About the BT CS Forex Signals Indicator

The Powerful BT CS Forex Signals Indicator for MT4 is a color-based currency strength tool that helps traders identify strong bullish and bearish signals in real time.

It’s simple, fast, and highly visual – ideal for all trading styles.

How it works

- A buy signal occurs when the indicator displays ‘LONG” next to the currency pair.

- A sell signal occurs when the indicator displays “SHORT” next to the currency pair.

Main Features

- Instant visual buy and sell signals on the chart

- Works across all pairs, commodities, and indices

- Non-repainting visual system

- Supports scalping, intraday, and swing trading

Benefits of Using the Indicator

- Helps traders enter with the trend or catch early reversals

- Improves timing and reduces emotional decisions

Free Download

Download the “bt-cs-indicator.ex4” indicator for MT4

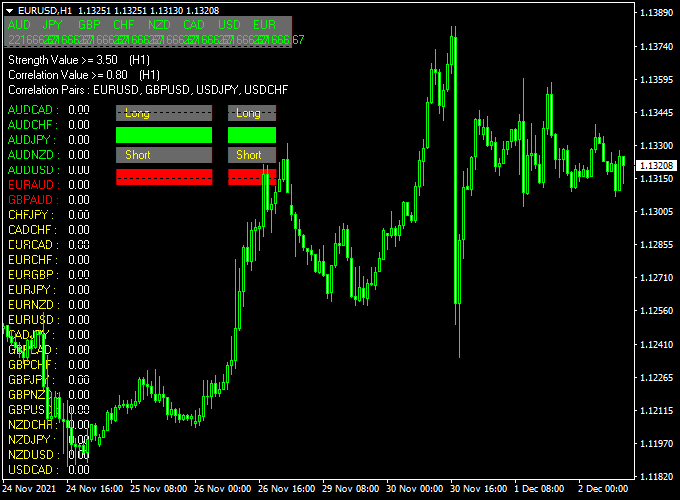

Indicator Example Chart (EUR/USD H1)

The example chart below displays the BT CS MT4 indicator in action on the trading chart.

Pros

- Very easy to use

- Fast reaction to price action without lag

- Effective for all timeframes and trading instruments

Cons

- No arrows or sound alerts – requires chart attention

- May give false signals during flat or low-volume periods

Download Now

Download the “bt-cs-indicator.ex4” indicator for Metatrader 4

Powerful BT CS Forex Signals + DKX Arrows Alerts Forex Strategy (MT4)

This strategy combines the currency strength analysis of the Powerful BT CS Forex Signals Indicator with the precise entry timing of the DKX Arrows Alerts Forex Indicator.

By using the Powerful BT CS to measure the relative strength of currencies, traders can identify strong directional bias, while the DKX Arrows provide clear entry signals confirming trend momentum.

What This Strategy Is About

The Powerful BT CS Forex Signals Indicator analyzes the strength of individual currencies in a pair, highlighting when one currency is significantly stronger or weaker than the other.

This helps traders spot potential trending moves based on currency strength imbalance.

The DKX Arrows Alerts Indicator then offers timely buy or sell arrows that confirm entry points aligned with the strength signals, increasing trade accuracy and timing.

Best Timeframes and Pairs

This strategy is effective on M15 to H1 charts and works best on major pairs such as EUR/USD, GBP/USD, USD/JPY, and AUD/USD.

It is suitable for capturing medium-term trends where currency strength divergence is evident.

Buy Entry Rules

Conditions:

- The Powerful BT CS Indicator shows “LONG” when the base currency is stronger than the quote currency (indicating bullish strength).

- The DKX Arrows Alerts Indicator displays a bullish blue arrow below the price candle.

- Enter a buy trade at the close of the confirmation candle.

Stop Loss & Take Profit:

- Stop loss: Place below the recent swing low or the low of the confirmation candle.

- Take profit: Aim for at least 1.5 times the stop loss distance or target the next significant resistance level.

Sell Entry Rules

Conditions:

- The Powerful BT CS Indicator shows “SHORT” when the base currency is weaker than the quote currency (indicating bearish strength).

- The DKX Arrows Alerts Indicator displays a bearish pink arrow above the price candle.

- Enter a sell trade at the close of the confirmation candle.

Stop Loss & Take Profit:

- Stop loss: Place above the recent swing high or the high of the confirmation candle.

- Take profit: At least 1.5 times the stop loss distance or near the next support level.

Case Study 1

EUR/USD M15 Chart Analysis (37-Day Sample Period):

- Total Signals: 54 trades

- Winning Trades: 36 (66.7%)

- Average Win: +32 pips

- Average Loss: -14 pips

- Net Result: +900 pips over the testing period

Case Study 2

USD/JPY H1 Chart Analysis (32-Day Sample Period):

- Total Signals: 30 trades

- Winning Trades: 20 (66.7%)

- Average Win: +58 pips

- Average Loss: -26 pips

- Net Result: +876 pips over the testing period

Advantages of This Strategy

- Utilizes currency strength analysis to identify strong directional bias.

- Clear entry signals from DKX Arrows improve timing and reduce false entries.

- Works well across multiple pairs and timeframes.

- Suitable for trend following and swing trading.

Drawbacks to Consider

- May lag during sudden market reversals or news events.

- Requires monitoring to align currency strength signals with arrow confirmations.

- Stop loss and take profit levels need careful placement to avoid premature exits.

Strategy Conclusion and Tips

Combining the Powerful BT CS Forex Signals Indicator with the DKX Arrows Alerts Forex Indicator offers a robust strategy that blends currency strength analysis with precise entry timing.

For best results:

- Trade during active market sessions with good liquidity.

- Apply strict risk management with predefined stop losses and take profits.

- Backtest the strategy on your preferred pairs and timeframes before going live.

- Avoid trading during high-impact news releases to minimize false signals.

Indicator Specifications

| Indicator Name | BT CS Forex Signals |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| Timeframes | All Timeframes (best: M15–H4) |

| Markets | Forex, Commodities, Indices, Crypto |

| Indicator Type | Candle Strength & Trend Color Bar |

| Inputs |

|

FAQ Section

What does BT CS stand for?

BT CS refers to “Bar Trend – Candle Strength,” which is the core logic behind the indicator’s visual signal system.

Can I use this with other indicators?

Yes. It pairs well with moving averages, RSI, MACD, or price action tools for confirmation.

Final Words

The Powerful BT CS Forex Signals Indicator offers a fast and visual way to detect market momentum and trend strength.

Whether you’re scalping, day trading, or swing trading, this non-repainting tool helps reduce confusion and supports confident trade entries.