About the Power of JPY Indicator

The Power of JPY Forex indicator for Metatrader 4 measures the real-time relative strength of the Japanese Yen across the Forex market.

It helps traders identify whether the JPY is gaining or losing momentum against other major currencies.

This information allows you to focus only on currency pairs where the Yen has a meaningful advantage.

When the indicator moves above the zero level, the Japanese Yen is considered strong.

When it moves below the zero level, the Yen is considered weak.

By trading strong currencies against weak ones, you align your positions with broader market flows instead of random price movements.

The indicator is especially useful for trading pairs such as USD/JPY, EUR/JPY, GBP/JPY, and AUD/JPY.

It works on all time frames and can be used by scalpers, day traders, and swing traders.

For best results, many traders confirm entries with price action or additional technical tools.

Free Download

Download the “Power_of_JPY.ex4” Metatrader 4 indicator

Key Features

- Measures Japanese Yen strength in real time.

- Uses the zero level to define strong and weak conditions.

- Works on all JPY-related currency pairs.

- Compatible with all time frames.

- Can be combined with other indicators or strategies.

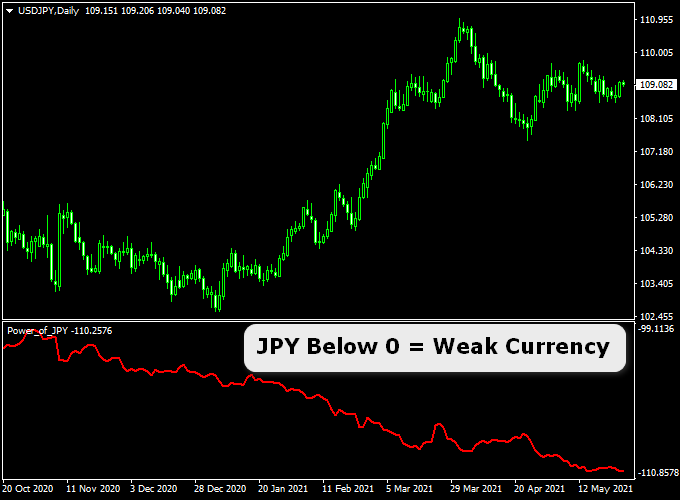

Indicator Chart

The chart displays the Power of JPY indicator beneath the main price chart.

The line fluctuates above and below the zero level to reflect Yen strength.

When strength shifts, traders can prepare for potential buy or sell opportunities on JPY pairs.

Guide to Trade with the Power of JPY Indicator

Buy Rules

- Open a buy trade when the Power of JPY line crosses above the 0.00 level.

- Confirm that the opposing currency is showing weakness.

Sell Rules

- Open a sell trade when the Power of JPY line crosses below the 0.00 level.

- Confirm that the opposing currency is showing strength.

Stop Loss

- For buy trades, place the stop loss below the most recent swing low.

- For sell trades, place the stop loss above the most recent swing high.

Take Profit

- Set take profit near the next key support or resistance level.

- Alternatively, trail the stop loss as price moves in your favor.

Power of JPY Indicator + Forex Trend Scanner MT4 Scalping Strategy

This scalping strategy combines the Power of JPY Forex Indicator for MT4 with the Forex Trend Scanner MT4 Indicator.

The Power of JPY measures the relative strength of the Japanese yen against other major currencies.

A cross above the 0.00 level indicates yen strength, while a cross below shows weakness.

The Forex Trend Scanner displays candle colors on the chart: green candles mark a bullish trend, and red candles indicate bearish momentum.

When these two indicators align, traders can catch short bursts of strong price movement on M5 or M15 charts.

This system is designed for short-term scalping with clear visual signals and minimal lag,

ideal for traders who prefer fast-paced setups on JPY-based pairs like USDJPY, EURJPY, or GBPJPY.

Buy Entry Rules

- The Power of JPY crosses below the 0.00 level, showing JPY weakness against the counter currency (for example, USDJPY becomes bullish when JPY weakens).

- The Forex Trend Scanner displays green candles, confirming a bullish market bias.

- Enter a buy trade when both indicators align on the same or consecutive candles on the M5 or M15 chart.

- Place stop loss 10–15 pips below the latest swing low (on M5) or 20–25 pips below (on M15), depending on volatility.

