The ATR Trailing Stop Metatrader 4 forex indicator is a stop and reverse trend following indicator based on Average True Range.

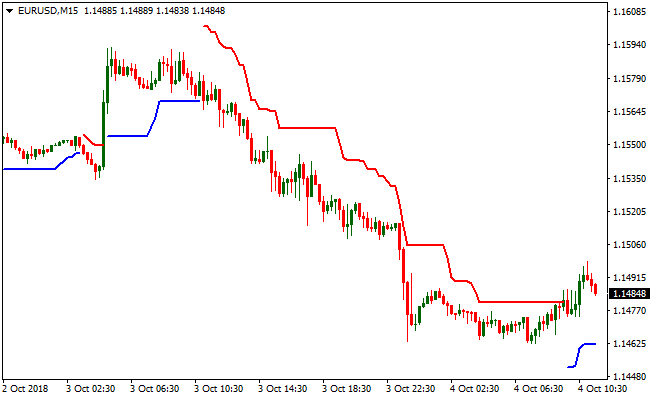

The forex indicator draws buy and sell signal lines below and above the currency pair.

- A blue colored line aligned below price is considered a buy trade signal

- A red colored line aligned above price is considered a sell trade signal

For buy trades, place a stop-loss 2 pips below the blue ATR Trailing Stop signal line and trail it up, but keep the SL 2 pips below the blue line.

For sell trades, place a stop-loss 2 pips above the red ATR Trailing Stop signal line and trail it down, but keep the SL 2 pips above the red line.

This simple forex system works well for scalpers and day traders.

Free Download

Download the “atr-trailing-stop.mq4” MT4 indicator

Indicator Chart (EUR/USD M15)

The EUR/USD 15-Minute chart below displays the ATR Trailing Stop Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the ATR Trailing Stop MT4 forex indicator are easy to interpret and go as follows:

Buy Signal: Open buy trade position when the color of the ATR Trailing Stop indicator changes from red to blue, this is a bullish trend.

Sell Signal: Open sell trade position when the color of the ATR Trailing Stop indicator changes from blue to red, this is a bearish trend.

Trade Exit: Close the open buy/sell trade when an opposite signal occurs, or use your own method of trade exit.

ATR Trailing Stop + Zone Trade Forex Scalper MT4 Strategy

This MT4 scalping strategy combines the ATR Trailing Stop MT4 indicator and the Zone Trade Forex Scalper MT4 indicator.

The ATR Trailing Stop shows a blue line below price for bullish trends and a red line above price for bearish trends.

The Zone Trade Scalper signals entries using green candlesticks for buys and red candlesticks for sells.

This strategy is ideal for M1 and M5 charts and designed for scalpers looking for quick trend-aligned trades.

Buy Entry Rules

- The ATR Trailing Stop line is blue, indicating a bullish trend.

- The Zone Trade Forex Scalper displays a green candlestick, signaling a buy.

- Enter a long trade immediately after the green candlestick closes, confirming bullish momentum.

- Place a stop loss a few pips below the ATR Trailing Stop line or below the recent swing low.

- Take profit at 8–15 pips on M1 charts or 15–25 pips on M5 charts, or trail stop as long as the blue ATR line remains below price and green signals continue.

Sell Entry Rules

- The ATR Trailing Stop line is red, indicating a bearish trend.

- The Zone Trade Forex Scalper displays a red candlestick, signaling a sell.

- Enter a short trade immediately after the red candlestick closes, confirming bearish momentum.

- Place a stop loss a few pips above the ATR Trailing Stop line or above the recent swing high.

- Take profit at 8–15 pips on M1 charts or 15–25 pips on M5 charts, or trail stop while the red ATR line remains above price and red signals continue.

Advantages

- Combines trend confirmation with precise scalping signals to reduce false entries.

- Works well on multiple pairs such as EURUSD, GBPUSD, USDJPY, and AUDUSD.

- Provides clear stop loss levels via the ATR line, adapting to market volatility.

- Simple to follow, suitable for fast-paced scalping on M1 and M5 charts.

Drawbacks

- Less effective in ranging markets where price oscillates around the ATR line.

- Requires quick execution to capture small pip targets.

- High frequency trades may increase costs due to spreads and commissions.

Example Case Study 1 (EURUSD M1 bullish scalp)

On EURUSD M1, the ATR Trailing Stop line turned blue indicating an upward trend.

The Zone Trade Scalper showed a green candlestick at 1.1052.

A buy trade was entered immediately.

Stop loss was set at 1.1048, 4 pips below the ATR line.

Price moved quickly to 1.1065, reaching 13 pips profit before partial profit was taken.

The blue ATR line remained below price, confirming trend continuation.

Example Case Study 2 (GBPJPY M5 bearish scalp)

On GBPJPY M5, the ATR Trailing Stop line turned red, indicating a downward trend.

The Zone Trade Scalper displayed a red candlestick at 155.50.

A short trade was entered immediately.

Stop loss was placed at 155.70, 20 pips above the ATR line.

Price dropped to 155.10, netting 40 pips before partial exit.

The red ATR line stayed above price, confirming the bearish trend.

Strategy Tips

- Trade pairs with active price movement during the most volatile trading sessions to improve scalping effectiveness.

- Ensure both the ATR trend line and the Zone Trade candlestick signal align before entering trades.

- Use proper position sizing relative to stop loss distance to manage risk on small time frames.

- Skip trades if the ATR line is flat or candlestick signals are inconsistent with the trend.

- Focus on fast execution and monitor spreads carefully to avoid slippage on M1 and M5 charts.

Download Now

Download the “atr-trailing-stop.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Variable (Back period, ATR period, Factor) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: trend