About the Marsi MTF Forex Market Trend Indicator

The Marsi MTF Forex Market Trend indicator for MetaTrader 4 is a momentum-based oscillator designed to analyze market direction across multiple time frames.

It helps traders understand trend strength and potential turning points by combining multi-time-frame data into a single, easy-to-read window.

The indicator oscillates between the 0 and 100 levels. These boundaries highlight extreme market conditions.

Readings near 0 reflect strong bearish pressure, while values close to 100 signal strong bullish momentum.

By tracking these movements, traders can better time entries and exits in trending markets.

Marsi MTF works on any currency pair and time frame.

It is suitable for trend traders, swing traders, and those who rely on higher time frame confirmation before executing trades on lower charts.

Free Download

Download the “Marsi mtf.ex4” indicator for MT4

Key Features

- Multi-time-frame trend analysis in one indicator.

- Oscillator ranges between 0 and 100.

- Identifies momentum extremes and trend continuation.

- Supports both trade entries and exits.

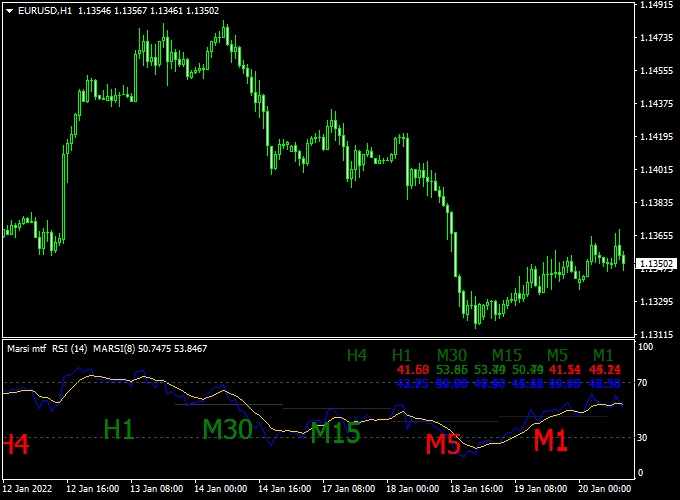

Indicator Chart

The chart displays the Marsi MTF Forex Market Trend indicator in a separate MT4 window.

The oscillator moves between the lower and upper boundaries, showing changes in momentum and trend strength across multiple time frames.

Guide to Trade with Marsi MTF Forex Market Trend Indicator

Buy Rules

- Look for the oscillator to rise from low values toward the mid-range.

- Confirm that higher time frames show bullish momentum.

- Enter after momentum stabilizes above the lower zone.

Sell Rules

- Watch for the oscillator to fall from high values toward the mid-range.

- Confirm bearish conditions on higher time frames.

- Enter once momentum weakens below the upper zone.

Stop Loss

- Place the stop loss beyond the most recent price structure.

- Allow more room when trading higher time frames.

- Avoid tight stops during strong momentum phases.

Take Profit

- Target the next key support or resistance area.

- Consider exiting when momentum reaches the opposite extreme.

- Lock in profits if the oscillator begins to flatten.

Practical Trading Tips

- Use Marsi MTF to confirm trend direction before entering.

- Avoid trading against extreme momentum readings.

Marsi MTF and 4 TF Ergodic CCI Arrows Forex Scalping Strategy

The MT4 Marsi MTF and 4 TF Ergodic CCI Arrows Scalping Strategy is designed for fast, short-term trading on M1 and M5 charts.

It combines the Marsi MTF Market Trend Indicator, which identifies extreme overbought and oversold conditions, with the 4-TF Ergodic CCI Arrows Indicator that provides precise buy and sell trend signals.

This combination allows scalpers to enter trades when the market is both oversold or overbought and aligned with the short-term trend.

The Marsi MTF Market Trend Indicator measures market extremes on a scale from 0 to 100, with 0 representing extreme oversold and 100 representing extreme overbought levels.

The 4-TF Ergodic CCI Arrows Indicator provides green arrows for bullish trends and red arrows for bearish trends, helping traders confirm the direction for entry.

This strategy works best during active trading sessions, such as London and New York, when volatility allows for quick scalping profits.

By combining extreme market levels with trend confirmation, traders can enter low-risk, high-probability trades.

Buy Entry Rules

- Confirm that the Marsi MTF level is near or below 10, indicating an oversold condition.

- Check that the 4 TF Ergodic CCI Arrows indicator displays a green arrow, confirming bullish momentum.

- Enter a buy trade at the open of the next candle.

- Set a stop loss 5–8 pips below the recent swing low or below the Marsi MTF oversold level.

- Take profit at the next resistance or when the 4-TF Ergodic CCI Arrows indicator shows a red arrow.

Sell Entry Rules

- Ensure the Marsi MTF level is near or above 90, indicating an overbought condition.

- Confirm that the 4 TF Ergodic CCI Arrows indicator displays a red arrow, signaling a bearish trend.

- Enter a sell trade at the open of the next candle.

- Place a stop loss 5–8 pips above the recent swing high or above the Marsi MTF overbought level.

- Take profit at the next support or when the Ergodic CCI arrows indicator turns green.

Advantages

- Combines market extreme levels with trend confirmation for higher accuracy.

- Visual signals make entries and exits clear and easy to follow.

- Works on very short timeframes, ideal for scalping.

- Reduces false entries by filtering trades against extreme conditions.

- Applicable to multiple currency pairs and gold.

Drawbacks

- Scalping requires continuous monitoring of charts.

- Requires quick execution due to short-term trades.

Case Study 1: EUR/JPY M1

During the Tokyo session, the Marsi MTF indicator reached a level of 5, indicating an extreme oversold condition.

The 4 TF Ergodic CCI Arrows displayed a green arrow at 149.25.

A buy trade was entered with a stop loss at 149.18 and a take profit at 149.40.

Within 12 minutes, the price reached the target, yielding +15 pips.

The combination of oversold level and trend confirmation ensured a low-risk scalp.

Case Study 2: AUD/USD M5

During the London session, the Marsi MTF indicator showed a level of 92, signaling an overbought market.

The 4 TF Ergodic CCI Arrows displayed a red arrow at 0.6710.

A sell trade was entered with a stop loss at 0.6720 and a target at 0.6685.

The price dropped within 25 minutes, achieving +25 pips.

Aligning overbought conditions with a bearish trend arrow allowed for a precise short-term trade.

Strategy Tips

- Focus on major currency pairs with tight spreads for efficient scalping.

- Trade primarily during the London and New York sessions for stronger moves.

- Combine Marsi MTF extreme levels with trend arrows to reduce false signals.

- Keep risk small per trade due to fast price movements on M1 and M5 charts.

- Avoid trading during low-volume sessions or news releases that can cause erratic spikes.

Download Now

Download the “Marsi mtf.ex4” indicator for Metatrader 4

FAQ

What makes Marsi MTF different from single-time-frame oscillators?

It combines multiple time frames into one view, reducing conflicting signals and improving trend alignment.

Is the indicator better suited for trending markets?

Yes. It performs best when the market shows directional movement rather than tight consolidation.

Can Marsi MTF be used for exits?

Yes. Many traders use momentum weakening or extreme readings as exit signals.

Summary

The Marsi MTF Forex Market Trend Indicator MT4 provides traders with a reliable way to analyze momentum across multiple time frames.

Its 0–100 oscillator range makes it easy to identify strong trends and potential exhaustion zones.

By filtering trades in the direction of broader market momentum, the indicator helps improve timing and reduce low-quality setups.

When combined with disciplined risk management, Marsi MTF becomes a valuable tool for trend-focused trading strategies.