The Auto Fibonacci Trading Zones technical forex indicator for Metatrader 4 draws two interesting trading zones on the activity chart, together with the most significant Fibonacci levels.

This indicator makes it easy to spot overbought and oversold trading zones on the chart.

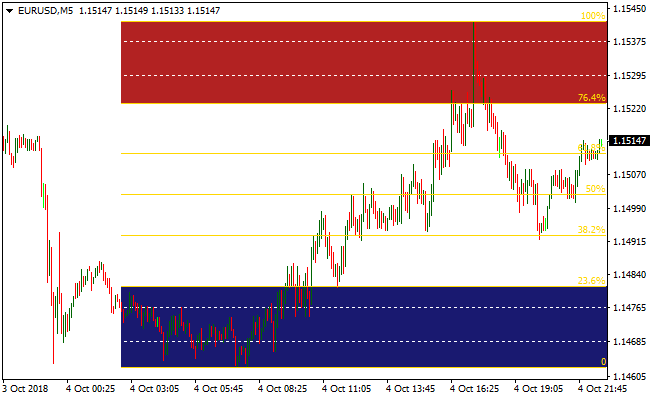

The blue trading zone is considered support. Here, traders look for buy trade opportunities when the overall market trend is upward.

The red trading zone is considered resistance. Here, traders look for sell trade opportunities when the overall market trend is downward.

The trading zones’ colors can be changed directly from the indicator’s inputs tab.

Free Download

Download the “autofibo-trading-zones.mq4” MT4 indicator

Indicator Chart (EUR/USD M5)

The EUR/USD 5-Minute chart below displays the Auto Fibonacci Trading Zones Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the Auto Fibonacci Trading Zones MT4 forex indicator are easy to interpret and go as follows:

Buy Signal: Initiate buy trade when price reaches the blue buy zone and the overall market trend is upward. Use other technical tools to confirm the buy trade.

Sell Signal: Initiate sell trade when price reaches the red sell zone and the overall market trend is downward. Use other technical tools to confirm the sell trade.

Trade Exit: Close the open buy/sell trade when an opposite signal occurs, or use your own method of trade exit.

Auto Fibonacci Trading Zones + German Sniper MT4 Strategy

This MT4 strategy combines the Auto Fibonacci Trading Zones MT4 indicator and the German Sniper MT4 indicator.

The Auto Fibonacci indicator identifies blue trading zones as support and red trading zones as resistance.

Traders look for buy opportunities in the blue zones when the market trend is upward and sell opportunities in red zones when the trend is downward.

The German Sniper indicator provides precise entry signals using the “SMART BUY” yellow line for buy trades and the “SMART SELL” yellow line for sell trades.

This strategy works best on M15 and H1 charts and is suitable for swing or short-term traders.

Buy Entry Rules

- Price is within or near the blue Fibonacci trading zone, which acts as support.

- The overall market trend is upward, as identified by price action or higher time frame analysis.

- The German Sniper indicator displays the “SMART BUY” yellow line.

- Enter a buy trade after the confirmation candle closes above or near the support zone.

- Place a stop loss below the blue trading zone or below the most recent swing low.

- Take profit near the next red Fibonacci trading zone (resistance) or use a fixed reward-to-risk ratio.

- Or trail stop while price stays above support and the German Sniper signal remains active.

Sell Entry Rules

- Price is within or near the red Fibonacci trading zone, which acts as resistance.

- The overall market trend is downward.

- The German Sniper indicator displays the “SMART SELL” yellow line.

- Enter a sell trade after the confirmation candle closes below or near the resistance zone.

- Set stop loss above the red trading zone or above the recent swing high.

- Take profit near the next blue Fibonacci trading zone (support) or use a fixed reward-to-risk ratio.

- Or trail stop while price stays below resistance and the German Sniper signal remains active.

Advantages

- Combines dynamic support and resistance zones with precise entry signals.

- Reduces false entries by requiring both zone confirmation and German Sniper signal alignment.

- Adaptable to multiple pairs including EURUSD, GBPUSD, AUDJPY, and USDCHF.

- Clear trade management using defined zones for stop loss and take profit.

Drawbacks

- In ranging markets, signals may trigger within zones without significant follow-through.

- Requires patience to wait for German Sniper confirmation in the correct zone.

- May produce fewer trades since both zone and indicator must align.

Example Case Study 1 (EURUSD H1 bullish trade)

On EURUSD H1, price retraced to the blue Fibonacci trading zone near 1.1000.

The overall trend was upward. The German Sniper indicator displayed a “SMART BUY” yellow line.

A confirmation candle closed above the support zone and a buy trade was entered at 1.1005.

Stop loss was placed at 1.0980, 25 pips below.

Price rallied to the next red zone near 1.1060, capturing 55 pips before partial profit was taken.

The German Sniper signal remained active and the trend continued higher.

Example Case Study 2 (GBPJPY M15 bearish trade)

On GBPJPY M15, price reached the red Fibonacci trading zone at 155.50.

The overall trend was downward. The German Sniper indicator displayed the “SMART SELL” yellow line.

A confirmation candle closed below the resistance zone and a sell trade was entered at 155.48.

Stop loss was set at 155.75, 27 pips above.

Price dropped to the next blue support zone at 154.80, netting 68 pips before a partial exit.

The trend continued downward while the signal remained valid.

Strategy Tips

- Prefer trading during active sessions when major pairs show clear swings.

- Wait for the German Sniper signal to confirm entry in the correct Fibonacci zone to reduce false signals.

- Consider scaling out positions as price approaches the next zone to secure profit.

- Monitor candle behavior near zone boundaries to avoid entries against strong momentum reversals.

Download Now

Download the “autofibo-trading-zones.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Variable (Fibonacci period, buy zone color, sell zone color) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: fibonacci