- Set a take profit target between 20–40 pips for M5 or 40–60 pips for M15.

- Or exit the trade when the Power of JPY rises above 0.00 or the Trend Scanner changes to red candles.

Sell Entry Rules

- The Power of JPY crosses above the 0.00 level, showing JPY strength against the counter currency (for example, USDJPY becomes bearish when JPY strengthens).

- The Forex Trend Scanner displays red candles, confirming bearish momentum.

- Enter a sell trade when both signals align on the same or consecutive candles on the M5 or M15 time frame.

- Set stop loss about 10–15 pips above the most recent swing high (on M5) or 20–25 pips (on M15).

- Take profit between 20–40 pips (M5) or 40–60 pips (M15).

- Or close the position when the Power of JPY drops below 0.00 or the candles turn green again.

Advantages

- Combines fundamental strength data (JPY strength/weakness) with clear visual trend confirmation (colored candles).

- Ideal for fast scalping during high-volume sessions such as Tokyo or London overlap.

- Easy to read visually—both indicators display intuitive color cues and clear threshold levels.

- Works effectively on volatile JPY pairs like GBPJPY and EURJPY, offering strong directional moves for short-term trades.

Drawbacks

- In quiet or sideways markets, both indicators may produce choppy signals and lead to false entries.

- The system performs best when volatility is high; during flat Asian sessions, it may underperform.

- Strong news events (such as BOJ announcements) can cause sudden reversals that invalidate signals.

- Late signals may occur when trend candles shift color after a large price move, reducing potential reward.

Case Study 1: USDJPY M5 Trade

During the Tokyo session, the Power of JPY dropped below 0.00, signalling yen weakness.

On the USDJPY M5 chart, the Forex Trend Scanner printed green candles.

The trader entered a buy at 151.30 with a 15-pip stop loss.

Price quickly rose to 151.65, achieving a 35-pip profit before the candles turned red, prompting an exit.

Case Study 2: GBPJPY M15 Trade

In the London session, the Power of JPY moved above 0.00, showing yen strength.

The Forex Trend Scanner switched to red candles.

A short position was entered at 188.90 with a stop loss at 189.15 (25 pips).

The pair dropped to 188.30 within 40 minutes, securing 60 pips before the candles reverted to green.

Strategy Tips

- Focus on pairs where the yen is the quote currency (USDJPY, GBPJPY, EURJPY) for the cleanest signals.

- Trade during high liquidity hours, such as the Tokyo or early London session, when JPY pairs are most active.

- Always verify that the Power of JPY movement is consistent with other JPY pairs before entering trades.

- Use a higher time frame (H1) to confirm the dominant direction before taking scalps on M5 or M15.

- Adjust take profit levels based on volatility; GBPJPY tends to move faster than USDJPY, so use wider targets.

- When the Forex Trend Scanner changes color but the Power of JPY remains on the same side of 0.00, consider waiting for confirmation before reversing direction.

- Keep your spreads and execution speed tight; every pip matters in scalping.

- Avoid trading near high-impact Japanese news events like BOJ rate decisions or inflation releases.

- Use trailing stops once the trade moves in profit by at least 20 pips to lock in gains.

- Backtest across several JPY pairs and note which ones produce the most stable results under this strategy.

Download Now

Download the “Power_of_JPY.ex4” MT4 indicator

FAQ

Which currency pairs work best with the Power of JPY indicator?

The indicator performs best on pairs that include the Japanese Yen, such as USD/JPY, EUR/JPY, GBP/JPY, and AUD/JPY.

These pairs respond strongly to shifts in Yen strength.

Can the Power of JPY indicator be used for scalping?

Yes, it can be used on lower time frames like M1 and M5.

Scalpers often combine it with session timing and price action for faster entries.

Is it necessary to use another indicator for confirmation?

While the indicator can be used on its own, many traders prefer to confirm entries with support and resistance or trend analysis.

This helps filter lower-quality trades.

Summary

The Power of JPY Forex indicator is a practical tool for traders who focus on currency strength analysis.

It helps identify high-probability setups by highlighting when the Japanese Yen is strong or weak.

The indicator is flexible across time frames and trading styles.

With proper confirmation and risk management, it can become a reliable part of a rule-based trading approach.