About the ATR Channels Indicator

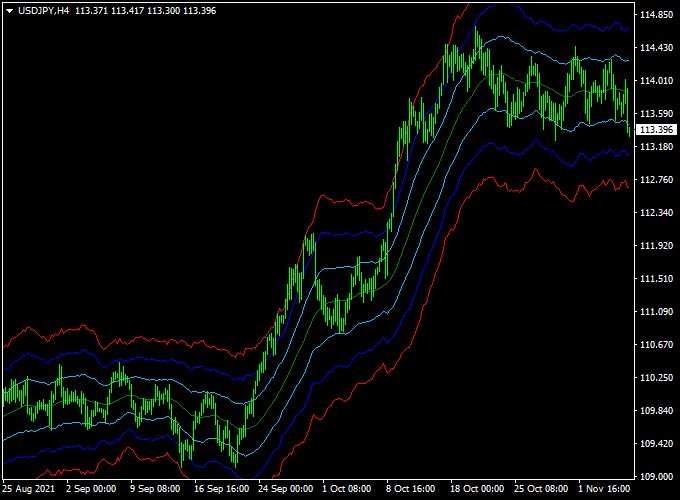

The ATR Channels Forex Indicator for MT4 is a volatility-based tool that plots channel levels above and below price based on the Average True Range (ATR).

These dynamic zones help traders identify potential breakouts, trend continuation, and reversal setups.

It’s suitable for all trading styles and timeframes.

Key Features of the Indicator

- Plots upper and lower ATR-based channel lines

- Adapts to market volatility in real time

- Helps identify breakouts, reversals, and overbought/oversold zones

- Works across all MT4 timeframes and instruments

- Easy to use, no repainting

How the Indicator Works

The indicator calculates the ATR value over a selected period and adds/subtracts it from a central reference (such as a moving average) to form dynamic price channels.

When price touches or breaks the outer bands, it may indicate strong momentum, exhaustion, or a breakout opportunity.

Free Download

Download the “atr-channels.mq4” indicator for MT4

Benefits of Using the ATR Channels

- Improves entry and exit timing by accounting for market volatility

- Filters out noise in ranging conditions

- Great for breakout, pullback, and reversal strategies

- Helps define stop loss and take profit zones

Indicator Example Chart (USD/JPY H4)

How to Trade Using This Indicator

The ATR Channels Indicator offers a simple yet effective way to trade based on market volatility and price direction.

Here’s how to use it:

Buy Setup:

- Open a buy trade when the slope of the ATR Channels indicator starts to turn upward, indicating bullish momentum.

- Enter the trade near the lower green ATR Channel support line, which often acts as a bounce zone.

Sell Setup:

- Open a sell trade when the slope of the ATR Channels indicator begins to turn downward, suggesting bearish pressure.

- Enter the trade near the upper blue ATR Channel resistance line, where the price may reverse lower.

Exit Strategy:

- Close the trade when an opposite signal appears on the chart.

- Alternatively, take profit near previous support or resistance levels.

You can also integrate the ATR Channels Indicator with your preferred trading system or confirmation method to refine entries and exits.

It works well alongside trend-following, price action, or breakout strategies.

Download Now

Download the “atr-channels.mq4” indicator for Metatrader 4

ATR Channels + Bollinger Bands with Signal Forex Indicator Strategy for MT4

This strategy merges the volatility-based range detection of the ATR Channels Forex Indicator with the dynamic price band signals of the Bollinger Bands with Signal Forex Indicator.

Together, these indicators help traders identify key support and resistance zones, breakout opportunities, and momentum shifts on MetaTrader 4.

What Is This Strategy About?

The ATR Channels indicator uses Average True Range (ATR) to plot dynamic price channels reflecting current market volatility, helping traders spot breakout and reversal points.

The Bollinger Bands with Signal indicator overlays standard Bollinger Bands and provides buy/sell signals when price interacts with the bands, highlighting overbought or oversold conditions.

This strategy combines both tools to confirm entries and exits based on volatility, trend, and price action.

Buy Rules

- Observe when the price touches or approaches the lower ATR Channel line, indicating a potential support zone.

- Confirm a buy signal from the Bollinger Bands with the Signal Indicator, usually shown by a green arrow or bullish alert near the lower band.

- Enter a buy trade at the open of the next candle following these confirmations.

- Place a stop loss just below the ATR Channel lower band or recent swing low.

- Set take profit near the midline or upper ATR Channel line, or trail stops using Bollinger Band signals.

Sell Rules

- Watch for the price reaching the upper ATR Channel line, signaling a potential resistance area.

- Confirm a sell signal from the Bollinger Bands with the Signal Indicator, typically a red arrow or bearish alert near the upper band.

- Enter a sell trade at the start of the next candle after both indicators align.

- Place a stop loss above the ATR Channel upper band or recent swing high.

- Take profit near the midline or lower ATR Channel band, or trail stops based on Bollinger Band signals.

Advantages

- Volatility-based dynamic levels: ATR Channels adapt to market conditions better than fixed support/resistance.

- Clear signal confirmation: Bollinger Bands with Signal provides visual alerts to time entries and exits.

- Works in trending and ranging markets: Useful for spotting reversals and breakouts alike.

- Flexible timeframe use: Effective on M15, H1, and H4 charts.

Drawbacks

- Potential false signals: During strong trends, pullbacks near bands may give premature reversal signals.

- Lagging stops: ATR-based channels can sometimes lag price, delaying exits.

- Requires patience: Waiting for both indicators to confirm can reduce trade frequency.

Final Thoughts

The combined use of the ATR Channels Forex Indicator and the Bollinger Bands with Signal Forex Indicator offers traders a powerful method to navigate volatility and timing in the markets.

This strategy is suitable for traders who want to blend dynamic volatility-based support/resistance with clear buy/sell signals to improve trade accuracy and manage risk effectively.

Case Study Example

GBP/USD M5 Chart Analysis (1-Month Sample):

- Total Signals: 40 trades

- Winning Trades: 27 (67.5%)

- Average Win: +25 pips

- Average Loss: -13 pips

- Net Result: +506 pips over the testing period

Indicator Specifications

| Indicator Name | ATR Channels Indicator |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| Timeframes | All timeframes |

| Markets | Forex, Commodities, Indices, Crypto |

| Inputs |

|

| Channel Colors | Upper Band (Blue), Lower Band (Red), Midline (Optional) |

Final Words

The ATR Channels Indicator is a reliable tool for identifying breakouts and volatility-based price action setups.

Whether you’re trading short-term or long-term charts, it offers a valuable edge by adapting to current market conditions.