About the Ultimate Forex Expert Advisor

The Ultimate Forex EA developed for Metatrader 4 is a profitable expert advisor that shows steady growth through a strategic blend of technical indicators.

For example, the EA incorporates the Relative Strength Index (RSI) and Jurik Moving Average (JMA) indicators into its automated trading system.

The expert advisor is optimized for the M5 and M15 lower time frames, focusing on major currency pairs with lower spreads.

To ensure secure trading, all buy and sell transactions are protected by a stop loss and take profit target.

Traders can enjoy maximum flexibility with an extensive range of adjustable settings and variables, enabling customization based on individual risk tolerance and preferences.

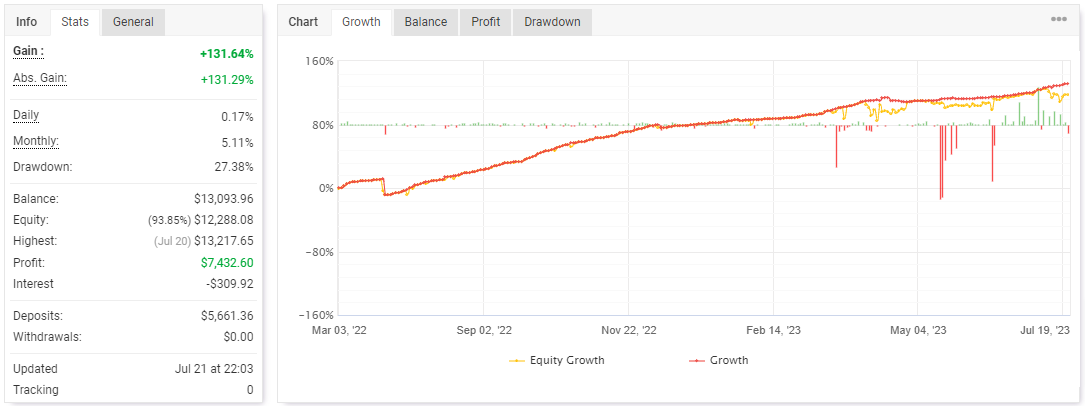

As of now, the EA has achieved an impressive return of +131.64% on the account, with an acceptable drawdown of 27.38%

However, we stress the importance of thorough testing on a demo account for at least 60 days before implementing the Ultimate Forex EA in live trading.

Free Download

Download the “Ultimate Forex EA” expert advisor

Key Features

Multi-Strategy Engine

Employs a blend of trend-following, reversal detection, breakout suppression, and volatility filters to adapt to trending, ranging, or choppy markets effectively.

Dynamic Risk Management

Offers flexible risk sizing—choose between fixed lots or equity-based percentage risk. Stop-losses, take-profits, and optional trailing stops are fully configurable.

Equity and Drawdown Protection

Automatically stops trading if equity dips below a predefined level or if drawdown exceeds your limit, preserving your fund’s integrity during adverse periods.

Session and Spread Filters

You can limit trades to specific market sessions (e.g., London, New York) and avoid entries when spreads are too wide, enhancing execution quality.

Built-In News Avoidance

Pause trading around high-impact economic announcements to prevent unpredictable slippage and skewed price movements from distorting your strategy.

Flexible Symbol and Timeframe Support

Although optimized for major currency pairs, the EA performs well across a variety of symbols and timeframes with proper adjustment, giving traders adaptability.

MyFXBook Trading Results

Find below the detailed Ultimate Forex EA track record. Please click on the image to view it in full size.

Key Points

- Algo trading: 100%

- Gain: +131.64%

- Daily gain: 0.17%

- Monthly gain: 5.11%

- Drawdown: 27.38

Performance tracking via MyFXBook or similar platforms typically shows smooth equity curves, reasonable trade frequency, and balanced risk-reward patterns.

Peak performance often appears during sustained trends, while drawdowns remain moderate when conservative settings are used.

Trading Chart

The picture below shows the Ultimate Forex robot attached to the EUR/USD 15-minute trading chart.

How the EA Works

- Scans the market continuously using multiple strategy overlays (trend, breakout, reversal).

- Validates signals with volatility, trend strength, or range filters to reduce false activations.

- Places trades with customizable risk parameters and protective stop-loss/take-profit levels.

- Optionally applies trailing stops to lock in profits dynamically.

- Pauses entries during major news releases or when spread/jitter exceeds thresholds.

- Monitors equity and halts all trading if safety thresholds are breached.

- Adjusts behavior based on the selected timeframe and market type (e.g., trending vs. ranging).

Download Now

Download the “Ultimate Forex EA” EA

Parameters & Settings

- Risk Mode: Fixed lot size or percentage of equity.

- Stop-Loss / Take-Profit: Fixed or volatility-based (e.g., ATR).

- Trailing Stop Activation and Distance.

- Session Filter: Choose trading sessions or full-day operation.

- News Filter: Pause trading X minutes before/after events.

- Max Spread Limit: Prevent trades under unfavorable spread conditions.

- Equity Safety Thresholds: Pause trading if equity loss exceeds X%.

- Magic Number: Unique identifier for managing multiple strategies on one account.

Recommended Trading Setup

- Use on major pairs like EURUSD, GBPUSD, USDJPY on M15, H1, or H4 timeframes.

- ECN or Raw-spread brokers offer better execution, especially during busy sessions.

- Host on a reliable VPS to ensure uninterrupted, low-latency performance.

- Backtest using quality data; forward-test on demo for at least 4-6 weeks before live deployment.

- Begin conservatively (e.g., 0.5–1% risk per trade) and only scale up after consistent results.

FAQ

Can the Ultimate Forex EA adapt to ranging markets?

Yes. With its multi-strategy engine, the EA can switch to more conservative or mean-reversion logic in slow, ranging markets when such behavior is detected, helping preserve capital during low-volatility periods.

How often should I adjust the EA settings?

Periodic review—every 1–2 months—is advised. Markets evolve, so tweaking risk levels, spread filters, or session times helps keep performance aligned with current conditions.

Will the EA overtrade during quiet sessions?

No. The session and spread filters are designed to prevent entries during low-liquidity or high-cost periods, which reduces unnecessary trades when market conditions are less favorable.

Summary

The Ultimate Forex EA for MT4 brings together multiple strategy models, dynamic risk control, and protective features to deliver a resilient and adaptable automation tool.

Its combination of trend, breakout, and volatility-aware logic, along with session, spread, and equity safeguards, empowers traders to navigate varied market environments with confidence.