MP Candle is a free mt4 (Metatrader 4) Forex indicator that can be used for both trade entry and exit or as an additional price action filter.

The indicator that opens up in the main chart window of your trading platform.

MP Candle is very reliable, lightweight, and will not slow down your trading platform.

The indicator works equally well on all currency pairs (majors, minors and exotic) and shows promising results if used correctly.

Free Download

Download the “mpcandle-indicator.mq4” indicator for MT4

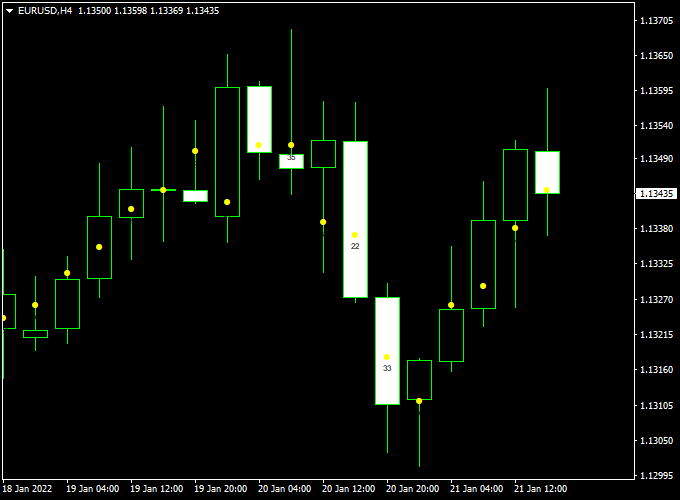

Indicator Chart (EUR/USD H4)

The example chart below displays the MP Candle mt4 indicator in action.

Tips:

Feel free to use your own favorite trade entry, stop loss and take profit strategy to trade with the MP Candle Forex indicator.

As always, trade in agreement with the overall trend and practice on a demo account first until you fully understand this indicator.

Please note that even the best trading indicator cannot yield a 100% win rate over long periods.

Indicator Specifications

Trading Platform: Developed for Metatrader 4 (MT4)

Currency pairs: Works for any pair

Time frames: Works for any time frame

Input Parameters: Variable (inputs tab), color settings & style

Indicator type: Candlestick

Repaint? Does not repaint the oscillator trend bars.

MP Candle + SuperTrend NRP Forex Indicator MT4 Strategy

This strategy combines the MP Candle Forex Indicator MT4 and the SuperTrend NRP Forex Indicator MT4 to create a simple and visual trading method for identifying trend reversals and riding intraday swings.

The MP Candle indicator shows hollow candles for bullish sentiment and white filled candles for bearish conditions.

The SuperTrend NRP provides a reliable dynamic trend line: green for bullish and orange for bearish. By combining both, traders can confirm entries visually and avoid trading against the trend.

This system works best on 15-minute to 1-hour charts and can be applied to most major currency pairs like EUR/USD, GBP/USD, and USD/JPY.

It’s ideal for intraday and swing traders who prefer to follow market structure rather than rely on complex indicators.

Buy Entry Rules

- Wait for the SuperTrend NRP line to turn green, confirming that the overall trend is bullish.

- Observe the MP Candle chart and wait for the first hollow candle to appear after the green SuperTrend line appears.

- Enter a buy trade at the close of that first hollow candle.

- Set your stop loss a few pips below the nearest swing low or below the SuperTrend line (for example, 20–30 pips depending on volatility).

- Take profit can be set 1.5 to 2 times your stop loss distance, or when a white filled candle appears, signaling a possible reversal.

Sell Entry Rules

- Wait for the SuperTrend NRP line to turn orange, indicating a bearish trend.

- Observe the MP Candle chart and wait for the first white filled candle to appear after the orange SuperTrend line shows.

- Enter a sell trade at the close of that first white filled candle.

- Set a stop loss above the nearest swing high or slightly above the SuperTrend line (around 20–30 pips depending on the pair).

- Take profit can be set at a 1.5 to 2 reward-to-risk ratio, or when a hollow candle appears, indicating a reversal signal.

Advantages

- Visually clear entry points with hollow and filled candles make decision-making easy.

- The SuperTrend filter prevents counter-trend trades, improving consistency.

- Simple rules suitable for both beginners and experienced traders.

- Works well on higher timeframes, reducing noise and false signals.

- It can be combined with other tools, such as moving averages or volume filters, for extra confirmation.

Drawbacks

- False signals may occur when the market is ranging or consolidating tightly.

- During high-impact news events, sudden reversals can cause the SuperTrend to repaint temporarily.

- Late entries may happen since confirmation requires waiting for the candle to close.

- Traders must monitor charts actively to catch the first reversal candle promptly.

Example Case Study 1 – EUR/USD (30-Minute Chart)

On the EUR/USD 30-minute chart, the SuperTrend NRP line switched from orange to green at 1.0720, confirming a bullish shift.

The MP Candle indicator then printed a hollow candle at 1.0728, signaling the start of upward momentum.

A buy trade was placed at 1.0730 with a stop loss at 1.0705 (25 pips).

The price climbed steadily, and a white filled candle appeared near 1.0775, where the position was closed for a +45 pip profit.

Example Case Study 2 – GBP/JPY (1-Hour Chart)

In this example, GBP/JPY showed a strong downward move as the SuperTrend line turned orange at 189.80.

Shortly after, the MP Candle printed a white filled candle at 189.65, confirming bearish pressure.

A sell was entered at 189.60, with a stop loss at 189.90 (30 pips).

The pair continued to decline over the next few hours, reaching 189.00.

The trade was closed at this level for a +60 pip gain, a 2:1 reward-to-risk result.

Strategy Tips

- Trade only when the SuperTrend clearly changes color and a new candle type confirms the shift.

- Use major pairs like EUR/USD, GBP/USD, and USD/JPY to minimize spread costs and maximize liquidity.

- Avoid trading during sideways sessions or right before major economic news releases.

- For better precision, combine this setup with a momentum filter such as RSI or MACD divergence to confirm entry strength.

- Always trail your stop once the price moves in your favor to lock in partial profits.

This MT4 strategy offers a balanced and disciplined approach to day and swing trading.

It encourages waiting for trend confirmation and entering at logical points, reducing false entries and improving profit consistency over time.

Download Now

Download the “mpcandle-indicator.mq4” indicator for Metatrader 4