About the Accumulation 1.2 Divergence Forex Indicator

The Accumulation 1.2 Divergence Forex Indicator for Metatrader 4 is a divergence-based technical tool designed to uncover hidden market strength and weakness.

By comparing price movement with indicator behavior, it helps traders anticipate potential reversals before they fully develop.

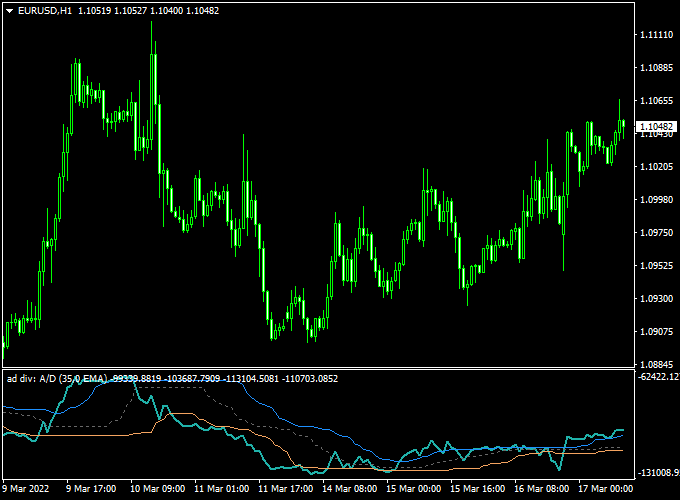

This indicator is plotted in a separate bottom window and uses multiple signal lines that interact with each other.

When these lines cross, they highlight bullish or bearish divergence scenarios, giving traders a visual and objective way to time entries.

Because divergence is a universal market concept, the Accumulation 1.2 indicator can be applied across different strategies, timeframes, and currency pairs.

It works equally well as a confirmation tool or as a primary signal generator.

Free Download

Download the “Accumulation 1.2 divergence.mq4” MT4 indicator

Key Features

- Detects bullish and bearish divergences.

- Clear signal line crossovers.

- Displayed in a separate indicator window.

- Suitable for trend reversal and pullback trading.

- Works on all MT4 timeframes and instruments.

Indicator Display

The Accumulation 1.2 Divergence indicator appears in the bottom chart window as multiple colored signal lines.

Crossovers between these lines correspond to divergence signals forming on the main price chart.

This clean layout allows traders to quickly identify potential opportunities without cluttering the primary trading chart.

How to Trade with Accumulation 1.2 Divergence Indicator

Buy

- Wait for the light sea green signal line to cross above the blue line.

- Confirm that price is forming bullish divergence against recent lows.

- Enter a buy trade after the crossover is confirmed.

Sell

- Wait for the light sea green signal line to cross below the brown line.

- Confirm that price is forming bearish divergence against recent highs.

- Enter a sell trade after the crossover is confirmed.

Stop Loss

- Place the stop loss below key support for buy trades.

- Place the stop loss above key resistance for sell trades.

Take Profit

- Aim for a minimum risk-to-reward ratio of 2.0.

- Consider exiting near previous swing levels.

- Trail the stop if the trade develops into a strong trend.

Accumulation Divergence + SuperTrend NRP MT4 Scalping Strategy

This MT4 scalping strategy combines the Accumulation 1-2 Divergence Forex Indicator and the SuperTrend NRP Forex Indicator for clear entry points aligned with the market trend.

It works best on M5 and M15 charts, but can also be applied on H1 for longer intraday trades.

This approach is ideal for traders looking for simple signals with high probability setups.

The strategy works because it combines momentum and trend confirmation.

The Accumulation Divergence indicator signals possible trend reversals or continuations, while the SuperTrend NRP ensures trades are only taken in the direction of the main trend.

Using both together reduces false signals and increases the chance of capturing quick market moves.

Buy Entry Rules

- Enter a buy when the light sea green signal line on the Accumulation Divergence indicator crosses the blue line from bottom to top.

- Confirm that the SuperTrend NRP line is green, showing a bullish trend.

- Place the stop loss just below the recent swing low.

- Take profit near the next resistance level or after a significant upward move identified on the chart.

- Alternatively, use 1 to 2 times the ATR value as a dynamic take profit.

Sell Entry Rules

- Enter a sell when the light sea green signal line on the Accumulation Divergence indicator crosses the brown line from top to bottom.

- Confirm that the SuperTrend NRP line is orange, indicating a bearish trend.

- Place the stop loss just above the recent swing high.

- Take profit near the next support level or after a significant downward move.

- ATR can also be used for dynamic exits.

Advantages

- Easy-to-read signals reduce trading stress.

- Combining momentum and trend filters out poor trades.

- Works on multiple time frames from M5 to H1.

- Simple setup suitable for beginners and intermediate traders.

- Can be used for scalping and short intraday trades.

Drawbacks

- Short-term charts can be noisy and produce occasional false signals.

- Requires discipline in placing stops and following exit rules.

- Spreads and slippage can reduce profits on lower time frames.

- Not ideal during low volatility periods or very flat markets.

Example Case Studies

Case Study 1 – EUR/USD M5

On November 7th, the light sea green line crossed the blue line from bottom to top at 1.0985.

The SuperTrend NRP line was green, confirming a bullish trend.

A buy trade was entered at 1.0985 with a stop loss at 1.0978, just below the recent swing low.

The next resistance level was at 1.1008.

The price moved quickly, hitting take profit at 1.1008 for a gain of 23 pips within 45 minutes.

Using the SuperTrend to confirm the trend prevented entering early during minor pullbacks.

Case Study 2 – GBP/USD M15

On October 18th, the light sea green line crossed the brown line from top to bottom at 1.2512 while the SuperTrend NRP line turned orange.

A sell trade was opened at 1.2512 with a stop loss at 1.2520, just above the recent swing high.

The next support level was at 1.2489.

The trade reached take profit at 1.2489, capturing 23 pips in 70 minutes.

This example shows how the combination of divergence and trend confirmation provides reliable entry signals.

Strategy Tips

- Wait for both the Accumulation Divergence signal and the SuperTrend confirmation before entering.

- Adjust stop loss and take profit according to volatility and recent support/resistance levels.

- Trade currency pairs with good volatility for faster scalping opportunities.

- Check for major news events that can increase risk and create unpredictable moves.

- Use trailing stops when possible to lock in profits during strong trends.

- Practice on demo accounts to understand the timing of entries, stops, and take profits before trading live.

Download Now

Download the “Accumulation 1.2 divergence.mq4” MT4 indicator

FAQ

What type of traders benefit most from this indicator?

Traders who focus on reversals, pullbacks, and early trend changes will find divergence-based signals especially useful.

Does the indicator work in ranging markets?

Yes, divergence often appears clearly in sideways conditions, making the indicator effective during consolidation phases.

Can it be combined with trend indicators?

Absolutely. Many traders combine it with moving averages or trend filters to improve signal accuracy.

Is the Accumulation 1.2 Divergence indicator beginner-friendly?

Yes, the simple line crossover logic makes it easy to understand even for newer traders.

Summary

The Accumulation 1.2 Divergence Forex Indicator for MT4 provides a structured way to trade divergences using clear visual signals.

Highlighting potential turning points early helps traders improve entry timing and overall trade management.

Its flexibility, clean design, and compatibility with many strategies make it a valuable tool for traders looking to incorporate divergence analysis into their trading approach.