About the Gann High Low Activator Indicator

The Gann High Low Activator indicator for MT4 transforms classic Gann trading logic into practical, easy-to-read trading signals.

Instead of complex calculations, the indicator prints colored candlesticks directly on the price chart to show trend direction.

Blue candlesticks indicate bullish market conditions, while red candlesticks signal bearish pressure.

This approach allows traders to stay aligned with the dominant trend without guessing market direction.

The indicator reacts to changes in price momentum and adjusts dynamically as new candles form.

It works on all currency pairs and timeframes, making it suitable for scalpers, day traders, and swing traders.

By focusing on trend continuation rather than prediction, the Gann High Low Activator helps traders avoid false entries during ranging markets.

Free Download

Download the “gann-high-low-activator.ex4” indicator for MT4

Key Features

- Colored candlestick signals based on the Gann High Low algorithm

- Instant visual identification of bullish and bearish trends

- Works on all MT4 timeframes and currency pairs

- Customizable LB input setting for signal sensitivity

- No lagging indicators or repainting signals

- Ideal for trend-following and pullback strategies

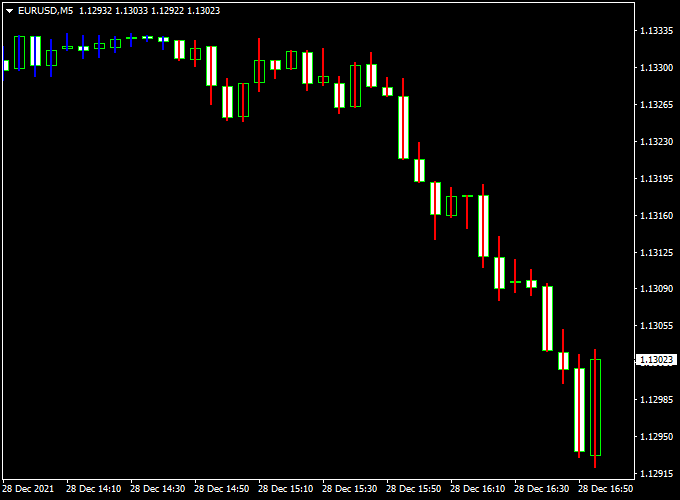

Indicator Chart

The chart below shows the Gann High Low Activator indicator applied to an MT4 price chart.

Blue candlesticks highlight bullish trend phases, while red candlesticks confirm bearish momentum.

These color changes help traders time entries in the direction of the prevailing trend.

Guide to Trade with Gann High Low Activator

Buy Rules

- Wait for blue candlesticks to appear on the chart

- Confirm price is making higher highs or holding above recent support

- Enter a buy trade at the close of a blue candlestick

Sell Rules

- Wait for red candlesticks to appear on the chart

- Confirm price is making lower lows or rejecting resistance

- Enter a sell trade at the close of a red candlestick

Stop Loss

- Place the stop loss below the most recent swing low for buy trades

- Place the stop loss above the most recent swing high for sell trades

- Keep risk per trade consistent across all positions

Take Profit

- Target the next key support or resistance level

- Use a fixed risk-to-reward ratio such as 1:2 or 1:3

- Consider trailing stops while the candlestick color remains unchanged

Practical tip

- Adjust the Lb input setting from the default value of 10 to fine-tune signal responsiveness

- Lower values produce faster signals, while higher values filter out market noise

Gann High Low Activator + Sniper Buy Sell Scalper MT4 Strategy

This MT4 scalping strategy combines the Gann High Low Activator Indicator with the Sniper Buy Sell Scalper Indicator.

It is designed for intraday traders looking for precise entry points while following the underlying trend.

The Gann High Low Activator shows the trend using colored candlesticks: blue for bullish and red for bearish conditions.

The Sniper Buy Sell Scalper provides white arrows for buy signals and red arrows for sell signals, giving clear entry timing for fast trades.

Buy Entry Rules

- Confirm that the candlesticks on the Gann High Low Activator are blue, indicating a bullish trend.

- Wait for the Sniper Buy Sell Scalper to plot a white arrow.

- Enter a buy trade at the open of the next candle after the white arrow appears.

