About the Scalper Sentiment Forex Indicator

The Scalper Sentiment Forex indicator for MT4 is a practical solution for traders who specialize in fast-paced market environments.

It is an excellent scalping tool that provides many opportunities during the London and New York trading sessions.

It is specifically built to handle the high volatility found during these peak hours without confusion.

A major advantage is that this scalping indicator does not repaint its signals, ensuring that what you see on your historical data is exactly how it behaved live.

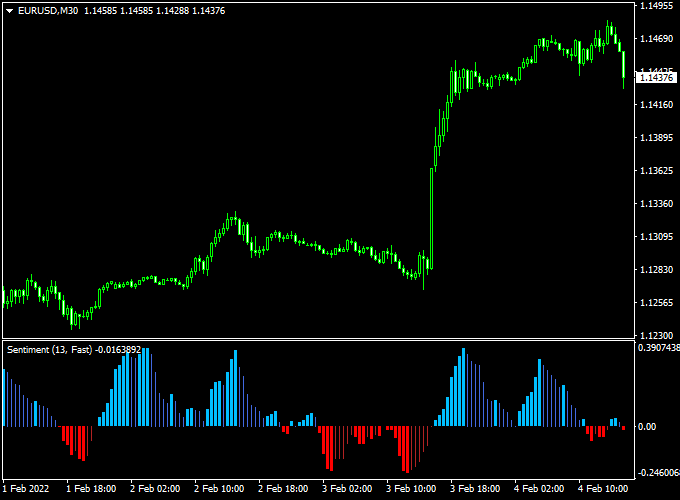

The indicator appears in a bottom window in the form of a colored buy/sell histogram.

Free Download

Download the “sentiment-histogram.mq4” indicator for MT4

Key Features

- It utilizes a color-coded histogram to highlight real-time shifts in market conviction.

- The non-repainting logic provides a stable environment for backtesting and execution.

- The tool identifies high-velocity moves that are typical for successful scalping sessions.

- The sub-window placement keeps the main chart clean for identifying price action patterns.

- It functions as an effective short-term trend filter to avoid trading against the current.

Indicator Chart

The Scalper Sentiment indicator chart displays a series of vertical bars in a dedicated window below the price action.

Blue bars represent a bullish sentiment, suggesting that the momentum is shifting in favor of the buyers.

Red bars signify a bearish sentiment, indicating that sellers are currently in control of the price move.

By watching the bars flip from one color to the other, a trader can pinpoint the exact start of a potential scalp.

Guide to Trade with the Scalper Sentiment Forex Indicator

Trading with this tool requires focusing on the initial color change of the histogram to capture the earliest part of a move.

Buy Rules

- Monitor the histogram window for a change from red to blue bars.

- A buy scalper trade occurs when the first blue colored trend bar appears on the chart.

- Confirm the entry by ensuring the price is not currently hitting a major resistance level.

- Wait for the candle to close to verify the bar color is locked in.

Sell Rules

- Watch the histogram window for the transition from blue to red bars.

- A sell scalper trade occurs when the first red colored trend bar appears on the chart.

- Verify the signal by looking for a bearish rejection on the main price chart.

- Ensure there is sufficient room for the price to drop before reaching the next support.

Stop Loss

- Tuck your buy stop loss a few pips beneath the most recent local swing low.

- Position your sell stop loss slightly above the most recent local swing high.

- Limit your risk to a small percentage of your equity to protect against sudden spikes.

- Adjust the placement to account for the average spread of the currency pair.

Take Profit

- Close the open trade when an opposite signal bar gets displayed on the chart.

- Secure your gains at a fixed reward ratio of at least 1:1.5 for consistent growth.

- Liquidate the position if the histogram bars begin to shrink significantly in height.

- Consider exiting near known psychological levels or horizontal price zones.

Scalper Sentiment + Zero Lag Moving Average MT4 Strategy

The Scalper Sentiment + Zero Lag Moving Average MT4 strategy is a powerful short-term trading method designed for traders who thrive in fast-moving markets.

