About the Market Cycles V1 Forex Indicator

The Market Cycles V1 Forex Indicator for Metatrader 4 is a short-term trading tool built to help scalpers identify recurring price cycles in ranging markets.

It uses three moving average bands with different periods to visualize shifts in short-term momentum.

These bands work together to signal when price is transitioning from one micro-cycle to another.

The indicator is plotted in a bottom chart window, keeping the main price chart clean and focused.

When all cycles align in the same direction, traders receive a straightforward buy or sell signal.

This makes the indicator suitable for fast-paced trading styles where decisions need to be made quickly.

Market Cycles V1 is especially useful during low to moderate volatility sessions where price tends to oscillate within defined ranges.

Free Download

Download the “Market Cycles V1.ex4” MT4 indicator

Key Features

- Displays three moving average cycles in a separate window.

- Designed specifically for short-term scalping strategies.

- Provides frequent intraday trade opportunities.

- Performs best in sideways and consolidating markets.

- Simple color-based signals for fast decision-making.

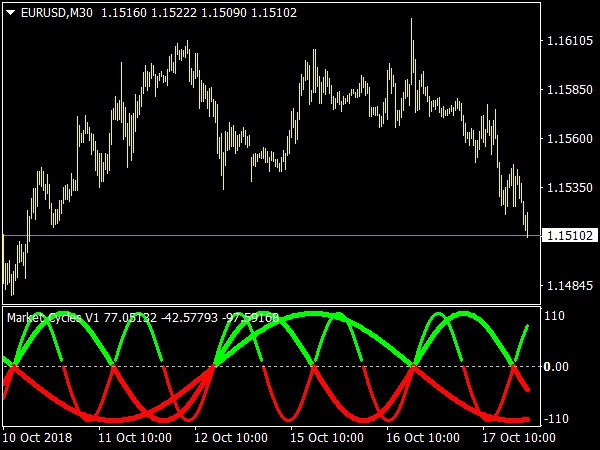

Indicator Chart

The Market Cycles V1 Forex Indicator is shown in a bottom chart window beneath price.

The chart displays three moving average bands that change color based on market direction.

When all cycles turn green or red, traders can quickly assess short-term bias and timing.

Guide to Trade with Market Cycles V1 Forex Indicator

Buy

- Open a buy trade when all market cycles are colored green.

- Confirm that price is moving within a range or short-term consolidation.

Sell

- Open a sell trade when all market cycles are colored red.

- Avoid entries during strong trending conditions.

Stop Loss

- Place the stop loss 1–3 pips below short-term support for buy trades.

- Place the stop loss 2–3 pips above short-term resistance for sell trades.

Take Profit

- Close buy trades after achieving 5–15 pips profit.

- Close sell trades after achieving 5–15 pips profit.

- Adjust targets based on spread and session volatility.

Market Cycles V1 + Trend Finder Forex Day Trading Strategy for MT4

This day trading strategy combines the Forex Market Cycles V1 MT4 Indicator with the Trend Finder MT4 Indicator.

The Market Cycles indicator shows the overall market condition: when all cycles turn green, it signals a bullish trend; when all cycles turn red, it signals a bearish trend.

The Trend Finder indicator provides precise trend entry signals: a blue line crossing the red line from below confirms a bullish trend, while a blue line crossing the red line from above confirms a bearish trend.

This strategy works best on H1 and H4 charts for day trading, focusing on major currency pairs.

It is suitable for traders who prefer clear trend direction confirmation and structured entries rather than scalping quick moves.

By combining market cycles with trend crossovers, you reduce false signals and increase the probability of catching strong intraday trends.

Buy Entry Rules

- Confirm that all Market Cycles are colored green, indicating a bullish market.

- Wait for the Trend Finder blue line to cross the red line from below, signaling bullish trend confirmation.

- Enter a buy trade at the market once both conditions are met.

- Place a stop-loss a few pips below the recent swing low or a significant support level.

- Take profit can be set near the next major resistance or pivot level, or exit the trade when the Trend Finder line crosses red from above.

Sell Entry Rules

- Confirm that all Market Cycles are colored red, indicating a bearish market.

- Wait for the Trend Finder blue line to cross the red line from above, signaling bearish trend confirmation.

- Enter a sell trade at the market once both conditions are met.

- Place a stop-loss a few pips above the recent swing high or a significant resistance level.

- Take profit can be set near the next major support or pivot level, or exit when the Trend Finder line crosses blue from below.

Advantages

- Combines overall market trend with precise entry signals for higher probability trades.

- Reduces false entries by requiring full market cycle confirmation plus Trend Finder crossover.

- Suitable for day trading on major currency pairs and H1/H4 charts.

- Helps traders stay aligned with market momentum rather than trading counter-trend moves.

Drawbacks

- Trades may be fewer since both indicators must align, possibly missing minor trend moves.

- Stop-loss and take profit need careful placement to avoid being stopped out during normal intraday volatility.

- Not ideal for very short time frames (M5/M15) as signals can lag.

Case Study 1 – EUR/USD H1

On 7 September at 09:00 GMT, all Market Cycles turned green, indicating bullish conditions.

Shortly after, the Trend Finder blue line crossed the red line from below at 1.1005.

A buy trade was entered at 1.1006. Stop-loss was set at 1.0985, just below the recent swing low.

The price steadily moved upward, hitting the next resistance at 1.1040 within four hours, capturing 34 pips.

The Trend Finder line remained bullish during this move, confirming the trend and allowing the trade to reach its target.

Case Study 2 – GBP/USD H4

On 10 September at 12:00 GMT, all Market Cycles turned red, indicating bearish conditions.

The Trend Finder blue line crossed the red line from above at 1.2508, confirming the bearish trend.

A sell trade was entered at 1.2507. Stop-loss was placed at 1.2530 above the recent swing high.

Price moved downward steadily, reaching 1.2455 over the next six hours, producing a 52 pip profit.

The Trend Finder line stayed red until the exit, ensuring a clean and profitable trade aligned with the overall market trend.

Strategy Tips

- Focus on major pairs during high liquidity hours to maximize trend moves.

- Only take trades when both Market Cycles and Trend Finder indicators align.

- Use recent swing highs/lows or pivot points for precise stop-loss placement.

- Consider trailing stops on larger H1/H4 moves to lock in profits as the trend continues.

- Backtest this strategy on your preferred pairs and time frames to adjust pip targets and stop-loss levels.

Download Now

Download the “Market Cycles V1.ex4” MT4 indicator

FAQ

What type of market is best suited for Market Cycles V1?

The indicator performs best in ranging or mildly volatile markets.

It is not designed to capture long-term trends.

How many trades can this indicator generate in one session?

During active trading hours, it can produce multiple trade setups.

The exact number depends on volatility and timeframe selection.

Can Market Cycles V1 be used on higher timeframes?

It is optimized for lower timeframes such as M1 to M15.

Higher timeframes may reduce signal frequency and effectiveness.

Is confirmation from other indicators necessary?

While not required, some traders combine it with support and resistance or session timing for added confidence.

Summary

The Market Cycles V1 Forex Indicator for MT4 is a practical scalping tool that focuses on short-term price cycles.

Its three-band moving average system delivers quick visual signals that are easy to follow.

For traders who prefer fast trades and modest pip targets, this indicator offers a focused approach to intraday market movement.

With disciplined execution and proper risk control, it can enhance consistency in ranging conditions.