About the Kwan Zig Zag Forex Indicator

The Kwan Zig Zag Indicator for MT4 is designed to provide rapid trading signals, ideal for scalpers.

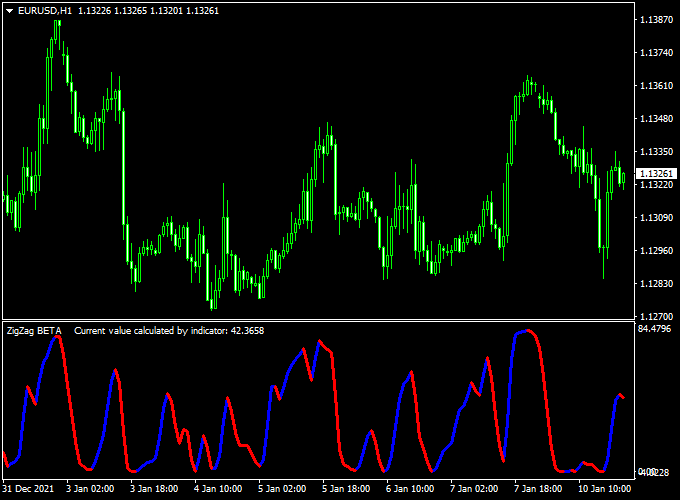

It appears in a separate chart window as a bi-colored line, giving clear buy and sell cues based on the trend direction.

Blue signals indicate buy opportunities when the overall trend is rising, while red signals indicate sell opportunities when the trend is declining.

Traders can reverse positions immediately whenever the opposite color appears, making it perfect for fast-paced scalping setups.

The indicator works on multiple timeframes, but it is especially effective on lower timeframes such as M1–M5 for scalping, and M15 for quick intraday trades.

It can be combined with other trend or momentum tools for better confirmation.

Free Download

Download the “Kwan.mq4” indicator for MT4

Key Features

- Bi-colored signal line for buy (blue) and sell (red) trades

- Provides rapid scalping signals

- Signals can be reversed immediately with the opposite line color

Indicator Chart

The chart shows the Kwan Zig Zag Indicator applied to MT4.

Blue lines indicate buy signals in an uptrend, while red lines indicate sell signals in a downtrend.

Traders can reverse positions when the line changes color.

This system is designed for scalping but can also be used for short intraday trades.

Guide to Trade with Kwan Zig Zag

Buy Rules

- Enter a buy when the signal line turns blue and the trend is rising

- Confirm overall trend using price action or a moving average if desired

- Reverse position immediately when the line turns red

Sell Rules

- Enter a sell when the signal line turns red and the trend is declining

- Confirm overall trend using price action or a moving average if desired

- Reverse position immediately when the line turns blue

Stop Loss

- For buys, place stops slightly below the last swing low of the trend

- For sells, place stops slightly above the last swing high of the trend

- Use tighter stops for M1–M5 scalping trades

- Adjust according to market volatility

Take Profit

- For buys, target the next minor resistance level or recent high

- For sells, target the next minor support level or recent low

- Exit fully if the signal line reverses

Practical Tips

- Best for scalping on M1–M5 charts

- M15 charts can be used for short intraday setups

- Combine with a trend filter or momentum oscillator for more accurate entries

MT4 Scalping Strategy Using Kwan Zig Zag and XP Moving Average Indicators

This MT4 scalping strategy combines the Kwan Zig Zag Forex Indicator MT4 with the XP Moving Average Indicator MT4 to catch short-term trends and precise entry points.

The Kwan Zig Zag indicator provides clear buy and sell signals with its blue and red histogram lines.

The XP Moving Average confirms the trend direction with green for bullish and red for bearish trends.

This combination works well on lower timeframes such as M1, M5, and M15, making it suitable for scalpers who want to capture quick profits in volatile market conditions.

It is ideal for traders who prefer precise, signal-based entries without relying on complicated chart patterns.

Buy Entry Rules

- Ensure the XP Moving Average line is green, indicating a bullish trend.

- Wait for the Kwan Zig Zag histogram to turn blue.

- Enter a buy position at the close of the signal candle.

- Set the stop loss a few pips below the most recent swing low on the Kwan Zig Zag.

- Set the take profit at 1.5 to 2 times the stop loss distance or close partially at the next minor resistance level.

Sell Entry Rules

- Ensure the XP Moving Average line is red, indicating a bearish trend.

- Wait for the Kwan Zig Zag histogram to turn red.

- Enter a sell position at the close of the signal candle.

- Set the stop loss a few pips above the most recent swing high on the Kwan Zig Zag.

- Set the take profit at 1.5 to 2 times the stop loss distance or close partially at the next minor support level.

Advantages

- Simple and clear signal confirmation using two indicators.

- Works on multiple currency pairs and lower timeframes.

- Helps traders avoid entering against the main trend.

- Scalping-friendly with quick entries and exits.

Drawbacks

- Requires constant monitoring for lower timeframe scalping.

- Stop loss adjustments are crucial to avoid early exits in volatile moves.

Case Study 1

On the EUR/USD M5 chart, the XP Moving Average turned green, signaling a bullish trend.

Shortly after, the Kwan Zig Zag histogram turned blue.

A buy position was opened at 1.1050 with a stop loss at 1.1040.

The price quickly moved to 1.1065, hitting the take profit for a gain of 15 pips within 10 minutes.

This trade demonstrates the strategy’s ability to capture small, fast moves with minimal risk.

Case Study 2

On the GBP/USD M15 chart, the XP Moving Average line turned red, confirming a bearish trend.

The Kwan Zig Zag histogram then turned red, signaling a sell entry.

The position was opened at 1.2500 with a stop loss at 1.2510.

The price moved to 1.2475, achieving a profit of 25 pips in 30 minutes.

This example shows how combining trend confirmation and signal entry can improve the accuracy of scalping trades.

Strategy Tips

- Focus on currency pairs with higher volatility for better scalping opportunities.

- Use this strategy during active market sessions such as London or New York.

- Adjust stop loss and take profit based on the current volatility to reduce risk.

- Always wait for both indicators to confirm before entering a trade to avoid false signals.

- Consider combining with volume indicators for added confirmation in volatile periods.

Download Now

Download the “Kwan.mq4” indicator for Metatrader 4

FAQ

Can I use this indicator for longer timeframes?

It is primarily designed for scalping, but M15 charts can be used for quick intraday trades.

How do I confirm the overall trend?

Use moving averages, trendlines, or price action to confirm that the trend aligns with the signal line.

Is it suitable for all currency pairs?

Yes. It works best on high-liquidity pairs for smooth price movements and reliable scalping signals.

Summary

The Kwan Zig Zag Forex Indicator for MT4 delivers fast, bi-colored signals for scalping.

Blue lines indicate buy trades in a rising trend, and red lines indicate sell trades in a declining trend, with immediate position reversal when the opposite color appears.

It is perfect for scalping on M1–M5 charts and can be applied for short intraday trades on M15.

The indicator simplifies decision-making, helping traders act quickly on trends while reducing analysis time.

By combining the indicator with trend or momentum confirmation tools, traders can improve accuracy and manage risk effectively.

The Kwan Zig Zag is a versatile and reliable tool for rapid Forex trading setups.