The strong currency versus weak currency MT4 forex indicator scans 7 currencies for you.

The list of scanned currencies: USD, EUR, NZD, CHF, JPY, GBP and AUD.

It will display the strongest versus the weakest currencies in one easy to read small dashboard window directly visible on the main Metatrader 4 chart.

It can be used for scalping, day trading, swing trading and position trading on all time frames.

Free Download

Download the “I_CloseDifference_v-08.mq4” MT4 indicator

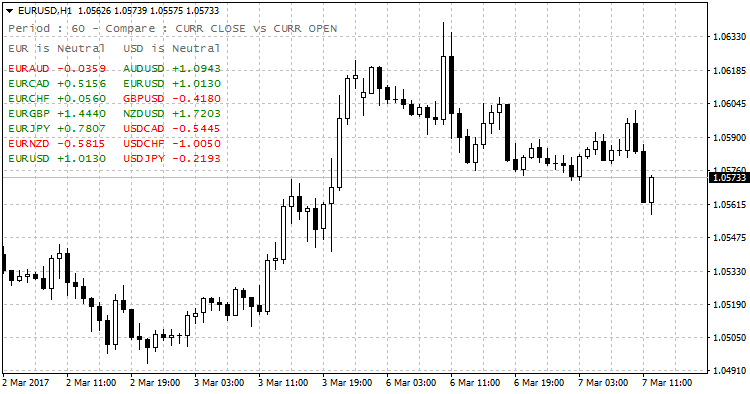

Indicator Chart (EUR/USD H1)

The EUR/USD H1 chart below shows this currency’s forex indicator in action.

Basic Trading Signals

To make the most out of this forex indicator, you will need to check the indicator for strong versus weak currencies.

Obviously, you go long the strongest currency versus the weakest of short the weakest currency versus the strongest.

For scalping and day trading, load the indicator onto the 1-minute and 5-minute charts.

For swing trading, use the hourly chart.

For position trading, load it onto the 4-hour or daily chart.

Strong vs Weak Currency Indicator and Volty Channel Forex Reversal Strategy for MT4

This MT4 forex strategy combines directional bias from the Strong Currency Versus Weak Currency MT4 Forex Indicator with dynamic exit management using the Volty Channel Signals MT4 Forex Indicator.

The strength indicator continuously scans USD, EUR, NZD, CHF, JPY, GBP and AUD to identify the strongest and weakest currencies, allowing traders to trade only pairs with an imbalance.

The Volty Channel indicator then provides precise momentum signals and color changes that help manage entries and exits more effectively.

This strategy is suitable for scalping and short term trading on M5 and M15 charts and works best during active market sessions.

Buy Entry Rules

- Identify the strongest currency versus the weakest using the strength indicator.

- Select a currency pair where the strongest currency is the base and the weakest is the quote.

- Wait for a blue dot from the Volty Channel Signals indicator.

- Enter a buy trade at the close of the candle with the blue dot.

- Place a stop loss a few pips below the most recent swing low.

- Take profit when the Volty Channel signal changes from blue to red.

Sell Entry Rules

- Identify the weakest currency versus the strongest using the strength indicator.

- Select a currency pair where the weakest currency is the base and the strongest is the quote.

- Wait for a red dot from the Volty Channel Signals indicator.

- Enter a sell trade at the close of the candle with the red dot.

- Place a stop loss a few pips above the most recent swing high.

- Take profit when the Volty Channel signal changes from red to blue.

Advantages

- Uses real-time currency strength to trade only the most imbalanced pairs.

- Dynamic take profit adapts to market momentum instead of fixed targets.

- Helps capture larger moves when trends extend.

- Reduces premature exits during strong directional moves.

- Effective for both scalping and short intraday trades.

Drawbacks

- Profit size can vary depending on how quickly color changes occur.

- Color changes may lag slightly during fast reversals.

- Requires active trade monitoring until exit signal appears.

Example Case Study 1

On EURUSD M5 during the London session, EUR was ranked as the strongest currency and USD as the weakest.

A blue Volty dot appeared after a brief pullback and a buy trade was opened.

Price continued to trend higher for several candles.

Instead of exiting early, the trade was held until the Volty signal changed from blue to red, locking in a 22 pip profit.

The dynamic exit allowed the trend to fully develop.

Example Case Study 2

On GBPJPY M15, the strength indicator showed GBP weakening while JPY remained strong.

A red Volty dot appeared near a minor retracement and a sell trade was entered.

Price moved steadily downward and the position remained open until the Volty color switched from red to blue.

The trade closed with a 38 pip gain, capturing the core of the bearish move without guessing the exit.

Strategy Tips

- Let the Volty color change handle exits to avoid emotional decision making.

- Stronger currency imbalances often lead to longer Volty color persistence.

- Avoid closing trades early unless market conditions change significantly.

- Review past trades to understand how long color phases usually last.

- Use consistent position sizing to manage variable profit outcomes.

Download Now

Download the “I_CloseDifference_v-08.mq4” Metatrader 4 indicator

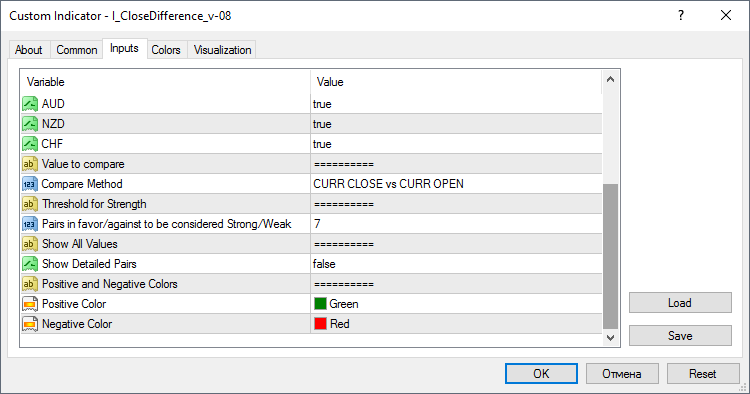

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: chart pattern indicator

Customization options: Variable (Currencies to Analyse, Value to compare, Compare Method, Treshold for Strength, Show Detailed Pairs) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Currency Weak vs Strong