About the Average Size Bar Volatility Indicator

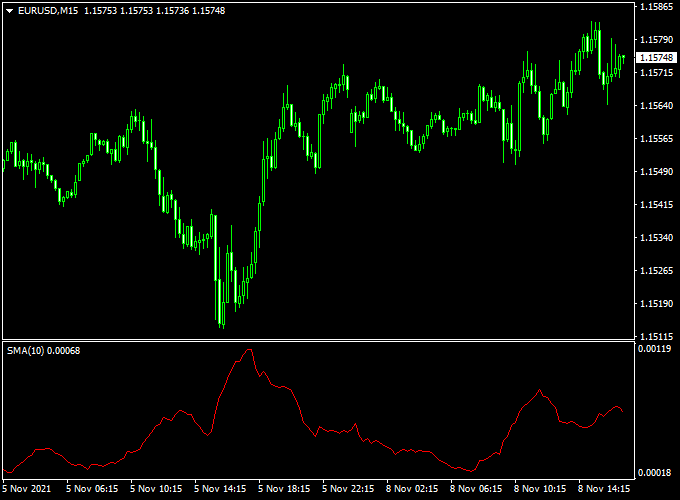

The Average Size Bar Volatility Forex Indicator for MT4 measures the average size of candlestick bars over a specified period.

This helps traders assess market volatility and better time their entries and exits. It’s a valuable tool for identifying quiet versus volatile trading phases.

General Assumptions:

- A rising Average Size Bar Volatility signal line indicates increasing market volatility.

- A falling Average Size Bar Volatility signal line indicates decreasing market volatility.

The indicator works on all trading instruments (Forex, CFD stocks, Indices, Cryptocurrencies, Commodities,..).

Key Features

- Calculates and displays average bar size (range) in pips

- Customizable calculation period to suit different trading styles

- Helps detect periods of high and low volatility

- Works across all timeframes and currency pairs

- Supports traders in improving risk management

Free Download

Download the “average-size-bar-indicator.mq4” indicator for MT4

Benefits of Using This Indicator

- Provides clear insight into market volatility changes

- Helps avoid trading during low-volatility periods

- Assists in setting realistic stop-loss and take-profit levels

- Useful for scalpers, day traders, and swing traders

Indicator Example Chart (EUR/USD M15)

How To Use This Indicator

Use the Average Size Bar Volatility Indicator to:

- Identify when volatility is increasing to enter trades with momentum

- Avoid trades during low-volatility consolidation

- Adjust your position size and risk according to current volatility

- Set dynamic stop-loss and take-profit levels based on average bar size

Download Now

Download the “average-size-bar-indicator.mq4” indicator for Metatrader 4

Average Size Bar Volatility + Elite PRO Scalper Strategy for MT4

This high-frequency trading strategy merges the real-time volatility measurement of the Average Size Bar Volatility Forex Indicator with the precision signals of the Elite PRO Scalper Indicator.

The result is a fast-paced, low-risk system ideal for scalpers and short-term traders who want to exploit brief price movements while filtering out low-quality setups based on market volatility.

What Is This Strategy About?

This strategy focuses on entering quick buy or sell trades during periods of ideal volatility.

The Elite PRO Scalper generates accurate short-term buy/sell signals, while the Average Size Bar Volatility indicator acts as a filter, ensuring you only trade when the market has enough momentum to make a move worthwhile.

The approach is designed for 1-minute to 5-minute charts but can also be applied to M15 with adjusted expectations.

How the Indicators Work Together

1. Average Size Bar Volatility Indicator

This tool measures the average size of recent bars in pips and plots this data in an easy-to-read format.

It helps you determine whether the market is quiet (low bar size) or active (high bar size).

When the average bar size exceeds a defined threshold, it signals that volatility is sufficient to justify scalping entries.

2. Elite PRO Scalper Indicator

This indicator provides rapid buy and sell signals based on internal price action logic, momentum, and volume.

It’s optimized for quick entries and exits, minimizing exposure and maximizing accuracy.

The signals are displayed clearly on the chart, with recommended stop-loss and take-profit levels.

Buy Rules

- Wait for a Buy Signal from the Elite PRO Scalper.

- Confirm that the Average Size Bar Volatility indicator is above a predefined threshold (e.g., 8–12 pips average bar size).

- Ensure the signal appears during active market sessions (London, New York).

- Enter at the close of the signal candle.

- Place a tight stop loss (e.g., 5–8 pips below entry).

- Target a fixed 1:1.5 or 1:2 risk-reward or exit at the next opposite signal.

Sell Rules

- Wait for a Sell Signal from the Elite PRO Scalper.

- Check that the current average bar size is still within the high-volatility range as shown by the Volatility Indicator.

- Trade only during liquid market hours.

- Enter at candle close.

- Set stop loss just above the recent swing high or 5–8 pips.

- Use a quick target—1:1.5 or the next support level.

Advantages of This Strategy

- High Accuracy: Elite PRO Scalper signals are filtered to only appear during favorable volatility conditions.

- Risk Efficiency: Tight stops and quick exits reduce drawdown and capital exposure.

- Speed: Ideal for scalping multiple opportunities per session.

- Volatility-Aware: Avoids trading during dead market periods, increasing win rate and trade quality.

Drawbacks and Considerations

- This strategy is not suited for trending markets on higher timeframes—it’s made for fast in-and-out trades.

- Requires focus and discipline—scalping demands strict execution and no hesitation.

- May generate fewer signals during low volatility periods; avoid forcing trades.

Case Study Example

GBP/USD M15 Chart (Sample Period: 2 Weeks)

- Total Trades: 25

- Winning Trades: 17 (68%)

- Average Win: +30 pips

- Average Loss: -14 pips

- Net Result: +398 pips over the testing period

Conclusion

The combination of the Average Size Bar Volatility Indicator and the Elite PRO Scalper Indicator creates a sharp, no-nonsense scalping system for MT4 users.

By only taking trades when volatility supports movement and using proven entry signals, this strategy offers an edge in short-term trading while keeping risk tightly under control.

Perfect for disciplined traders who thrive in fast-paced market conditions.

Indicator Specifications

| Indicator Name | Average Size Bar Volatility |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| Timeframes | All timeframes |

| Currency Pairs | All major and minor pairs |

| Inputs |

|

Final Words

The Average Size Bar Volatility Forex Indicator MT4 is a simple yet powerful tool to help traders adapt their strategies to changing market conditions.

By understanding bar size volatility, you can better manage risk and optimize your trade timing.