The RSI (Relative Strength Index) forex MT4 indicator is a very popular indicator used for currency trading that was originally developed by J. Welles Wilder.

RSI is used in a lot of forex strategies and systems to scan and display oversold and overbought market conditions.

The RSI oscillator oscillates between 0 and 100.

The 0 value is considered to be extremely oversold and the 100 value extremely overbought.

Use this indicator together with a trend-following indicator such as moving average, ADMI, Bollinger Bands,… for more reliable forex trading signals.

This indicator is useful for scalpers, day traders, swing traders and position traders on any currency pair.

Free Download

Download the “RSI.mq4” MT4 indicator

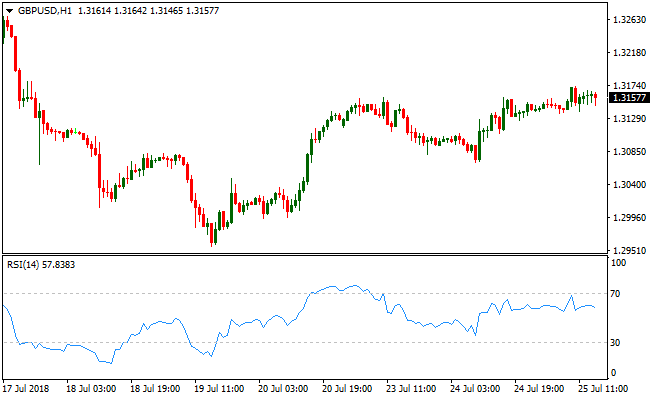

Indicator Chart (GBP/USD H1)

The GBP/USD H1 chart below displays the RSI forex indicator in action.

Basic Trading Signals

Trading signals from the RSI indicator are simple to interpret and goes a follows:

Buy Trade: RSI falls below 30 and then rises above

Sell Trade: RSI rises above 70 and then falls below

Tip: Add a longer period moving average (SMA or EMA type) to the trading chart and trade in the overall direction of the trend indicated by the moving average.

Trend up? Only trade RSI buy signals and avoid its sell signals

Trend down? Only trade RSI sell signals and avoid its buy signals

RSI Indicator and Fibonacci MTF Channel Forex Trend Strategy for MT4

This MT4 forex strategy combines the RSI Relative Strength Index Metatrader 4 Forex Indicator with the Fibonacci MTF Channel Metatrader 4 Forex Indicator to capture entries that align with both momentum and trend direction.

The Fibonacci MTF Channel helps identify the overall market bias by showing an upward slope for bullish conditions and a downward slope for bearish conditions.

The RSI indicator signals potential entry points when it moves out of oversold territory for buys or drops back down from overbought levels for sells.

This approach works well on timeframes such as M15 and H1 where intraday moves have enough room to develop while still offering frequent setups.

It works most effectively on major and cross currency pairs such as USDJPY, EURJPY, GBPJPY, EURAUD, and NZDUSD, where the trend and RSI signals tend to align clearly and produce more reliable trading opportunities during the day.

Buy Entry Rules

- The Fibonacci MTF Channel indicator must be upward sloping, indicating a bullish trend.

- The RSI must fall below 30 and then rise back above 30, signaling a recovery from oversold conditions.

- Enter a buy trade at the close of the candle where the RSI crosses above 30 while the channel remains bullish.

- Place a stop loss below the nearest swing low or just below the lower channel boundary to limit risk.

- Exit the trade when the RSI enters overbought territory (above 70) followed by a drop back below 70, or when the channel flattens or turns downward.

Sell Entry Rules

- The Fibonacci MTF Channel indicator must be downward sloping, indicating a bearish trend.

- The RSI must rise above 70 and then fall below 70, signaling exhaustion of bullish pressure and a shift toward bearish momentum.

- Enter a sell trade at the close of the candle where the RSI crosses below 70 while the channel remains bearish.

- Place a stop loss above the nearest swing high or just above the upper channel boundary to manage risk.

- Exit the trade when the RSI falls into oversold territory (below 30) followed by a rise back above 30, or when the channel flattens or turns upward.

Advantages

- Aligns momentum signals from RSI with the prevailing trend direction shown by the Fibonacci MTF Channel.

- Helps avoid countertrend trades by requiring trend confirmation first.

- Flexible exit rules let you stay in strong moves until momentum weakens.

- Applicable to multiple major forex pairs and suitable for M15 and H1 timeframes.

- Helps capture intraday swings without overtrading minor price noise.

Drawbacks

- RSI signals can lag in fast, volatile markets causing delayed entries.

- Trend may flatten shortly after entry, resulting in early exits or smaller profits.

- During sideways markets, signals can give whipsaws if the channel does not remain consistent.

- Requires patience to wait for both trend direction and RSI confirmation to align.

Case Study 1

On USDJPY H1 during the Tokyo to London overlap, the Fibonacci MTF Channel showed a consistent upward slope as price remained above higher channel bands.

During a mild pullback, the RSI dipped below 30 and later crossed back above 30, signaling renewed buying interest.

A long entry was taken at the close of the confirming candle.

Price continued higher and ultimately reached a zone where RSI entered overbought territory and then dipped back below 70, signaling an exit.

This move resulted in a gain of approximately 40 pips before market momentum began to slow.

Case Study 2

On EURAUD M15 during the London session, the Fibonacci MTF Channel was clearly downward sloping as price maintained lower lows and lower highs.

RSI rose above 70, signaling a brief retracement within the downtrend, and then fell back below 70 confirming bearish continuation.

A short trade was entered at the close of that candle.

Price continued lower for roughly 35 pips before RSI entered oversold territory and then rose back above 30, indicating it was time to exit.

The stop loss above the recent swing high was not tested during this move.

Strategy Tips

- Only take buy signals when the Fibonacci MTF Channel shows a clear upward slope and sell signals when it is clearly downward sloping.

- Wait for clean RSI crosses back above 30 for buys and below 70 for sells to avoid false signals in choppy ranges.

- Aim to trade during major session overlaps for stronger trend moves and more reliable signals.

- Adjust stop loss placement based on recent swing points and channel boundaries rather than fixed pip amounts.

- Be patient and allow trades time to develop; avoid closing too early if momentum remains strong.

- If the channel starts to flatten after entry, consider tightening stops to protect profits.

Download Now

Download the “RSI.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: chart pattern indicator

Customization options: Variable (RSI Period) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Oscillator