The LRMA Bollinger Bands Metatrader 4 forex indicator consists of Bollinger Bands and the LRMA trading indicator.

Trading the LRMA BB indicator is quite similar to trading the traditional Bollinger Bands (BB) technical indicator.

The trend is up when the LRMA BB bands are pointing to the upside.

The trend is down when the LRMA BB bands are pointing to the downside.

During rising markets (rising bands), look for buy trade opportunities around the purple LRMA center line or near lower Bollinger Bands blue channel line.

Similarly, during falling markets (falling bands), look for sell trade opportunities around the LRMA center line or near the upper Bollinger Bands blue channel line.

This special version of the BB indicator can be used for all trading styles, including scalping, day trading and swing trading.

Free Download

Download the “lrma-bb-indicator.mq4” MT4 indicator

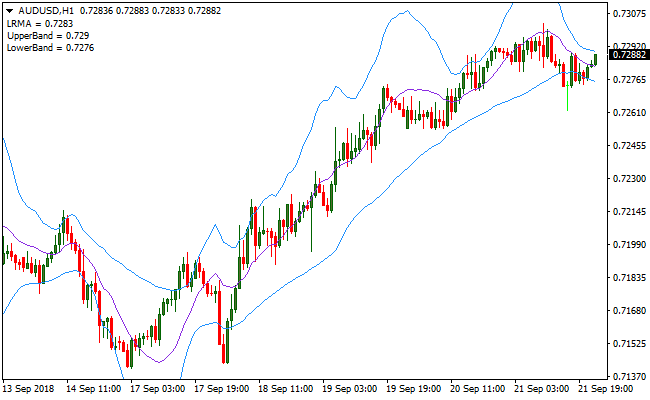

Indicator Chart (AUD/USD H1)

The AUD/USD Hourly chart below displays the LRMA Bollinger Bands Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the LRMA Bollinger Bands MT4 forex indicator are easy to interpret and goes as follows:

Buy Signal: During rising LRMA Bollinger Bands (bullish trend), look to open a buy trade near the LRMA center line. Confirm the buy trade with a bullish candlestick reversal pattern.

Sell Signal: During falling LRMA Bollinger Bands (bearish trend), look to open a sell trade near the LRMA center line. Confirm the sell trade with a bearish candlestick reversal pattern.

Trade Exit:

For buy trades, look to exit the trade near the upper BB resistance band or use your own method of trade exit.

For sell trades, look to exit the trade near the lower BB support band or use your own method of trade exit.

LRMA Bollinger Bands + 4 Moving Averages Forex Scalping Strategy

This scalping strategy combines the LRMA Bollinger Bands MT4 Indicator and the 4 Moving Averages Buy/Sell Signals MT4 Indicator to capture short-term trend moves in the market.

The LRMA Bollinger Bands show the overall trend direction based on the slope of the bands. Rising bands indicate bullish momentum, while falling bands indicate bearish momentum.

The 4 Moving Averages indicator provides fast entry signals with colored bars.

Green bars above zero signal bullish conditions, and purple bars below zero signal bearish conditions.

Combining these two indicators allows scalpers to enter trades aligned with the trend and exit quickly for small but frequent profits.

This strategy works best on lower time frames such as M1, M5, and M15.

It is designed for active traders who prefer quick trades with tight stops.

The dual confirmation reduces false signals and helps identify short-term trends in high-probability zones.

Scalpers can trade multiple currency pairs, focusing on those with good liquidity during major trading sessions.

Buy Entry Rules

- LRMA Bollinger Bands are rising, indicating a bullish trend.

- 4 Moving Averages indicator shows green bars above the zero level.

- Enter a buy trade at the open of the next candle after both conditions are met.

- Place a stop loss below the most recent swing low or below the lower Bollinger Band.

- Set take profit around 1–1.5 times the stop-loss distance or trail using the lower Bollinger Band for dynamic exit.

Sell Entry Rules

- LRMA Bollinger Bands are falling, indicating a bearish trend.

- 4 Moving Averages indicator shows purple bars below the zero level.

- Enter a sell trade at the open of the next candle after both conditions are met.

- Place a stop loss above the most recent swing high or above the upper Bollinger Band.

- Set take profit around 1–1.5 times the stop-loss distance or trail using the upper Bollinger Band for dynamic exit.

Advantages

- Helps capture short-term trends with quick entry and exit signals.

- Combining trend direction and bar confirmation reduces false scalping signals.

- Works on multiple timeframes, making it versatile for M1, M5, and M15 charts.

- Indicators are visual and easy to interpret, suitable even for beginners.

- Dynamic exit options allow traders to adapt to fast-moving markets.

- Scalable to different currency pairs, especially high-liquidity ones.

- Enables precise timing for scalp trades without relying on complex indicators.

- Can be combined with support and resistance zones for higher accuracy entries.

Drawbacks

- Rapid price spikes may trigger stops prematurely, especially on low liquidity pairs.

- Requires constant monitoring and fast reaction due to small profit targets.

- May underperform during news events unless you avoid trading during major releases.

- Not ideal for traders who prefer longer-term positions or automated strategies without supervision.

- Profit potential per trade is limited, so risk-reward management is essential.

Example Case Study 1

On EURUSD M5, the LRMA Bollinger Bands were rising and the 4 Moving Averages indicator displayed green bars above zero.

A buy trade was entered at 1.1025 with a stop loss at 1.1015 and a take profit at 1.1047.

The trade moved in favor over the next 15 minutes, achieving a 22-pip gain.

The combination of the rising bands and green bar confirmation ensured entry during a short-term bullish spike.

Example Case Study 2

On GBPUSD M1, the LRMA Bollinger Bands were falling and the 4 Moving Averages indicator displayed purple bars below zero.

A sell trade was entered at 1.2480 with a stop loss at 1.2488 and take profit at 1.2465.

Within 10 minutes, the price moved down and hit the take profit for a 15-pip gain.

Scalping with both indicators allowed the trader to capture a quick trend move while avoiding minor counter-trend bounces.

Strategy Tips

- Rising LRMA Bollinger Bands indicate bullish momentum; falling bands indicate bearish momentum.

- Confirm trend direction with the 4 Moving Averages indicator before entering.

- Focus on highly liquid pairs such as EURUSD, GBPUSD, and USDJPY during major sessions.

- Keep risk per trade low, around 1% of your account, since scalping involves frequent trades.

- Combine with session timing to avoid choppy conditions during low-volume periods.

- Use trailing stops along the Bollinger Bands to lock in profits when trends continue.

- Avoid trading during major economic news releases unless prepared for higher volatility.

- Backtest the strategy on each pair to understand typical pip ranges and best time frames.

Download Now

Download the “lrma-bb-indicator.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Variable (LRMA period, Bands) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Trend