About the Solar Wind Forex Indicator

The Solar Wind for MT4 provides a streamlined framework for short-term market analysis by tracking momentum cycles.

This setup presents market data in an accessible sub-window format, which helps traders avoid the confusion of overcrowded price charts.

The Solar Wind Forex indicator for Metatrader 4 can be categorized as an oscillator that delivers short-term trend direction with high responsiveness.

The indicator works out of the box for scalping and day trading purposes alike, making it an ideal choice for those who target quick intraday moves.

The indicator pops up in a separate MT4 chart window as a colored oscillator without extreme boundaries, allowing the bars to expand and contract based on the intensity of the current trend.

Free Download

Download the “Solar wind.mq4” indicator for MT4

Key Features

- It utilizes a color-coded histogram to provide instant confirmation of momentum shifts.

- The indicator features a dual-color system where green represents bullish cycles and red represents bearish ones.

- It identifies potential reversal points early by tracking the expansion and contraction of the oscillator bars.

- The sub-window placement ensures the main chart remains clear for identifying price patterns.

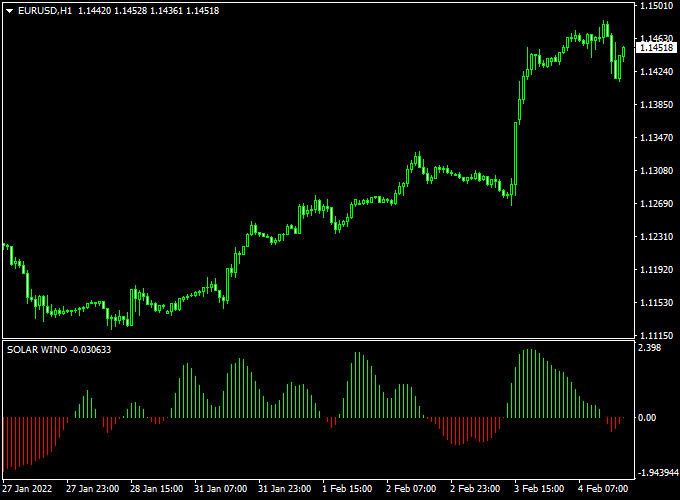

Indicator Chart

The Solar Wind indicator chart features a series of vertical bars in a dedicated window below the price action.

When the bars are green and growing in height, it suggests that bullish momentum is accelerating.

Conversely, when the bars turn red and expand downward, it indicates that bearish pressure is building.

By watching the color of the bars, a trader can easily determine the underlying trend bias at any given moment.

Guide to Trade with Solar Wind Forex Indicator

Trading with this tool involves monitoring the histogram for color changes that signal a shift in market control.

Buy Rules

- Monitor the indicator window for a transition where the red bars end and a green bar appears.

- Open a buy order when the Solar Wind indicator turns back to green color.

- Confirm the signal by ensuring the current candle has closed with a bullish bias.

- Verify that the price is not currently hitting a major historical resistance zone.

Sell Rules

- Watch for the moment the green momentum cycle fades and the histogram turns red.

- Open a sell order when the Solar Wind indicator turns back to red color.

- Verify the entry by waiting for the candle to close to lock in the bearish trend bias.

- Ensure the broader market sentiment on a higher timeframe supports the sell position.

Stop Loss

- Secure your buy entry by placing the stop loss a few pips below the most recent swing low.

- Protect your sell trade by positioning the stop loss slightly above the latest swing high.

- Adjust your stop placement to account for current volatility and your broker’s spread.

- Always follow a disciplined risk management plan to protect your trading capital.

Take Profit

- Exit the trade as soon as the histogram bars change back to the opposite color.

- Target a 1:2 risk-to-reward ratio to maintain a positive statistical edge.

- Consider closing the position if the bars begin to shrink significantly in size.

- Liquidate the trade at the next major horizontal support or resistance level.

Solar Wind Indicator + Ichimoku Trend Monitor Forex Scalping Strategy

This scalping strategy combines the Solar Wind Forex Indicator MT4 with the Ichimoku Trend Monitor with Alert MT4.

The Solar Wind indicator provides quick entry signals based on color changes: green for bullish trend bias and red for bearish trend bias.

The Ichimoku Trend Monitor confirms trends across multiple time frames using a dashboard of arrows: blue arrows indicate bullish trends, and red arrows indicate bearish trends.

