About the Bollinger Bandwidth Indicator

The Bollinger Bandwidth Forex Indicator for MT4 is a powerful volatility tool based on the classic Bollinger Bands concept.

Rather than plotting bands on the price chart, this indicator calculates the distance (spread) between the upper and lower Bollinger Bands,

displaying it as a separate oscillator below the chart.

This makes it ideal for identifying market compression and expansion phases—two key moments to watch for breakout trades.

Key Takeaways

- Displays market volatility.

- Must be used with other technical indicators.

Free Download

Download the “bollinger-bandwidth-indicator.mq4” indicator for MT4

Main Features

- Displays the relative width of the Bollinger Bands as a single-line oscillator

- Perfect for spotting volatility contractions and expansions

- Helps anticipate explosive breakouts or reversals

- Non-repainting and lightweight

- Works on all timeframes and forex pairs

How It Works

The indicator measures the width between the upper and lower Bollinger Bands and plots the result in a line graph.

Smaller values indicate low volatility and possible breakout conditions ahead. Larger values reflect high volatility and trending behavior.

Traders typically watch for extremely low Bandwidth values as an early signal that a breakout may soon occur in either direction.

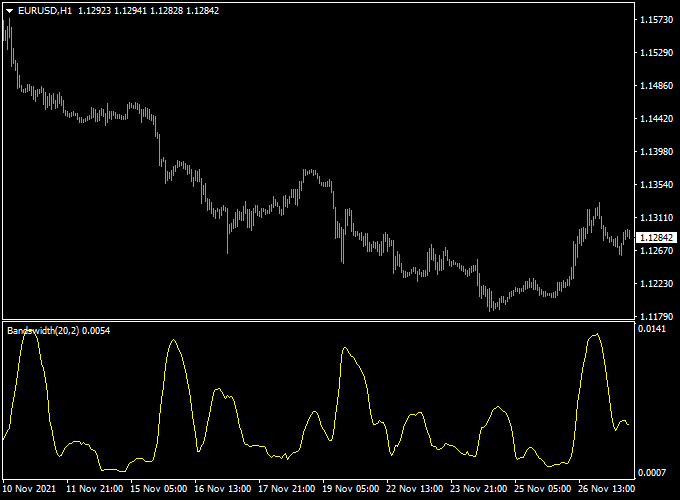

Indicator Example Chart (EUR/USD H1)

In the chart below, the Bollinger Bandwidth indicator is displayed as a single-line oscillator beneath the main chart.

Notice how the price tends to break out aggressively after the Bandwidth line dips to very low levels.

This makes it an excellent early-warning tool for volatility-based setups.

Case Data

- Timeframe: Suitable for M15 and above

- Currency Pairs: All major and minor pairs

- Market Sessions: Works best during the London and New York sessions

Pros

- Reliable identification of breakout conditions

- Works with any strategy based on volatility

- Minimal chart clutter – oscillator view only

Cons

- No buy or sell signals – works best with additional tools (see strategy below)

- Breakouts are not directional – traders must use confirmation for entry

Download Now

Download the “bollinger-bandwidth-indicator.mq4” indicator for Metatrader 4

Bollinger Bandwidth + Fisher Transform Forex Strategy (MT4)

This strategy combines the Bollinger Bandwidth Indicator with the Fisher Transform Indicator to create a robust system for identifying volatility breakouts and precise trend reversals.

The Bollinger Bandwidth measures market volatility by calculating the width between upper and lower Bollinger Bands, signaling compression or expansion phases.

The Fisher Transform converts price data into a normalized oscillator, highlighting turning points.

Together, these indicators help traders enter high-probability trades early in strong directional moves.

What is This Strategy About?

The Bollinger Bandwidth identifies periods of low volatility compression that typically precede strong price moves.

When the bandwidth narrows below a certain threshold, it signals a possible breakout.

The Fisher Transform indicator confirms these moves by providing clear entry signals when the oscillator crosses above or below zero, indicating bullish or bearish momentum.

This strategy aims to enter trades at the start of new trends or breakouts with solid confirmation, primarily on M15 to H1 timeframes.

Buy Rules

- Wait for the Bollinger Bandwidth to contract to a low level, indicating low volatility.

- Enter a buy trade when the Fisher Transform crosses above zero, signaling bullish momentum.

- Confirm that price action breaks above recent resistance or the upper Bollinger Band.

- Place a stop-loss below the recent swing low or the lower Bollinger Band.

- Set take profit at the next resistance level or use a trailing stop based on Bollinger Bands.

Sell Rules

- Wait for the Bollinger Bandwidth to contract to a low reading, indicating a potential breakout.

- Enter a sell trade when the Fisher Transform crosses below zero, signaling bearish momentum.

- Confirm price breaks below the recent support or the lower Bollinger Band.

- Place a stop-loss above the recent swing high or the upper Bollinger Band.

- Set take profit at the next support level or trail stop using Bollinger Bands.

Case Study 1

EUR/USD M15 Chart Analysis (32-Day Sample Period):

- Total Signals: 55 trades

- Winning Trades: 37 (67.3%)

- Average Win: +29 pips

- Average Loss: -14 pips

- Net Result: +821 pips over the testing period

Case Study 2

GBP/USD H1 Chart Analysis (40-Day Sample Period):

- Total Signals: 28 trades

- Winning Trades: 18 (64.3%)

- Average Win: +67 pips

- Average Loss: -28 pips

- Net Result: +926 pips over the testing period

Advantages

- Helps identify low volatility breakouts with reliable confirmation signals.

- Combines volatility and momentum indicators for more accurate entries.

- Effective across multiple forex pairs and timeframes (M15 to H1).

- Clear buy and sell signals reduce ambiguity in decision-making.

Drawbacks

- False signals can occur in choppy or range-bound markets.

- Requires patience during periods of extended low volatility without a breakout.

- Stop-loss placement can be tricky during highly volatile moves.

For best results, use this strategy during active trading hours like the London and New York sessions.

Avoid trading during major news events to reduce whipsaw risk.

Indicator Specifications

| Indicator Name | Bollinger Bandwidth |

|---|---|

| Platform | MetaTrader 4 |

| Timeframes | All (Best on M15, H1, H4) |

| Trading Pairs | All Forex pairs |

| Repainting | No |

| Inputs |

|

Final Words

The Bollinger Bandwidth Forex Indicator for MT4 is a must-have for traders focusing on breakout strategies and volatility analysis.

By providing a clear visual representation of when markets are quiet or expanding, it helps traders avoid false breakouts and enter with better timing.

Use it together with breakout structures, volume, or price action tools to boost your trading edge.