The Pivot Darma technical indicator for MT4 displays the daily open + support and resistance levels on the chart.

It is a great indicator for all kind of forex breakout traders.

Price above the daily open price is said to be bullish. Conversely, price below the daily open price is said to be bearish.

Buy: Breakout traders wait to open a buy trade until the price crosses and closes above the Pivot Darma resistance line.

Sell: Breakout traders wait to open a sell trade until the price crosses and closes below the Pivot Darma support line.

For scalping and day trading, use the indicator on the 15-minute, 30-minute and hourly chart during the London and New York trading sessions.

Free Download

Download the “pivot-darma.mq4” MT4 indicator

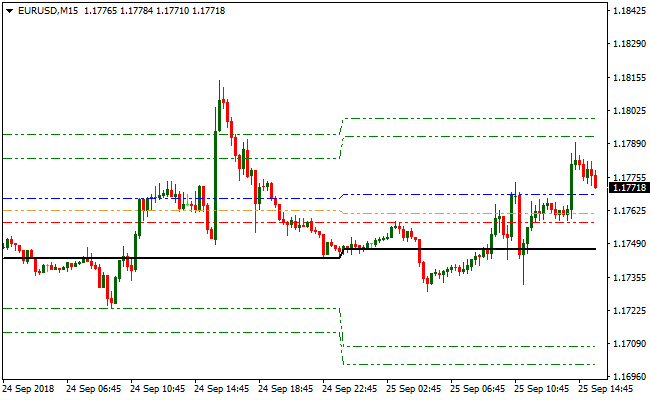

Indicator Chart (EUR/USD M15)

The EUR/USD 15-Minute chart below displays the Pivot Darma Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the Pivot Darma MT4 forex indicator are easy to interpret and goes as follows:

Buy Signal: Open a buy trade position when the pair crosses and closes above the Pivot Darma resistance line.

Sell Signal: Open a sell trade position when the pair crosses and closes below the Pivot Darma support line.

Trade Exit: Close the open buy/sell trade when an opposite signal occurs, or use your own method of trade exit.

Pivot Darma + HalfTrend 1.02 Forex Day Trading Strategy

This MT4 day trading strategy combines trend levels from the Pivot Darma indicator with entry signals from theHalfTrend 1.02 with Arrows indicator.

The Pivot Darma indicator identifies the overall trend: bullish when price is above the resistance line and bearish when price is below the support line.

HalfTrend 1.02 provides precise buy and sell signals with blue and magenta arrows.

This strategy is suitable for intraday trading on M15 and H1 charts and focuses on trend-following trades with clear entry and exit rules.

Buy Entry Rules

- Price must be above the Pivot Darma resistance line, indicating a bullish trend.

- Wait for a blue buy arrow from HalfTrend 1.02.

- Enter a long trade at candle close when both conditions are met.

- Place stop loss below the recent swing low or Pivot Darma support line.

- Take profit at the next resistance level or when a magenta sell arrow appears.

Sell Entry Rules

- Price must be below the Pivot Darma support line, indicating a bearish trend.

- Wait for a magenta sell arrow from HalfTrend 1.02.

- Enter a short trade at candle close when both conditions are met.

- Place stop loss above the recent swing high or Pivot Darma resistance line.

- Take profit at the next support level or when a blue buy arrow appears.

Advantages

- Helps filter trades in the direction of the main trend, reducing the chance of counter-trend losses.

- Visual arrows from HalfTrend 1.02 make entries easy to identify without complex calculations.

- Pivot Darma levels act as natural support and resistance, assisting with stop loss and take profit placement.

- Can be applied on multiple timeframes for both M15 and H1 intraday trading.

- Combines trend direction and entry confirmation in a single strategy for higher probability trades.

- Reduces guesswork by clearly indicating bullish and bearish conditions based on price relative to Pivot Darma levels.

- Works well on major currency pairs with good liquidity, providing consistent trading opportunities.

Drawbacks

- May produce delayed signals during sudden trend reversals, causing missed entries or late exits.

- Pivot Darma levels may not always adapt quickly to rapid price movements, especially on lower timeframes.

- Not ideal for very short-term scalping unless combined with additional confirmation tools.

Case Study 1: Buy Trade

On an M15 chart for EUR/USD, the price was trading above the Pivot Darma resistance line, indicating a bullish trend.

At the same time, a blue buy arrow appeared from the HalfTrend 1.02 indicator, confirming a strong upward momentum.

A buy trade was entered at 1.10415 with a stop loss placed at 1.10400 below the recent swing low.

The price continued to climb, and the trade was successfully closed for a 30-pip profit at 1.10715 when a magenta sell arrow appeared, signaling a potential reversal.

Case Study 2: Sell Trade

On an H1 chart for GBP/USD, the price was trading below the Pivot Darma support line, signaling a bearish trend.

Concurrently, a magenta sell arrow appeared from the HalfTrend 1.02 indicator, confirming strong downward momentum.

A sell trade was opened at 1.25445 with a stop loss placed at 1.25470 above the recent swing high.

The price dropped steadily, and the trade was closed for a 45-pip profit at 1.24995 when a blue buy arrow appeared, indicating a potential trend reversal.

Strategy Tips

- Focus on major currency pairs like EUR/USD, GBP/USD, and USD/JPY for better liquidity and tighter spreads.

- Confirm the trend on a higher timeframe before taking trades on M15 or H1 charts.

- Enter trades only when both the Pivot Darma trend condition and the HalfTrend arrow signal align.

- Set stop losses according to recent swing highs/lows or Pivot Darma levels to protect capital.

- Take profit at the next support/resistance level or when an opposite HalfTrend arrow appears.

- Avoid trading during major news releases to reduce the risk of false signals and sudden spikes.

- Keep a trading journal to track which sessions and pairs perform best with this strategy.

- Adjust stop loss and take profit based on pair volatility and market conditions to maintain a good reward-to-risk ratio.

- Be patient and wait for clear signals rather than chasing trades during indecisive market conditions.

Download Now

Download the “pivot-darma.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Variable (Change day hour, daily open, support, resistance) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Pivot | Support | Resistance