This combination helps scalpers enter trades aligned with both momentum and multi-timeframe trend confirmation.

This strategy is designed for M1 and M5 charts, making it ideal for fast scalping sessions.

It is best used during active market hours, such as London and New York, when currency pairs like EURUSD, GBPUSD, and USDJPY show strong intraday moves.

Buy Entry Rules

- Check that all chosen time frame arrows on the Ichimoku Trend Monitor are blue, confirming bullish momentum.

- Wait for the Solar Wind indicator to turn green.

- Enter a buy trade at the close of the candle when the Solar Wind indicator turns green.

- Place a stop loss a few pips below the recent swing low or support level.

- Take profit targets between 7–15 pips, suitable for M1 and M5 scalping.

Sell Entry Rules

- Check that all chosen time frame arrows on the Ichimoku Trend Monitor are red, confirming bearish momentum.

- Wait for the Solar Wind indicator to turn red.

- Enter a sell trade at the close of the candle when the Solar Wind indicator turns red.

- Place a stop loss a few pips above the recent swing high or resistance level.

- Take profit targets between 7–15 pips, optimized for short-term scalps.

Advantages

- Combines real-time trend bias with multi-timeframe confirmation for high-probability trades.

- Works effectively on M1 and M5 charts for rapid scalping.

- Suitable for major currency pairs with tight spreads.

- Helps traders stay aligned with momentum while avoiding counter-trend entries.

Drawbacks

- Requires constant attention due to the short-term nature of M1 and M5 trades.

- Spread and slippage can reduce small profits on quick scalps.

Case Study 1: EURUSD M1 – London Session

During the London session, EURUSD displayed blue arrows across all chosen time frames on the Ichimoku Trend Monitor.

The Solar Wind indicator turned green at 1.0992.

A buy trade was entered with a 5-pip stop loss.

Within 6 minutes, price reached 1.1005, yielding a 13-pip profit.

The combination of trend confirmation and real-time signal produced a reliable M1 scalp.

Case Study 2: GBPUSD M5 – New York Session

GBPUSD on the M5 chart showed red arrows on all Ichimoku Trend Monitor time frames, indicating bearish momentum.

The Solar Wind indicator turned red at 1.2778.

A sell trade was executed with a 6-pip stop loss.

Price moved down to 1.2765 within 15 minutes, capturing a 13-pip profit.

Strategy Tips

- Focus on high-liquidity sessions for more reliable and stronger price movements.

- Trade only when both the Solar Wind and Ichimoku Trend Monitor agree on the trend direction.

- Keep stop losses tight and take profits small to maintain consistent scalping gains.

- Use multiple currency pairs to diversify opportunities during active sessions.

- Combine with support and resistance levels on M1 and M5 charts to improve entry accuracy.

- Avoid trading during low volatility periods or market consolidations.

- Maintain disciplined risk management, risking only 1–2% per trade.

Download Now

Download the “Solar wind.mq4” indicator for Metatrader 4

FAQ

Does this oscillator have overbought or oversold levels?

Unlike the RSI or Stochastics, the Solar Wind is an “open” oscillator, meaning it does not have fixed boundaries like 0 or 100.

The bars represent the strength of the momentum relative to previous candles.

This allows the indicator to stay in a trend much longer without giving premature reversal signals, making it more effective for catching the middle of a strong trend rather than just the extremes.

Can I use this for scalping on the 1-minute chart?

Yes, the Solar Wind is very popular among scalpers because it reacts quickly to price changes.

On lower timeframes, it helps you identify the “micro-cycles” of the market.

To increase your success rate, try to only take signals that align with the trend on a higher timeframe, such as the 15-minute or 1-hour chart.

How do I handle signals in a ranging market?

In a sideways market, the color of the bars may flip frequently.

To avoid these “whipsaw” trades, only enter when the histogram bars are clearly expanding in height.

Small, alternating bars usually indicate a lack of volume, and it is often better to wait for a clear breakout before following the Solar Wind signal.

Summary

The Solar Wind for MT4 is an effective momentum tool that assists in determining the appropriate timing for market entries.

By offering a visual map of short-term trend direction, it helps you avoid the common mistake of trading against an impulse.

This tool helps traders maintain a disciplined routine by highlighting levels where the market is statistically likely to expand.

Using this indicator allows you to filter high-risk trades and focus on high-conviction momentum shifts.