- Set a stop loss below the recent swing low or nearby support level.

- Take profit at the next minor resistance, major resistance, or Fibonacci extension level depending on price action.

Sell Entry Rules

- Confirm that the candlesticks on the Gann High Low Activator are red, indicating a bearish trend.

- Wait for the Sniper Buy Sell Scalper to plot a red arrow.

- Enter a sell trade at the open of the next candle after the red arrow appears.

- Set a stop loss above the recent swing high or nearby resistance level.

- Take profit at the next minor support, major support, or Fibonacci retracement level, depending on price action.

Advantages

- Simple and visually intuitive, making it easy to identify trade setups quickly.

- Works well for scalping in multiple timeframes from M1 to M15.

- Helps traders stay aligned with the prevailing trend, reducing counter-trend trades.

- Flexible take-profit levels allow scaling out of trades to lock in profits.

- Suitable for both beginner and experienced traders due to clear entry and exit rules.

Drawbacks

- May generate false signals during sideways or low-volatility markets.

- Requires rapid execution and focus, which can be demanding in fast markets.

- Stop losses can be triggered by sudden market spikes or slippage.

- Less effective in extremely choppy conditions where candlesticks frequently change color.

- Frequent trading may increase transaction costs on some brokers.

Case Study 1: EUR/JPY 5-Minute Chart

On the EUR/JPY 5-minute chart, candlesticks on the Gann High Low Activator turned blue, indicating a bullish trend.

The Sniper Buy Sell Scalper plotted a white arrow at 151.20.

A buy trade was entered with a stop loss at 151.00.

The price moved up to 151.65 within 20 minutes, generating a 45-pip gain.

This demonstrates how the strategy can capture short-term upward moves effectively.

Case Study 2: USD/CHF 1-Minute Chart

On the USD/CHF 1-minute chart, candlesticks turned red on the Gann High Low Activator, signaling bearish conditions.

The Sniper Buy Sell Scalper plotted a red arrow at 0.9005.

A sell trade was executed with a stop loss at 0.9015.

The price declined to 0.8975 within 15 minutes, securing a 30-pip profit.

This shows the strategy’s effectiveness for quick intraday downtrends.

Strategy Tips

- Focus on pairs with strong intraday volatility to maximize scalping opportunities.

- Combine this strategy with higher timeframe analysis to confirm the overall trend direction.

- Keep an eye on the spread; avoid trading when spreads widen, as it can reduce profitability.

- Use a risk-reward ratio for each trade and adjust position size accordingly.

- Monitor multiple timeframes to spot potential trend reversals before entering trades.

- Consider closing part of your position at the first take-profit level and letting the rest run to capture extended moves.

Download Now

Download the “gann-high-low-activator.ex4” indicator for Metatrader 4

FAQ

How does the Lb setting affect the Gann High Low Activator signals?

The Lb setting controls how sensitive the indicator reacts to price changes.

Lower values generate faster signals but may increase noise.

Higher values smooth the signals and focus on stronger, more sustained trends.

Is the indicator better suited for trending or ranging markets?

The Gann High Low Activator performs best in trending conditions.

During sideways markets, candlestick colors may switch more frequently.

Using a higher timeframe or a trend filter can improve trade quality.

Can this indicator be used for trade exits as well?

Yes. Many traders use a candlestick color change as a signal to exit positions.

When the color flips, it often indicates weakening momentum or a potential trend shift.

Does the indicator work the same on forex, gold, and indices?

The logic remains the same across all instruments.

However, volatile assets like gold or indices may require adjusted Lb settings to reduce false signals.

Summary

The Gann High Low Activator indicator for MT4 offers a practical way to trade trends using classic Gann principles.

Its colored candlestick signals remove unnecessary complexity and allow traders to focus on execution and risk management.

The indicator is flexible, easy to configure, and suitable for a wide range of trading styles.

For even stronger results, the Gann High Low Activator combines well with a trend filter such as the 200 EMA.

This combination helps traders stay aligned with the dominant market direction while avoiding low-probability setups.

With proper discipline and consistent risk control, this indicator can become a solid addition to any MT4 trading plan.