The ACD Pivot Points indicator For MT4 draws the daily Pivot Point together with the recommended buy and sell trade entry prices.

The buy and sell trade entry levels are plotted above and below the Pivot Point itself.

It’s recommended to use the indicator on the following time frames: M5, M15, M30 and H1.

The indicator works for all trading instruments.

Free Download

Download the “acd-pivot-points-indicator.mq4” indicator for MT4

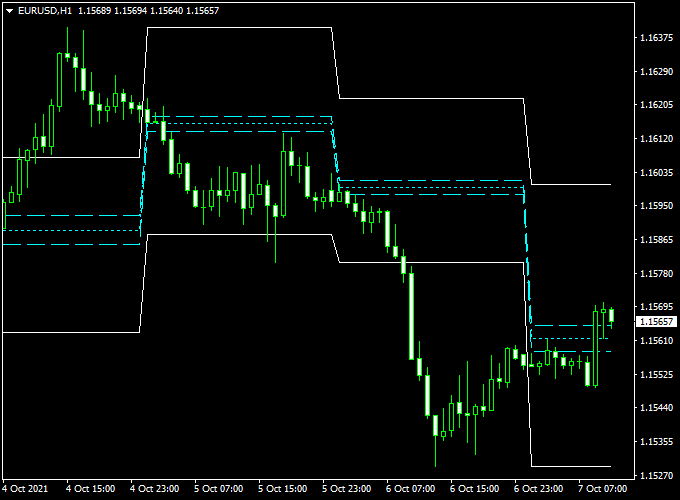

Indicator Example Chart (EUR/USD H1)

How to trade with it (example)?

Open a buy position as soon as price closes above the upper dotted horizontal line and the market is trending up.

Open a sell position as soon as price closes below the lower dotted horizontal line and the market is trending down.

Exit the trade for a fixed profit target or for a risk to reward ratio of 1.5 or better.

Feel free to use your own favorite trading method to open and close trades with the ACD Pivot Points indicator.

Indicator Specifications

Trading Platform: Developed for Metatrader 4 (MT4)

Currency pairs: Works for any pair

Time frames: Works for any time frame

Input Parameters: Pivot range start, Pivot range end, display Pivot Point, display MA’s, color settings & style

Indicator type: Pivot Point

Repaint? Does not repaint the Pivot Point & levels.

Download Now

Download the “acd-pivot-points-indicator.mq4” indicator for Metatrader 4

Installation:

Open the Metatrader 4 platform

From the top menu, click on “File”

Then click on “Open Data Folder”

Then double click with your mouse button on “MQL4”

Now double click on “Indicators”

Paste the acd-pivot-points-indicator.mq4 indicator in the Indicators folder.

Finally restart the MT4 platform and attach the indicator to any chart.

How to remove the indicator?

Click with your right mouse button in the chart with the indicator attached onto it.

Select “Indicator List” from the drop down menu.

Select the indicator and press delete.

How to edit the indicator’s inputs and parameters?

Right click with your mouse button in the chart with the indicator attached onto it.

From the drop down menu, click on indicators list.

Select the indicator from the list and press edit.

Now you can edit the indicator.

Finally, press the OK button to save the updated configuration.