The All In One (AIO) Divergence Signal forex indicator for MT 4 scans for bullish and bearish divergence between AIO and price.

This is a very useful indicator that works on price action, so basically, there’s no lag. It can be applied to any currency pair and timeframe.

The All In One MT4 indicator offers a lot of options and trading alerts such as push notifications, email notifications, signal buffer,…

Free Download

Download the “AIO Divergence.mq4” MT4 indicator

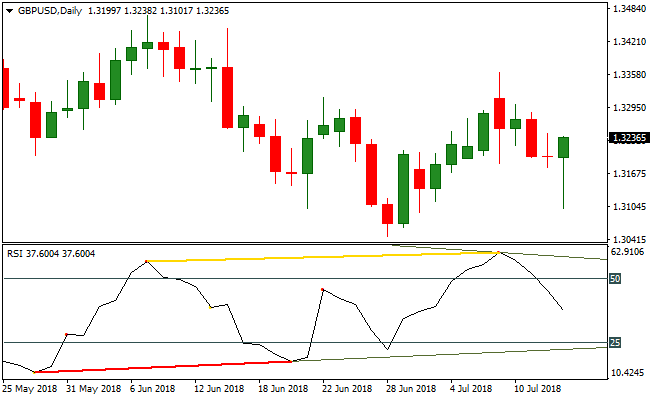

Indicator Chart (GBP/USD D1)

The GBP/USD Daily chart below shows the All In One (AIO) Divergence Signal forex indicator in action.

Basic Trading Signals

Divergences are used to look for possible reversals in the trend.

Look to buy: A Bullish divergence occurs between price and AOI in a bearish trend.

Traders would set a stop loss a few pips below the most recent swing low.

Look to sell: A bearish divergence occurs between price and AOI in a bullish trend.

Traders would set a stop loss a few pips above the most recent swing high.

All-in-One Divergence and SuperTrend MTF Indicator Forex Strategy

This MT4 trading strategy combines divergence signals with trend confirmation using the All-in-One Divergence MT4 Forex Indicator and the SuperTrend MTF MT4 Forex Signal Indicator.

The All-in-One Divergence indicator identifies bullish and bearish divergences between price and the Awesome Oscillator Indicator (AOI).

A bullish divergence occurs in a bearish trend, signaling a potential buy, while a bearish divergence occurs in a bullish trend, signaling a potential sell.

The SuperTrend MTF indicator confirms the overall trend with green lines for bullish trends and red lines for bearish trends.

Combining these tools on M15 and H1 charts allows traders to enter trades with trend alignment while spotting early reversal opportunities across different currency pairs.

Buy Entry Rules

- Confirm a bullish divergence between price and AOI in a bearish trend using the All-in-One Divergence indicator.

- Check that the SuperTrend MTF shows a green line or turning bullish to align with the potential trend reversal.

- Enter a buy trade at the candle close when divergence is confirmed.

- Place a stop loss a few pips below the most recent swing low.

- Take profit at the next resistance level or when SuperTrend turns red indicating a trend reversal.

Sell Entry Rules

- Confirm a bearish divergence between price and AOI in a bullish trend using the All-in-One Divergence indicator.

- Check that the SuperTrend MTF shows a red line or turning bearish to align with the potential trend reversal.

- Enter a sell trade at the candle close when divergence is confirmed.

- Place a stop loss a few pips above the most recent swing high.

- Take profit at the next support level or when SuperTrend turns green indicating a trend reversal.

Advantages

- Combines divergence signals with trend confirmation for higher probability trades.

- All-in-One Divergence captures early potential reversals before full trend shifts occur.

- SuperTrend MTF provides accurate trend direction to avoid countertrend trades.

- Works on M15 and H1 charts for intraday and swing trades.

- Defined stop loss and take profit rules reduce emotional decision-making.

- Helps traders enter trades with both trend alignment and reversal opportunities.

- Reduces the risk of entering premature trades by requiring dual confirmation.

- Simple to implement and monitor during active trading sessions.

Drawbacks

- Divergence signals may sometimes be invalid in strong trending markets, causing false entries.

- SuperTrend confirmation may lag slightly, delaying entry opportunities.

- Requires active monitoring, especially on shorter M15 charts.

- Limited setups in sideways or low volatility markets.

Example Case Study 1

On EURJPY H1, a bullish divergence appeared between price and AOI while the trend was slightly bearish.

The SuperTrend MTF showed a green line indicating a shift toward bullish momentum.

A long trade was entered at candle close with a stop loss set 6 pips below the recent swing low.

Price moved upward, reaching the next resistance level, capturing a 48 pip gain.

The combination of divergence and trend alignment provided a reliable entry.

Example Case Study 2

On GBPUSD M15, a bearish divergence occurred between price and AOI in a bullish trend.

The SuperTrend MTF confirmed the bearish trend with a red line.

A short trade was entered at candle close with a stop loss placed 4 pips above the recent swing high.

Price declined steadily and the trade closed near the next support level, achieving a 22 pip profit.

Aligning the divergence signal with SuperTrend trend confirmation ensured a higher probability trade.

Strategy Tips

- Always wait for both divergence confirmation and SuperTrend trend alignment before entering trades.

- Focus on highly liquid currency pairs for more reliable divergence signals.

- Use M15 and H1 charts to balance signal accuracy with trading frequency.

- Place stop losses according to recent swing highs/lows to manage risk effectively.

- Consider partial profit-taking at intermediate levels to protect gains in volatile markets.

- Combine with support and resistance zones to refine the exit strategy.

- Scale position size according to volatility to protect capital during rapid price movements.

- Be patient and only enter trades when both divergence and trend indicators align.

Download Now

Download the “AIO Divergence.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: chart pattern indicator

Customization options: Variable (oscillator, bearish divergence, bullish divergence, support/resistance lines, qSteps, fast MA period, slow MA period, regressions,…)Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: price action