About the Trend Continuation Indicator

The Trend Continuation Forex Indicator for MT4 is a custom-built buy and sell signal tool designed to help traders stay aligned with strong market trends.

It works similarly to the ADX indicator by focusing on both trend direction and trend strength, making it suitable for traders who prefer momentum-based setups.

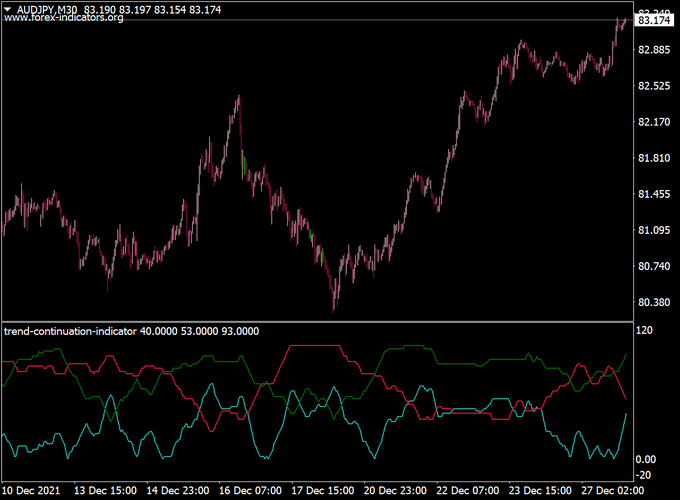

The indicator appears in a separate window below the price chart and displays red, green, and blue lines that react to changes in market conditions.

By monitoring line crossovers and their behavior, traders can identify when a trend is likely to continue rather than fade.

Trend Continuation is lightweight, runs smoothly on MetaTrader 4, and can be used as a standalone trading tool or combined with oscillators for additional confirmation.

Free Download

Download the “trend-continuation-indicator.ex4” MT4 indicator

Key Features

- Provides buy and sell signals based on trend continuation.

- Measures both trend direction and trend strength.

- Displayed in a bottom chart window with colored lines.

- Suitable for trade entry and exit decisions.

- Works on all currency pairs and timeframes.

Indicator Chart

The Trend Continuation indicator chart shows colored signal lines plotted in a separate window below the price.

Green and red line crossovers indicate potential buy and sell opportunities, while line behavior reflects the strength of the ongoing trend.

Guide to Trade with Trend Continuation Indicator

Buy Rules

- Open a buy trade when the green line crosses above the red line.

- Confirm the crossover after the candle closes.

- Trade in the direction of the prevailing market trend.

Sell Rules

- Open a sell trade when the green line crosses below the red line.

- Wait for the crossover to be confirmed on a closed candle.

- Avoid trades during low-momentum market conditions.

Stop Loss

- Set stop loss below the nearest support level for buy trades.

- Set stop loss above the nearest resistance level for sell trades.

- Adjust stop distance based on timeframe and volatility.

Take Profit

- Use nearby support or resistance levels as profit targets.

- Trail stop loss as the trend develops.

- Close the trade when an opposite signal appears.

Trend Continuation Indicator + XP Moving Average Forex Day Trading Strategy for MT4

This intraday strategy combines the Trend Continuation Forex Indicator for MT4 and the XP Moving Average Indicator for MT4.

It catches short-term momentum moves on major currency pairs and works best on 15-minute (M15) and 30-minute (M30) charts.

The Trend Continuation indicator identifies early trend changes while the XP Moving Average confirms the trend direction.

Trades are taken only when both indicators agree, increasing accuracy.

Buy Entry Rules

- Wait for the green line of the Trend Continuation indicator to cross the red line from bottom up.

- Confirm that the XP Moving Average line is green, indicating a buy trend.

- Enter a buy trade at the open of the next candle after the crossover.

- Place the stop loss 15–25 pips below the recent swing low.

- Set take profit at 1.5× to 2× your risk (for example, 20 pips risk → 30–40 pips reward).

- Exit early if the XP Moving Average turns red or the price closes back below it.

Sell Entry Rules

- Wait for the green line of the Trend Continuation indicator to cross the red line from top down.

- Confirm that the XP Moving Average line is red, indicating a sell trend.

- Enter a sell trade at the open of the next candle after the crossover.

- Place the stop loss 15–25 pips above the recent swing high.

- Set take profit at 1.5× to 2× your risk.

- Exit early if the XP Moving Average turns green or the price closes back above it.

Advantages

- Simple and mechanical with clear crossovers and color confirmation.

- Reduces false entries because both indicators must agree.

- Ideal for day trading fast markets like EUR/USD, GBP/USD, and USD/JPY.

- Good reward-to-risk potential during strong intraday trends.

Drawbacks

- Requires focus and quick decision-making to catch valid setups.

Example Case Study 1

On EUR/USD M15, the green line crossed above the red line on the Trend Continuation indicator at 09:30 GMT.

The XP Moving Average was green, confirming a buy bias.

Entry was taken at 1.0850 with a 20-pip stop loss and 35-pip target.

Within two hours, the price reached 1.0885, and the trade closed at +35 pips profit.

Example Case Study 2

Later that day, EUR/USD showed a sell setup.

At 14:10 GMT, the green line crossed below the red line, and the XP Moving Average turned red.

A short trade was opened at 1.0870 with a 22-pip stop loss and 40-pip target.

By 15:40 GMT, the price hit 1.0830 for a +40 pip gain.

Strategy Tips

- Focus on London and New York sessions when volatility is higher.

- Always wait for candle close confirmation before entering trades.

- Avoid trading during major news events, as spikes can distort both indicators.

- Limit to two open trades per session to control risk.

- Adjust stop size according to pair volatility.

Download Now

Download the “trend-continuation-indicator.ex4” MT4 indicator

FAQ

What type of trader is Trend Continuation best suited for?

It is well suited for traders who focus on trend-following and momentum-based strategies.

Can Trend Continuation be used as a standalone system?

Yes, it provides both entry and exit signals and does not require additional indicators.

Which timeframes work best with this indicator?

It works on all timeframes, though higher timeframes often deliver more stable trends.

Summary

The Trend Continuation Forex Indicator for MT4 offers traders a practical way to trade in the direction of strong market momentum.

By combining trend direction with trend strength, it helps traders avoid weak market phases and focus on higher-probability setups.

Its simple signal logic, smooth performance, and flexibility across markets make it a valuable addition to any trend-based trading approach, with room for further refinement through personalized risk and trade management rules.