About the Optimized AMA Indicator

The Optimized AMA indicator for MT4 is an enhanced version of the original AMA (Adaptive Moving Average) tool.

It provides clear trend-following signals through blue and red dots directly on the chart, making it easy for traders to spot bullish and bearish opportunities.

Blue dots indicate potential buy trades, while red dots indicate potential sell trades.

The indicator can be used alone or combined with other technical tools to improve signal reliability and align trades with overall market trends.

The default settings can be adjusted in the inputs tab, allowing traders to customize the indicator to their preferred strategy, timeframe, and risk tolerance.

Free Download

Download the “ama-optimized-indicator.mq4” MT4 indicator

Key Features

- Displays trend-following buy (blue) and sell (red) dots on the chart.

- Signals are easy to interpret for traders of all experience levels.

- Can be used standalone or with other technical indicators.

- Fully adjustable input settings for custom strategies.

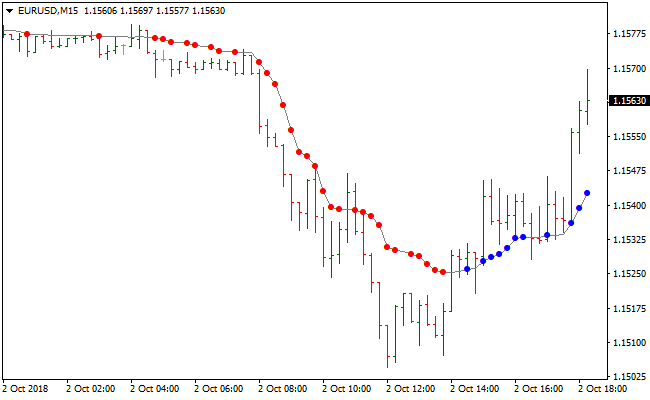

Indicator Chart

The Optimized AMA chart shows price with blue and red dots marking trend direction.

Blue dots indicate bullish opportunities, while red dots indicate bearish opportunities.

Traders can follow these dots to enter and exit trades in line with the major currency trend.

Guide to Trade with Optimized AMA Indicator

Buy Rules

- Wait for the dot to change from red to blue.

- Confirm the trend is upward using other indicators or price action.

- Enter a buy trade at the color change.

Sell Rules

- Wait for the dot to change from blue to red.

- Confirm the trend is downward using other indicators or price action.

- Enter a sell trade at the color change.

Stop Loss

- For buy trades, place the stop-loss slightly below the most recent swing low or support level.

- For sell trades, place the stop-loss slightly above the most recent swing high or resistance level.

- Adjust stops according to market volatility and timeframe.

Take Profit

- Close buy trades when an opposite sell signal occurs.

- Close sell trades when an opposite buy signal occurs.

- Optional: use support/resistance levels or partial profit-taking for trade exits.

Optimized AMA + Murrey Math Support and Resistance Forex Strategy

This MT4 strategy combines the Optimized AMA MT4 indicator and the Murrey Math Support and Resistance MT4 indicator.

The Optimized AMA indicator provides buy and sell signals with blue dots for bullish trades and red dots for bearish trades.

The Murrey Math indicator draws support and resistance levels which can be used to trade market bias.

In bullish trends, buy trades are taken near support levels and profits are taken near the next resistance.

In bearish trends, sell trades are taken near resistance levels and profits are taken near the next support.

This strategy works well on M15 and H1 charts and is suitable for major currency pairs with clear intraday trends.

Buy Entry Rules

- The Optimized AMA indicator displays a blue dot, signaling a buy opportunity.

- The overall trend is bullish, identified by price staying above key Murrey Math support levels.

- Enter a long trade after the blue dot appears and price is near or bouncing off a Murrey Math support level.

- Place a stop loss a few pips below the nearest Murrey Math support line.

- Take profit near the next Murrey Math resistance level or allow the trade to run while the bullish trend remains strong.

Sell Entry Rules

- The Optimized AMA indicator displays a red dot, signaling a sell opportunity.

- The overall trend is bearish, identified by price staying below key Murrey Math resistance levels.

- Enter a short trade after the red dot appears and price is near or rejecting from a Murrey Math resistance level.

- Place a stop loss a few pips above the nearest Murrey Math resistance line.

- Take profit near the next Murrey Math support level or let the trade run while the bearish trend remains strong.

Advantages

- Combines precise entry signals from Optimized AMA with trend bias and levels from the Murrey Math indicator.

- Clear guidance for both bullish and bearish trends using support and resistance levels.

- Effective on multiple currency pairs, including EURUSD, GBPUSD, USDJPY, and AUDUSD.

- Works on M15 and H1 charts, suitable for intraday and short-term swing trading.

- Allows traders to manage exits based on actual market structure rather than fixed risk-to-reward rules.

Drawbacks

- Less effective in choppy or range-bound markets where the price frequently oscillates between levels.

- Stop losses may be triggered by sudden spikes near support or resistance levels.

- Requires patience to wait for the signal dot near the key Murrey Math levels.

Example Case Study 1 (EURUSD M15 bullish trade)

On EURUSD M15, a blue dot appeared from the Optimized AMA indicator at 1.1050.

The overall trend was bullish, with price bouncing near the Murrey Math support line at 1.1045.

A long trade was entered at 1.1052 with a stop loss at 1.1040.

Price moved to the next Murrey Math resistance at 1.1075, capturing 23 pips.

The bullish trend remained intact, allowing the trade to continue to 1.1085 for additional profit.

Example Case Study 2 (GBPUSD H1 bearish trade)

On GBPUSD H1, a red dot appeared from the Optimized AMA indicator at 1.2655.

The overall trend was bearish, with price rejecting near the Murrey Math resistance at 1.2660.

A short trade was entered at 1.2654 with a stop loss at 1.2670.

Price declined to the next Murrey Math support level at 1.2620, capturing 34 pips.

The bearish trend continued, allowing further downward movement to 1.2605 for additional profit.

Strategy Tips

- Focus on trading pairs with strong intraday trends for better signal reliability.

- Wait for Optimized AMA dots to appear near Murrey Math levels to improve entry accuracy.

- Monitor higher time frame trends to align trades with the main market direction.

- Use trailing stops once the trade moves in your favor to maximize profits while respecting support and resistance levels.

- Trade during active market sessions when price respects Murrey Math levels for more predictable moves.

- Use multiple time frame analysis to filter entries and ensure trend consistency.

Download Now

Download the “ama-optimized-indicator.mq4” Metatrader 4 indicator

FAQ

Can Optimized AMA be used alone?

Yes, it works as a standalone trend-following indicator, but combining it with other tools can improve signal accuracy and reduce false entries.

Which timeframes are best for this indicator?

The indicator works on all timeframes. Scalpers often use M5–M15, while day traders and swing traders may prefer H1–H4 charts.

Can I customize the signals?

Yes, traders can modify the input settings, including sensitivity and period, to match their preferred trading style.

Summary

The Optimized AMA indicator for MT4 provides a straightforward trend-following system that makes it easy for Forex traders to identify bullish and bearish opportunities using color-coded dots.

This indicator is ideal for traders seeking a simple, visual method to follow market trends.

Its flexible settings and clear signals allow traders to adjust strategies for different timeframes and trading styles, helping improve trade timing and alignment with the trend.

Traders can use the Optimized AMA alone or alongside other confirmation tools to increase confidence in entries and exits while tracking market momentum efficiently.