About the Dark Cloud & Piercing Candlestick Pattern Indicator

The Dark Cloud & Piercing Candlestick Pattern Indicator for MT4 identifies key candlestick reversal patterns directly on your chart.

It spots the Dark Cloud Cover and Piercing Line patterns, which are classic signals used by professional traders to anticipate potential trend reversals.

By highlighting these patterns with clear arrows, the indicator allows traders to make informed decisions without manually scanning candlestick formations.

This tool is suitable for all traders, from beginners to experienced, and works across multiple currency pairs and timeframes.

Using the indicator can enhance your trading strategy by providing early warning signals of potential price reversals, helping to optimize entry and exit points.

The indicator is easy to use, lightweight, and displays results directly on the main MT4 chart window.

Free Download

Download the “i Darkcloud Piersing.mq4” indicator for MT4

Key Features

- Identifies Dark Cloud Cover and Piercing Line candlestick patterns automatically

- Displays white arrows directly on the main MT4 chart for easy recognition

- Supports multiple timeframes and currency pairs

- Helps anticipate potential trend reversals for better trade timing

- Lightweight and beginner-friendly

- Works as a standalone indicator or in combination with trend indicators

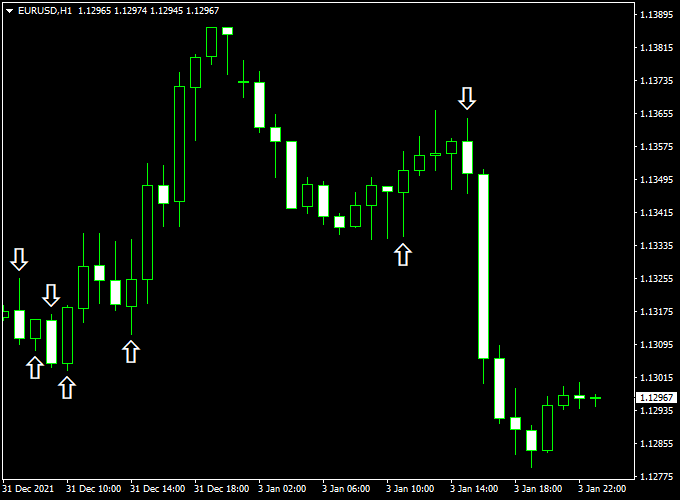

Indicator Chart

The chart below shows the Dark Cloud & Piercing Candlestick Pattern Indicator in action.

White arrows mark Dark Cloud and Piercing patterns, signaling potential bearish and bullish reversals.

Traders can use these arrows to identify entry points and align trades with overall market trends.

Guide to Trade with Dark Cloud & Piercing Candlestick Pattern Indicator

Buy Rules

- Wait for a white arrow indicating a Piercing candlestick pattern

- Confirm with an upward trend or support level

- Open a buy order once the signal aligns with market conditions

Sell Rules

- Wait for a white arrow indicating a Dark Cloud candlestick pattern

- Confirm with a downward trend or resistance level

- Open a sell order once the signal aligns with market conditions

Stop Loss

- Place below the recent swing low for buy trades

- Place above the recent swing high for sell trades

Take Profit

- Set according to risk/reward ratio, typically 1:2 or 1:3

- Adjust based on support/resistance levels or trend direction

Practical Tips

- Always confirm signals with higher timeframe trends to avoid false reversals

- Combine the indicator with trend-following tools for stronger confirmation

- Consider support and resistance levels when setting Stop Loss and Take Profit

- Do not rely on the indicator alone for long-term trades; use it as part of a full strategy

- Test settings on a demo account before applying to live trades

Dark Cloud Piercing + No Lag Moving Average MT4 Scalping Strategy

This scalping strategy combines the Dark Cloud Piercing Candlestick Pattern Indicator with the No Lag Moving Average Indicator for MT4.

The goal is to capture short, high-probability moves during intraday trading sessions.

It’s a straightforward yet effective approach that helps traders align fast candlestick reversals with a clear, adaptive trend line.

