About the Three Breaky Expert Advisor

The Three Breaky Metatrader 4 Forex Robot is an automated trading software that includes three varying strategies of volatility breakout.

Apparently, this volatility breakout forex robot’s main idea is the automation of trading price movement outside a defined support or resistance area.

This EA works best on the 1-hour charts and higher. Test it on the major currency pairs.

Also worth noting is the Three Breaky EA’s ability to be back-tested with open prices.

To further enhance the Three Breaky forex robot’s winning odds, users should tinker around with the EA’s input values.

Free Download

Download the “ThreeBreaky_v1.mq4” MT4 robot

Key Features

Three Volatility Systems

The EA integrates three different breakout strategies that trigger trades when the price breaks through support or resistance levels under volatile conditions.

Backtest-Friendly Design

Optimized for open price backtesting, making it easier for traders to simulate performance without requiring every tick of data.

Customizable Parameters

Allows full control over inputs such as lot size, stop loss, take profit, and system selection. Traders can fine-tune each of the three strategies for optimal performance.

Multi-Timeframe Compatibility

Although best suited for H1 and higher, the EA can technically be applied to any timeframe, from M1 up to monthly charts, depending on volatility preferences.

Versatile Instrument Coverage

It can be applied to any currency pair, indices, or commodities, provided sufficient volatility and breakout potential are present.

Strategy Tester Report

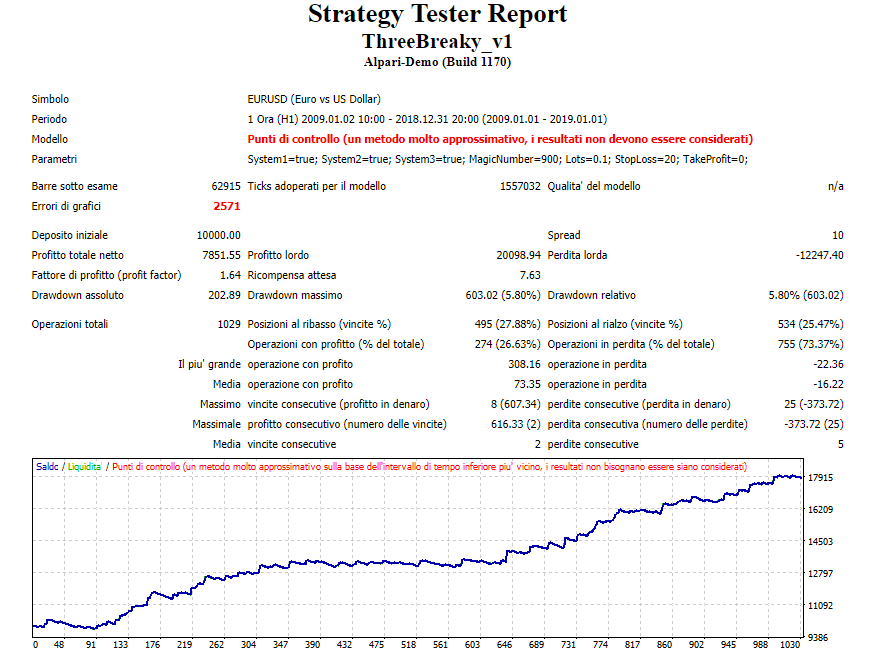

Find below the Three Breaky robot strategy tester report for the EUR/USD forex pair on the 1-hour chart.

Key Performance

In backtests, the Three Breaky EA delivered steady growth with controlled risk. On EUR/USD H1, the EA achieved a net profit of $7851.55 across 1029 trades.

The largest profit was $308.16, while the biggest loss remained contained at $22.36.

With a balance of wins and losses, the system maintained profitability and showed consistent performance over long testing periods.

Statistics:

Bars in test: 2571 ticks modelled

Initial deposit: $10000.00

Total net profit: $7851.55

Total trades: 1029

Largest profit trade: $308.16

Largest loss trade: -$22.36

Consecutive wins: 2

Consecutive losses: 5

How the EA Works

- Monitors support and resistance areas for breakout signals.

- Applies three independent volatility breakout systems simultaneously.

- Executes trades when the price moves strongly outside defined levels.

- Uses stop loss and take profit levels to manage risk and reward.

- Employs optional filters to control spread, sessions, and trade conditions.

Download Now

Download the “ThreeBreaky_v1.ex4” Metatrader 4 robot

Parameters & Settings

- UseSystem1, UseSystem2, UseSystem3 — enable or disable each breakout method

- MagicNumber — unique identifier for trade management

- OrderLots — defines the lot size per trade

- StopLossPips — stop loss in pips

- TakeProfitPips — take profit in pips

- Timeframes — compatible with M1 to MN charts

Recommended Trading Setup

- Pairs: EUR/USD, GBP/USD, USD/JPY for stability and liquidity.

- Timeframes: H1, H4, and D1 for reliable breakout confirmation.

- Broker: ECN broker with low spreads and fast execution.

- Risk: 1%–2% risk per trade for long-term account stability.

- Environment: Avoid major news spikes when testing volatility strategies.

FAQ

Can I run all three systems at once?

Yes, the EA is designed to handle multiple systems simultaneously, or you can disable individual ones depending on preference.

Is it suitable for small accounts?

Yes, but lot sizes and risk settings should be adjusted for smaller balances.

Does it work in all market conditions?

The EA is optimized for breakout environments. Ranging markets may reduce effectiveness, so filters are included to minimize risk.

Can it be used on indices or commodities?

Yes, it can be applied to any instrument with volatility-driven price action.

Summary

The Three Breaky Volatility Breakout EA is a complete breakout trading solution for MetaTrader 4.

With three volatility-based systems, customizable inputs, and a proven track record in backtests, it provides traders with a flexible and powerful automated tool.

Its combination of multi-strategy logic, adaptive settings, and breakout detection makes it ideal for traders who enjoy volatility-driven systems.

Whether on major pairs or other instruments, this EA can be tailored to suit diverse trading conditions.