About the Day Trading Expert Advisor

The Day Trading Metatrader 4 Forex Robot is an automated forex trading software that trades with a popular day trading strategy as the building block for its algorithm that delivers buy/sell market entry and exit signals.

The Forex robot is known to work best on the 1-day time frame on major currency pairs like the EUR/USD, GBP/USD, USD/CAD, USD/JPY, AUD/USD, and others.

You can experiment with cross pairs as well, such as GBP/JPY and EUR/JPY.

With a push of a button, the Day Trading expert advisor runs nonstop, entering, exiting, and managing positions that are signaled by the mathematical algorithm applied to previous price history.

The robot is known to move to its initial stop to break even in order to remove the risk from the open trade.

Free Download

Download the “Day Trading.mq4” MT4 robot

Key Features

Automated Day Trading

This EA automatically identifies potential day trading opportunities, executes trades, and manages positions throughout the trading day, allowing you to focus on other tasks.

Customizable Risk Management

Adjust parameters such as stop loss, take profit, and trailing stop to suit your risk tolerance and trading objectives.

Multiple Currency Pair Compatibility

While optimized for major currency pairs like EUR/USD, GBP/USD, and USD/JPY, the EA can be applied to other pairs, depending on market conditions.

Optimized for MT4 Platform

Seamlessly integrates with MetaTrader 4, leveraging its advanced charting tools and execution capabilities.

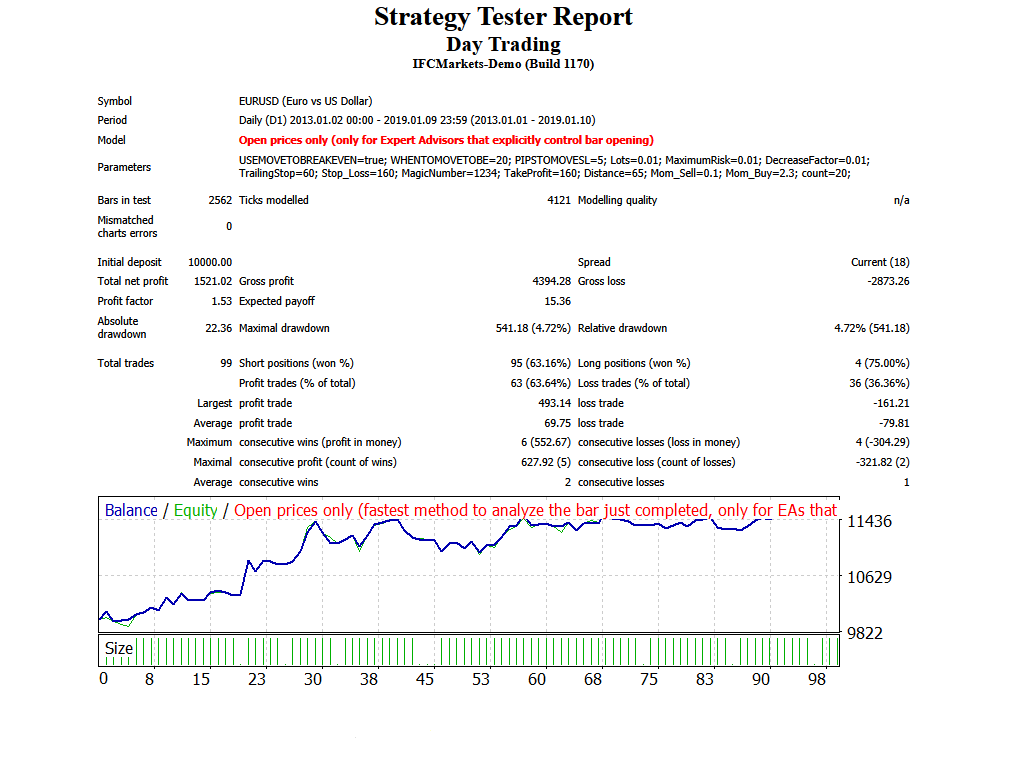

Strategy Tester Report

Find below the Day Trading forex robot strategy tester report for the EUR/USD forex pair on the daily chart.

Key Performance

The EA made a total profit of $1521.02 from a total of 99 trades.

The largest winning trade generated $493.14 in profits, while the largest losing trade generated a loss of $161.21.

Statistics:

Bars in test: 2562 ticks modelled

Initial deposit: $10000.00

Total net profit: $1521.02

Total trades: 99

Largest profit trade: $493.14

Largest loss trade: -$161.21

Consecutive wins: 2

Consecutive losses: 1

How the EA Works

- Monitors the M1 and M5 timeframes for price movements.

- Applies a strategy based on moving averages and RSI indicators.

- Executes buy or sell orders when specific conditions are met.

- Utilizes stop loss, take profit, and trailing stop for risk management.

- Operates during major trading sessions to ensure liquidity.

Download Now

Download the “Day Trading.ex4” Metatrader 4 robot

Parameters & Settings

- Stop Loss: 30 pips

- Take Profit: 50 pips

- Trailing Stop: 20 pips

- Moving Average Period: 14

- RSI Period: 14

- RSI Overbought Level: 70

- RSI Oversold Level: 30

Recommended Trading Setup

- Timeframe: M1 and M5

- Currency Pairs: EUR/USD, GBP/USD, USD/JPY

- Broker: Choose a broker with low spreads and fast execution

- Account Type: Standard or ECN account

- Leverage: 1:100 to 1:500

FAQ

How does the Day Trading EA decide when to enter a trade?

The EA analyzes market trends using moving averages and RSI indicators, entering positions when predefined conditions signal a potential profitable move.

Can I run this EA on multiple accounts at the same time?

Yes, you can run the EA on multiple accounts or currency pairs, but ensure your broker supports simultaneous execution for smooth performance.

What makes this EA suitable for beginners?

The EA is fully automated, requiring minimal manual intervention. Beginners can rely on it to execute trades while learning intraday trading concepts.

Will the EA work during all market sessions?

It is designed to perform optimally during major trading sessions when liquidity is high, such as the London and New York sessions.

Is it possible to adjust the EA’s risk settings?

Absolutely. Traders can customize stop loss, take profit, and trailing stop levels to match their risk tolerance and account size.

Summary

The Day Trading MetaTrader 4 Forex Robot is an advanced automated trading tool designed for traders who prefer to open and close positions within the same trading day.

By leveraging a strategy based on moving averages and RSI indicators, the EA identifies optimal entry and exit points to capture intraday market movements.

With customizable risk management features and positive backtest results, this EA can be a valuable addition to your trading strategy.