About the Amazing Kijun Sen Forex Indicator

The Amazing Kijun Sen Forex Indicator for MT4 is a dynamic tool built around the Kijun trade formula.

It helps traders determine trend direction, identify pullbacks, and time entries and exits based on the behavior of a single, reliable price line.

This indicator plots a bright yellow Kijun Sen line directly on the main MT4 chart.

The line itself represents the balance level of recent price action, giving traders a visual reference for where the market considers fair value during trending conditions.

When price interacts with this line, it often signals important shifts in momentum or continuation of the current trend.

Whether you trade intraday or swing setups, the Amazing Kijun Sen provides a straightforward way to stay in tune with market rhythm without relying on overly complex signals.

Its simplicity makes it suitable for both beginners and experienced traders who prefer clean, uncluttered charts.

Free Download

Download the “KijunSen.mq4” indicator for MT4

Key Features

- Displays the yellow Kijun Sen line on the MT4 chart

- Helps define bullish and bearish trend direction

- Supports both trade entry and exit timing

- Minimalist design with high clarity

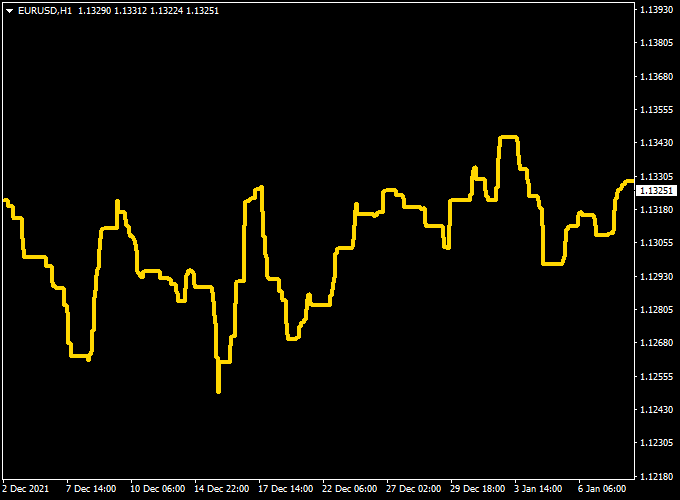

Indicator Chart

The chart displays the Amazing Kijun Sen indicator on the MT4 platform.

The yellow Kijun Sen line traces the evolving balance level of price, helping visualize the dominant trend and pullbacks.

When the line slopes consistently up or down, it confirms trend direction and potential entries.

Guide to Trade with the Amazing Kijun Sen

Buy Rules

- Confirm the yellow Kijun Sen line is sloping upwards

- Wait for the price to pull back toward the Kijun Sen line

- Enter a buy when the price stays above the line and resumes upward movement

Sell Rules

- Confirm the yellow Kijun Sen line is sloping downwards

- Wait for the price to retrace toward the Kijun Sen line

- Enter a sell when the price remains below the line and continues lower

Stop Loss

- Place the stop beyond the nearest support or resistance level

- For buys, set the stop below confirmed support

- For sells, set the stop above confirmed resistance

Take Profit

- Target the next major support or resistance zone

- Exit partially at the first reaction level

- Close the trade near strong historical levels

Practical Tips

- Avoid entering when the Kijun Sen line flattens or twists frequently

- Use price action around the Kijun Sen for tighter stop placement

MT4 Scalping Strategy Using Amazing Kijun-Sen + Best Forex Scalping Indicator

This MT4 scalping strategy combines the Amazing Kijun-Sen Forex Indicator with the Best Forex Scalping Indicator.

It is designed for traders looking to capture quick market movements and profit from short-term trends.

The strategy works best on lower time frames such as M5 and M15, making it ideal for intraday scalping.

By using trend direction from the Kijun-Sen and precise buy/sell signals from the scalping indicator, this system minimizes false entries and maximizes the chance of successful trades.

Buy Entry Rules

- Check that the Kijun-Sen yellow line is sloping upwards, indicating a bullish trend.

- Confirm a buy signal from the Best Forex Scalping Indicator (blue arrow appears).

- Enter a buy trade at the close of the candle, showing the blue arrow.

- Place the stop loss just below the recent minor swing low to limit risk.

- Set the take profit at 1–1.5 times the stop loss distance or at the next minor resistance level.

Sell Entry Rules

- Check that the Kijun-Sen yellow line is sloping downwards, indicating a bearish trend.

- Confirm a sell signal from the Best Forex Scalping Indicator (red arrow appears).

- Enter a sell trade at the close of the candle, showing the red arrow.

- Place the stop loss just above the recent minor swing high.

- Set the take profit at 1–1.5 times the stop loss distance or near the next minor support level.

Advantages

- Combines trend-following with precise entry signals to create high-probability scalps.

- Reduces the chance of false entries in choppy markets.

- Simple rules make it easy to implement for both beginners and advanced traders.

- Effective on multiple currency pairs, especially majors and liquid cross pairs.

- Clear stop loss and take profit rules provide disciplined risk management.

Drawbacks

- May generate fewer trades in sideways or low volatility periods.

- Requires constant attention as trades are short-term.

- Late signals can occur if the trend changes rapidly.

- Performance depends on the proper selection of currency pairs and time frames.

Case Study 1: EUR/USD M5 Scalping Trade

On the M5 chart, the Kijun-Sen line was sloping upwards, signaling a bullish trend.

A blue arrow appeared on the Best Forex Scalping Indicator at 1.1042.

A buy trade was opened at the close of the confirmation candle.

The stop loss was set at 1.1038 below the recent swing low, and the take profit was set at 1.1048, achieving a 6-pip gain.

The trade closed within 20 minutes as the trend continued upward briefly before consolidating.

Case Study 2: GBP/USD M15 Scalping Trade

On the M15 chart, the Kijun-Sen line sloped downward, indicating a bearish trend.

A red arrow appeared on the Best Forex Scalping Indicator at 1.3065.

A sell trade was opened at the close of the confirmation candle.

The stop loss was placed at 1.3072, just above the recent swing high, and the take profit at 1.3055.

The trade closed successfully after 35 minutes, resulting in a 10-pip profit.

Strategy Tips

- Focus on liquid currency pairs to reduce slippage and spread costs.

- Combine this strategy with economic calendar monitoring to avoid news spikes.

- Use small lot sizes and consistent risk per trade to protect your account during scalping.

- Consider using a trailing stop if the trend shows strong momentum to maximize profits.

- Practice on a demo account first to get familiar with the speed and signals of this scalping setup.

Download Now

Download the “KijunSen.mq4” indicator for Metatrader 4

FAQ

How does the Amazing Kijun Sen differ from standard Kijun tools?

This indicator focuses on a single optimized Kijun Sen calculation. By removing additional Ichimoku components, it offers faster interpretation and smoother interaction with price.

What does the slope of the yellow line indicate?

The slope reflects directional pressure. An upward slope signals sustained buying interest, while a downward slope shows persistent selling pressure rather than short-term fluctuations.

Is this indicator suitable for trending markets only?

It performs best during trending conditions. In sideways markets, the yellow Kijun Sen may flatten, which helps traders avoid low-quality setups.

Summary

The Amazing Kijun Sen Forex Indicator for MT4 offers a clean and disciplined way to trade market direction using the Kijun trade formula.

Its single yellow line represents price balance and trend strength without adding unnecessary complexity.

By focusing on slope, pullbacks, and price interaction with the Kijun Sen, traders can improve timing and reduce emotional decision-making.

The indicator is easy to apply, adaptable across timeframes, and suitable for both entries and exits.