About the Higher Time Frame Forex Trend Indicator

The Higher Time Frame Forex Trend indicator for MT4 helps traders spot the dominant market trend.

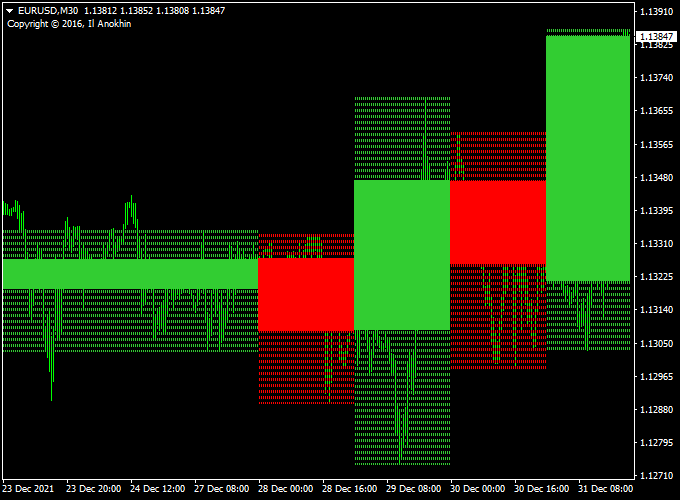

It shows green and red boxes on the main chart to indicate bullish and bearish conditions.

Green boxes suggest a bullish trend, signaling potential buy opportunities.

Red boxes indicate a bearish trend, signaling potential sell opportunities.

By relying on higher time frame analysis, traders can avoid noise from short-term fluctuations.

The simple box display makes trend direction easy to interpret, even for beginners.

Free Download

Download the “HigherTimeframe.mq4” indicator for MT4

Key Features

- Displays higher time frame trend signals as colored boxes

- Green boxes indicate bullish conditions

- Red boxes indicate bearish conditions

- Reduces market noise for cleaner trend identification

Indicator Chart

The Higher Time Frame Forex Trend indicator shows green and red boxes on the main MT4 chart.

Green boxes represent upward trends, while red boxes represent downward trends.

Traders use these boxes to align trades with the stronger trend and filter out counter-trend entries.

Guide to Trade with Higher Time Frame Forex Trend Indicator

Buy Rules

- Enter a buy trade when a green box appears.

- Hold the trade while green boxes continue appearing.

- Consider entering after a small pullback for a better price.

Sell Rules

- Enter a sell trade when a red box appears.

- Hold the trade while red boxes continue appearing.

- Consider entering after a minor retracement for better risk/reward.

Stop Loss

- For buys, place the stop below the recent swing low.

- For sells, place the stop above the recent swing high.

- Allow a few pips for normal price fluctuations.

Take Profit

- Take partial profits near the next support (for sells) or resistance (for buys).

- Keep the remaining position open while boxes stay green or red.

- Exit entirely if the box color changes against your trade.

- Use trailing stops to secure gains on strong trends.

Practical Trading Tips

- Trade only when the box color is clear and stable.

- Use price action near key levels for better entries.

- Focus on major session overlaps for stronger moves.

- Watch for clusters of boxes to identify trend reversals.

Higher Time Frame Box + FX Prime Trend MT4 Day Trading Strategy

This strategy combines the Higher Time Frame Forex Trend Indicator (MT4) with the FX Prime Trend Indicator (MT4).

The Higher Time Frame indicator uses colored boxes: green for bullish trends and red for bearish trends.

The FX Prime Trend provides precise entry signals: green line for buys and red line for sells.

This setup is ideal for intraday trading on M15 and M30 charts.

It helps capture strong moves during the day using a trend filter and clear entry signals.

Buy Entry Rules

- The Higher Time Frame indicator shows a green box, confirming a bullish trend.

- The FX Prime Trend indicator displays a green line, signaling a buy.

- Enter at the close of the green confirmation candle.

- Stop loss: place 15–20 pips below the recent swing low or below the green box.

- Take profit: target 30–35 pips for M15 trades, 40–50 pips for M30 trades.

- Trail stops can capture additional pips as the trend continues.

Sell Entry Rules

- The Higher Time Frame indicator shows a red box, confirming a bearish trend.

- The FX Prime Trend indicator displays a red line, signaling a sell.

- Enter at the close of the red confirmation candle.

- Stop loss: place 15–20 pips above the recent swing high or above the red box.

- Take profit: target 30–35 pips for M15 trades, 40–50 pips for M30 trades.

- Trail stops can capture additional pips as the trend extends.

Advantages

- Trend filter reduces countertrend trades.

- FX Prime Trend provides precise entries for better risk/reward.

- Suitable for M15–M30 intraday charts.

- Combining trend direction and entry signal improves win probability.

Drawbacks

- Lag in trend boxes may delay entries slightly.

- Sideways markets may produce false FX Prime signals.

- Patience is needed to wait for both indicators to align.

- Stop losses may be hit on intraday retracements.

Example Case Study 1 — AUD/USD M15 (Bullish)

On the M15 AUD/USD chart, the Higher Time Frame indicator shows a green box.

The FX Prime Trend line turns green on a bullish candle.

Entry is taken at candle close.

Stop loss is placed 18 pips below the recent swing low.

Price moves upward and hits the take profit target of 32 pips within 45 minutes.

Trailing stops behind subsequent bullish candles capture an additional 10 pips before the trend shows signs of retracement.

Example Case Study 2 — USD/CHF M30 (Bearish)

USD/CHF on the M30 chart shows a red box on the Higher Time Frame indicator.

The FX Prime Trend line turns red on a bearish candle.

Entry is taken at candle close.

Stop loss is set 20 pips above the recent swing high.

Price trends downward, hitting the initial take profit of 45 pips in about 1 hour.

Trailing stop captures another 12 pips as the trend extends slightly before reversing.

Strategy Tips

- Always trade in the direction of the Higher Time Frame trend to increase the probability of success.

- Focus on high-liquidity pairs like EUR/USD, AUD/USD, USD/CHF, and GBP/USD.

- Avoid trading during major news releases to reduce volatility risk.

- Use proper risk management; do not over-leverage.

- Combine with higher timeframe analysis (H1 or H4) to filter weaker setups.

- Trailing stops using swing points can help maximize gains while protecting profits.

Download Now

Download the “HigherTimeframe.mq4” indicator for Metatrader 4

FAQ

How does the indicator determine trend direction?

It analyzes price action from higher time frames and shows green boxes for upward trends and red boxes for downward trends. This highlights the dominant market flow.

How should I manage reversals?

When the box color flips, consider closing your trade or scaling out. Consecutive boxes of the new color indicate a potential trend shift.

Should it be combined with other tools?

Yes. Using it with support/resistance levels, oscillators, or entry indicators can improve accuracy and help avoid false signals.

Summary

The Higher Time Frame Forex Trend indicator for MT4 simplifies trend identification with colored boxes.

Green boxes indicate bullish momentum, red boxes indicate bearish momentum.

When paired with other trend or entry indicators, it helps traders align trades with the strongest market direction and improves overall trade accuracy.