intraday moves.

Buy Entry Rules

- The Keltner Channel indicator prints a blue star indicating a buy trend.

- The Vortex Oscillator histogram is above zero, confirming bullish momentum.

- Enter a buy trade at the close of the candle with the blue star.

- Place the stop loss a few pips below the recent swing low.

- Exit the trade when the histogram drops below zero or when a brown star appears.

Sell Entry Rules

- The Keltner Channel indicator prints a brown star indicating a sell trend.

- The Vortex Oscillator histogram is below zero, confirming bearish momentum.

- Enter a sell trade at the close of the candle with the brown star.

- Place the stop loss a few pips above the recent swing high.

- Exit the trade when the histogram rises above zero or when a blue star appears.

Advantages

- Combines trend signals with momentum confirmation for higher probability setups.

- Visual signals help clarify trade entries and exits on fast charts.

- Adaptable to multiple intraday time frames including M5 and M15.

- Works well with major and liquid cross pairs.

- Helps avoid countertrend scalping by filtering trades that are not in line with momentum.

- Reduces guesswork during entries, making the strategy easy to follow.

- Can be combined with basic support and resistance levels for refinement.

- Provides both entry and exit cues, reducing emotional decisions.

Drawbacks

- Signals may lag slightly after strong impulsive price moves.

- False trend stars can occur during choppy or range‑bound markets.

- Requires quick decision‑making and fast execution on lower time frames.

- Stop losses must be managed carefully in volatile sessions.

Case Study 1

On EURUSD M5 during the London session, the Keltner Channel indicator printed a blue star signaling a buy trend.

Shortly after, the Vortex Oscillator histogram moved above zero confirming bullish momentum.

A long trade was entered at candle close with the stop loss placed below the recent swing low.

Price moved higher with good strength and the trade was exited when the histogram fell below zero, gaining 22 pips in a short time.

Case Study 2

On AUDUSD M15 during the New York session, the Keltner Channel printed a brown star indicating a sell trend.

The Vortex Oscillator histogram confirmed bearish momentum by staying below zero.

A sell trade was entered at the close of the signal candle with the stop loss above the recent swing high.

Price moved lower steadily and the trade was closed when a blue star appeared on the chart, securing 44 pips.

Strategy Tips

- Trade in the direction of the dominant trend on higher time frames to increase the success rate.

- Combine the strategy with recent swing highs and lows to refine stop placement.

- Focus on the most active trading hours for the chosen currency pair to catch stronger moves.

- Limit trades during sideways market conditions when the stars and histogram may give mixed signals.

- Consider partial profit-taking if price reaches a key support or resistance level before the signal flips.

- Keep position sizes small on lower time frames to manage volatility and reduce risk.

- Use alerts for star signals or histogram flips to avoid missing fast moves on lower time frames.

- Be patient and avoid overtrading, focusing only on high-probability setups where both indicators align.

Download Now

Download the “keltner-channel-with-signals.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: chart pattern

Customization options: Variable (MA_period, MA_mode, Price_mode, ATR_period, K, MultiColor, arrows) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Volatility | Alerts