The Absolute Strength Histogram MT4 forex indicator draws buy/sell colored histogram bars in a separate Metatrader 4 window.

The histogram bars are based on a mix of trend strength and a moving average.

Green absolute histogram price bars indicate the trend is bullish and currency traders look for buy trade opportunities.

Red absolute histogram price bars indicate the trend is bearish and currency traders look for sell trade opportunities.

For more reliable trading signals, combine the Absolute Strength Histogram with a trend following indicator, for example the 100 simple moving average would be a good choice.

Trade in the direction of the underlying trend and avoid trading against the trend.

Works for scalping, day trading and swing trading purposes.

Feel free to experiment with the default indicator settings.

Free Download

Download the “absolute-strength-histogram.mq4” MT4 indicator

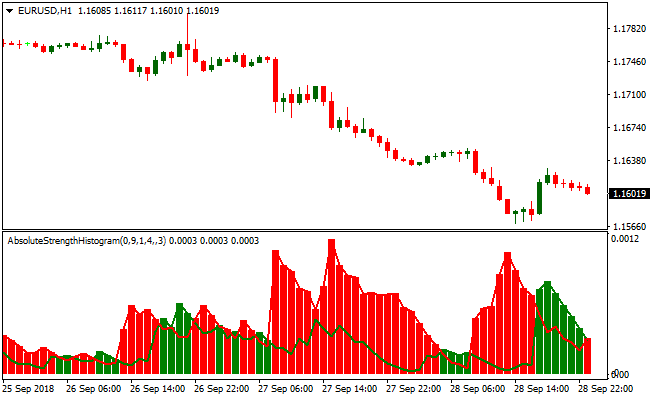

Indicator Chart (EUR/USD H1)

The EUR/USD Hourly chart below displays the Absolute Strength Histogram Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the Absolute Strength Histogram MT4 forex indicator are easy to interpret and go as follows:

Buy Signal: Initiate a new buy trade when the Absolute Strength Histogram forex indicator changes from red histogram bars to green histogram bars.

Sell Signal: Initiate a new sell trade when the Absolute Strength Histogram forex indicator changes from green histogram bars to red histogram bars.

Trade Exit: Close the open buy/sell trade when an opposite signal occurs, or use your own method of trade exit.

Absolute Strength Indicator + ZeroLag MACD Forex Scalping Strategy MT4

This scalping strategy combines the Absolute Strength Histogram MT4 Indicator and the ZeroLag MACD MT4 Indicator to provide a fast and efficient method for day trading.

The Absolute Strength Histogram measures short-term momentum, showing green bars for bullish momentum and red bars for bearish momentum.

The ZeroLag MACD confirms the overall trend by indicating whether price action is above or below the zero line.

By combining these two indicators, traders can identify high-probability entry points where momentum and trend align.

This strategy is particularly effective on short timeframes such as M1, M5, and M15, making it ideal for scalpers who aim to capture small, quick profits multiple times per day.

It works best on major currency pairs with high liquidity, as price moves more reliably and spreads are tighter.

By focusing on momentum and trend alignment, the strategy helps reduce false entries and increases the chance of successful scalping trades.

Buy Entry Rules

- Open a buy trade when the Absolute Strength Histogram shows green bars.

- Confirm that the ZeroLag MACD value is above zero.

- Enter the trade at the next candle close when both conditions are met.

- Set the stop loss below the recent swing low or just under a nearby support level.

- Take profit when the Absolute Strength Histogram shows a red reversal bar.

Sell Entry Rules

- Open a sell trade when the Absolute Strength Histogram shows red bars.

- Confirm that the ZeroLag MACD value is below zero.

- Enter the trade at the next candle close when both conditions are met.

- Set the stop loss above the recent swing high or just above a nearby resistance level.

- Take profit when the Absolute Strength Histogram displays a green reversal bar.

Advantages

- Fast signals allow capturing small, quick market movements suitable for scalping.

- Combining momentum and trend indicators reduces false entries compared to using a single indicator.

- Works on multiple short timeframes, giving traders flexibility to trade M1, M5, or M15 charts.

- Dynamic take profit and stop loss based on price levels allow adaptive exits depending on market conditions.

- Simple rules make it easy for beginners to follow while still being effective for experienced traders.

- Helps identify both momentum and trend reversals, improving scalp timing accuracy.

Drawbacks

- Frequent trades can increase costs due to spreads and possible slippage.

- Requires constant attention and fast reactions, making it unsuitable for casual traders.

- Signals may be less reliable during low volatility or quiet sessions.

- Short timeframes can produce noise, requiring discipline to avoid overtrading.

- Success depends heavily on timing the entry and exit accurately.

- Not ideal for accounts with very high spreads or slow execution brokers.

Case Study 1: EUR/JPY on M5

On the 5-minute EUR/JPY chart, the Absolute Strength Histogram turned green while the ZeroLag MACD value was above zero.

A buy trade was entered at 148.50 with a stop loss at 148.40.

The price moved steadily upward and reached 148.70, capturing a profit of 20 pips before the histogram bars began to fade and the MACD approached zero.

Case Study 2: AUD/USD on M1

On the 1-minute AUD/USD chart, red histogram bars appeared on the Absolute Strength Histogram and the ZeroLag MACD value dropped below zero.

A sell trade was opened at 0.6705 with a stop loss at 0.6710.

The price moved down to 0.6698, giving a gain of 7 pips before the histogram started turning green and the MACD approached zero.

Additional Strategy Tips

- Combine signals with higher timeframe trend analysis to avoid trading against the overall market direction.

- Wait for small pullbacks toward the SuperTrend or support/resistance levels before entering trades to improve timing.

- Limit scalping trades to the most volatile periods of the day to maximize pip potential.

- Use alerts on your indicators to avoid constantly watching the chart and catch setups immediately.

- Adjust stop loss and take profit levels dynamically depending on pair volatility and recent market swings.

- Keep position sizes small to manage risk, since scalping trades are frequent and tight.

- Focus on major currency pairs and avoid exotic pairs where spreads are high and liquidity is low.

- Record each trade in a journal with time, pair, entry, exit, and pip gain/loss to monitor performance and optimize the strategy.

- Combine with other simple confirmations such as candlestick patterns to improve the accuracy of entries.

- Practice discipline and avoid overtrading, only taking trades that meet all entry criteria from both indicators.

Download Now

Download the “absolute-strength-histogram.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Variable (Mode, Length, Smooth, Signal, Mode MA) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Histogram Trend