It combines the precision of the Scalper Sentiment Forex Indicator with the trend-filtering ability of the Zero Lag Moving Average Indicator.

This setup helps traders identify momentum shifts early and align trades with the dominant market direction.

The strategy works best on lower time frames such as M1, M5, and M15.

It’s particularly effective for scalpers who want quick entries and exits during the London or New York sessions.

The goal is to catch short bursts of price movement while minimizing exposure to reversals.

The combination of sentiment-based entries and a trend confirmation filter makes this approach both fast and logical.

Buy Entry Rules

- Wait for the first blue trend bar to appear on the Scalper Sentiment Indicator.

- Confirm that the price is trading above the red Zero Lag Moving Average line.

- Enter a buy trade at the close of the first blue bar.

- Set a stop loss just below the recent swing low or 10–15 pips, whichever is smaller.

- Set a take profit target between 15–25 pips or use a trailing stop to lock in gains as the price advances.

Sell Entry Rules

- Wait for the first red trend bar to appear on the Scalper Sentiment Indicator.

- Confirm that the price is trading below the red Zero Lag Moving Average line.

- Enter a sell trade at the close of the first red bar.

- Set a stop loss just above the recent swing high or 10–15 pips.

- Set a take profit target between 15–25 pips or use a trailing stop for volatile sessions.

Advantages

- Combines sentiment and trend for reliable short-term entries.

- Provides clear and visual entry signals.

- Adapts well to fast-moving forex pairs such as EURUSD, GBPJPY, and XAUUSD.

- Easy to follow for beginners with minimal chart clutter.

- Compatible with different MT4 brokers and setups.

Drawbacks

- Requires fast execution to capture small price movements.

- Not ideal for traders who prefer swing or long-term trading styles.

Case Study 1: EURUSD M5 Scalping Session

During the London open, EURUSD formed a blue trend bar on the Scalper Sentiment Indicator while the price was above the Zero Lag Moving Average.

A buy entry was triggered at 1.0720 with a 12-pip stop loss.

Within 20 minutes, the pair surged to 1.0748, hitting a 28-pip take profit target.

This quick trade captured the early momentum of the session with minimal drawdown, showing how well the two indicators work together for intraday bursts.

Case Study 2: GBPJPY M15 Reversal Trade

In the afternoon session, GBPJPY printed its first red trend bar, while the price moved below the Zero Lag Moving Average.

A short trade was placed at 190.40 with a 15-pip stop.

The pair dropped swiftly to 189.90, yielding a 50-pip profit as volatility picked up.

The clear alignment between sentiment and moving average direction allowed traders to catch a strong downside wave with confidence.

Strategy Tips

- Focus on major sessions when volatility is highest for stronger signals.

- Avoid trading during flat markets or before high-impact news releases.

- Combine this strategy with key support and resistance levels to refine entries.

- Use a fixed risk per trade, ideally 1–2% of account balance.

- Regularly backtest and review performance across pairs to find the most responsive instruments.

Download Now

Download the “sentiment-histogram.mq4” indicator for Metatrader 4

FAQ

What are the best hours to trade with this indicator?

The Scalper Sentiment indicator thrives during high-volume periods.

The London and New York sessions offer the most liquidity and price movement, which is exactly what this indicator needs to produce reliable signals.

Trading during the “overlap” between these two sessions is often the most productive time for users of this tool.

Can I use this for higher timeframe trend following?

The Scalper Sentiment indicator can be used as an additional short-term trend filter on any timeframe.

While it is built for scalping, placing it on a 4-hour chart can help you identify the “inner” momentum of a larger trend.

This helps you find better entries by ensuring the short-term sentiment aligns with the long-term direction.

Summary

The Scalper Sentiment for MT4 is an effective momentum tool that assists in determining the appropriate timing for market entries.

By providing a visual representation of buyer and seller strength, it helps you stay focused on high-probability opportunities.

This tool helps traders maintain a disciplined routine by highlighting levels where the market is statistically likely to move.

Using this indicator allows you to filter high-risk trades and focus on high-conviction momentum bursts.