About the Inverse Fisher Transform of RSI Signal Indicator

The Inverse Fisher Transform of RSI Signal Indicator for MT4 is a powerful oscillator designed to detect turning points and generate high-probability buy and sell signals.

By transforming the traditional RSI values, it produces sharper and more reliable indications of market momentum shifts.

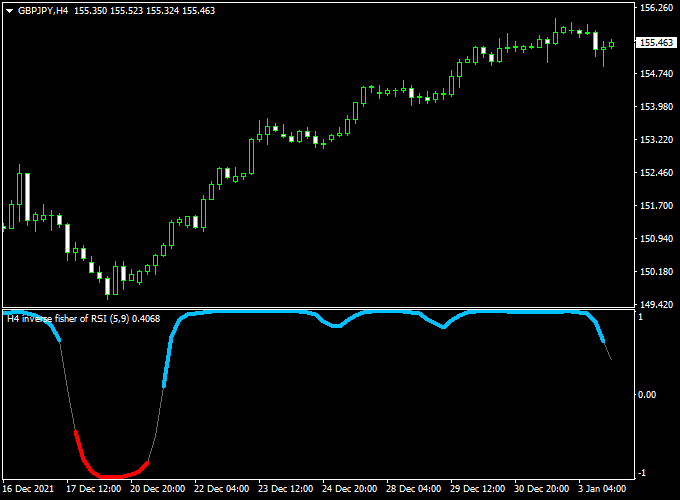

The indicator appears in a separate MT4 chart window as a colored oscillator that moves above and below the neutral 0.00 level.

Blue lines suggest bullish conditions, while red lines indicate bearish momentum.

This visual representation allows traders to quickly identify potential trend reversals and entry points.

Traders can use the Inverse Fisher Transform of RSI Signal on multiple timeframes, making it suitable for both short-term scalping and longer intraday trades.

Its precision helps reduce false signals and gives traders a clearer view of momentum changes in the market.

Free Download

Download the “Inverse fisher transform of RSI.mq4” indicator for MT4

Key Features

- Inverse Fisher transformation applied to RSI for more precise signals

- Blue and red oscillator lines indicate buy and sell opportunities

- Floats above and below 0.00 for easy trend identification

- Non-repainting oscillator for reliable signal tracking

- Suitable for scalping, day trading, and swing trading

Indicator Chart

The chart shows the Inverse Fisher Transform of RSI Signal applied in a separate MT4 window.

Blue lines represent potential buy conditions, while red lines signal possible sell trades.

The oscillator’s movement around the 0.00 level highlights trend shifts and provides traders with clear visual cues for entries and exits.

Guide to Trade with the Inverse Fisher Transform of RSI Signal Indicator

Buy Rules

- Enter a buy trade when the blue oscillator line appears

- Confirm the trend is bullish or price action supports a long position

- Prefer signals that occur near support or after pullbacks

- Target short-term momentum gains depending on the timeframe

Sell Rules

- Enter a sell trade when the red oscillator line appears

- Confirm that the broader trend or price action favors short trades

- Prefer signals that occur near resistance or after minor rallies

- Use caution during low-volatility periods

Stop Loss

- For buy trades, place a stop loss below the nearest swing low

- For sell trades, place a stop loss above the recent swing high

Take Profit

- Close the trade when the opposite colored line appears

- Set a fixed pip target according to the timeframe

- Consider scaling out partial positions for longer swings

Practical Tips

- Combine the oscillator with trend direction or moving averages for higher accuracy

- Avoid trading during quiet market sessions

- Use higher timeframes to confirm the general trend before taking lower timeframe entries

- Do not chase signals; wait for clear oscillator confirmation

Inverse Fisher Transform of RSI + TEMA MT4 Intraday Strategy

This strategy combines the Inverse Fisher Transform of RSI MT4 Indicator and the Triple Exponential Moving Average (TEMA) MT4 Indicator to capture intraday trading opportunities.

The Inverse Fisher Transform of RSI provides entry signals: a blue line indicates a buy, and a red line signals a sell.

The TEMA confirms trend direction: a red line shows a bullish trend, while a green line indicates a bearish trend.

Combining these indicators helps traders enter trades with the trend while timing entries effectively.

This strategy works best on M5 and M15 charts, ideal for intraday traders targeting short-term price moves.

Buy Entry Rules

- Confirm that the TEMA shows a bullish trend (red line).

- Wait for the Inverse Fisher Transform of RSI to turn blue, signaling a buy.

- Enter a buy trade at the close of the signal candle.

- Set a stop loss below the most recent swing low or 10–15 pips below the entry.

- Set a take profit at 1:1.5 risk-reward or exit when the Inverse Fisher Transform of RSI turns red.

Sell Entry Rules

- Confirm that the TEMA shows a bearish trend (green line).

- Wait for the Inverse Fisher Transform of RSI to turn red, signaling a sell.

- Enter a sell trade at the close of the signal candle.

- Set a stop loss above the most recent swing high or 10–15 pips above the entry.

- Set a take profit at 1:1.5 risk-reward or exit when the Inverse Fisher Transform of RSI turns blue.

Advantages

- Combines trend confirmation with clear entry signals for higher probability trades.

- Effective on short-term charts for fast intraday trading.

- Simple to follow and suitable for novice and experienced traders.

- Allows early exits when trends reverse, reducing potential losses.

Drawbacks

- False signals may occur in sideways or choppy markets.

- Requires constant monitoring due to fast intraday movements.

- Parameter settings can affect performance, requiring regular review.

- Frequent trading may increase spread and commission costs.

Example Case Study 1: GBP/JPY (M5)

The price was above the TEMA red line, indicating a bullish trend.

The Inverse Fisher Transform of RSI turned blue, triggering a buy trade at 151.200.

Stop loss was set at 151.100.

The trade was closed at 151.400, achieving the take profit within 30 minutes.

Example Case Study 2: EUR/JPY (M15)

The price was below the TEMA green line, indicating a bearish trend.

The Inverse Fisher Transform of RSI turned red, triggering a sell trade at 130.500.

Stop loss was at 130.600.

The trade was closed at 130.200, reaching the take profit target within an hour.

Strategy Tips

- Check higher timeframes (H1) for trend confirmation to improve probability.

- Avoid trading during major news releases to reduce the risk of volatility spikes.

- Regularly adjust indicator settings to adapt to market conditions.

- Always use proper risk management and stick to defined stop loss and take profit levels.

Download Now

Download the “Inverse fisher transform of RSI.mq4” indicator for Metatrader 4

FAQ

What makes this oscillator different from standard RSI?

The Inverse Fisher Transform sharpens RSI values, producing clearer buy and sell signals and reducing lag for quicker entries.

Can it be used for scalping as well as longer trades?

Yes. The indicator is versatile and works across all timeframes, from M1 scalping to H4 intraday trades.

Can it be combined with other indicators?

Yes. Many traders pair it with trend filters, moving averages, or support/resistance levels to enhance signal reliability.

Summary

The Inverse Fisher Transform of RSI Signal Indicator for MT4 delivers precise buy and sell signals through a colored oscillator.

Its design allows traders to quickly spot trend reversals and momentum shifts, making trading more efficient.

By combining its signals with trend confirmation or other technical tools, traders can filter weaker signals and focus on higher-probability setups.