The Dark Cloud Piercing Indicator plots a white up arrow when a bullish piercing pattern forms, and a white down arrow when a dark cloud cover appears, signaling potential reversals.

The No Lag Moving Average confirms the active trend using a blue line for bullish trends and a red line for bearish ones.

Together, these tools provide clarity and speed — both essential for scalping.

This method works best on the M5 and M15 charts for pairs like EURUSD, GBPUSD, and XAUUSD.

It’s designed for traders who want to make fast decisions with precise visual signals rather than analyzing multiple indicators.

Buy Entry Rules

- Wait until the No Lag Moving Average turns blue, confirming an uptrend.

- Look for a white up arrow from the Dark Cloud Piercing Indicator.

- Enter a buy trade at the opening of the next candle.

- Place a stop loss 8–12 pips below the recent swing low.

- Set your take profit at 1.5 to 2 times your stop loss distance, or close when the line turns red.

Sell Entry Rules

- Wait until the No Lag Moving Average turns red, confirming a downtrend.

- Look for a white down arrow from the Dark Cloud Piercing Indicator.

- Enter a sell trade at the opening of the next candle.

- Place a stop loss 8–12 pips above the recent swing high.

- Set your take profit at 1.5 to 2 times your stop loss distance, or close when the line turns blue.

Advantages

- Provides simple, clear buy and sell signals for quick decision-making.

- Combines candle-based reversal logic with trend confirmation.

- Works efficiently on short timeframes like M5 and M15.

- Low indicator lag helps react faster to price changes.

- Ideal for traders who prefer active market engagement.

Drawbacks

- Less effective during flat or sideways markets.

- Requires quick reaction time, which may not suit all traders.

- Whipsaws can occur during high volatility news events.

- Best results depend on disciplined risk management.

Example Case Study 1

On the EURUSD M5 chart, the No Lag Moving Average turned blue at the start of the London session.

A few candles later, a white up arrow appeared.

The buy entry was triggered, and within 20 minutes, the pair gained +12 pips before the price slowed down.

Stop loss was only 8 pips below entry, resulting in a 1.5R reward-to-risk ratio.

This trade illustrates how the setup can capture fast intraday movements.

Example Case Study 2

During the New York session, XAUUSD displayed a white down arrow just after the No Lag Moving Average turned red.

A short position was opened with a 10-pip stop loss.

Within 30 minutes, the price dropped by 18 pips, hitting the take profit target.

The setup aligned perfectly with momentum and confirmed the strength of the short-term bearish bias.

Strategy Tips

- Trade only during active sessions, such as London or New York, for higher volatility.

- Avoid overlapping major news releases.

- Stick to one or two pairs to master their price rhythm.

- Always close trades before the major session ends to avoid reversals.

- Backtest the settings before live trading to match your risk style.

Download Now

Download the “i Darkcloud Piersing.mq4” indicator for Metatrader 4

FAQ

How does the Dark Cloud & Piercing Candlestick Pattern Indicator work?

It scans the chart for Dark Cloud and Piercing patterns and marks them with white arrows to signal potential reversals.

Can I use this indicator on all timeframes?

Yes, it works on all MT4 timeframes from M1 to H4 and across all currency pairs.

Do I need additional indicators to trade effectively?

While it can be used alone, combining it with trend indicators or support/resistance levels improves accuracy.

How do I adjust the settings?

Settings allow you to customize sensitivity and arrow display. Adjust based on trading style and timeframe.

Summary

The Dark Cloud & Piercing Candlestick Pattern Indicator is an essential tool for traders looking to identify reversal opportunities efficiently.

It provides clear signals with white arrows directly on the MT4 chart and is compatible with multiple timeframes and currency pairs.

Its simplicity makes it perfect for beginners, while its accuracy is valuable for experienced traders.

Combining this indicator with trend-following tools or support/resistance analysis enhances trading precision and can lead to more profitable entries and exits.

The indicator is lightweight, easy to use, and a great addition to any trading strategy.