About the Average Daily Range Info Panel

The Average Daily Range Info Panel indicator for Metatrader 4 provides useful ADR market insights at a glance.

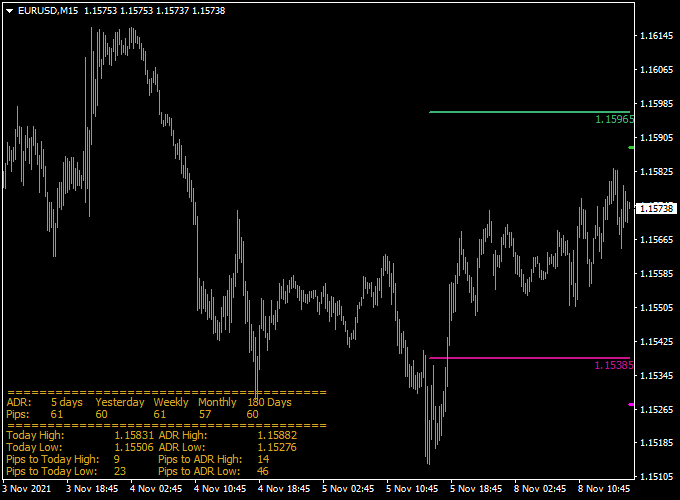

The indicator pops up in the lower left corner of the activity chart as a small dashboard indicator.

It provides the following market info: ADR in pips for 5 days, yesterday, weekly, monthly, and for 180 days.

What’s more?

Today’s high and low price, pips to today’s high, pips to today’s low, pips to ADR high, and pips to ADR low.

This powerful market information might help traders pinpoint entry and exit levels more accurately.

Key Features

- Displays average daily range in pips for selected pairs

- Shows the current day’s progress compared to the ADR

- Customizable panel position and colors for easy viewing

- Supports multiple currency pairs and timeframes

- Helps improve trade entry, exit, and stop-loss decisions

Free Download

Download the “Average Daily Range.ex4” indicator for MT4

How It Works

The indicator calculates the average daily range by analyzing the high and low prices over a user-defined period, typically the last 14 days.

It then displays this range as a numeric value and graphically compares it to the current day’s price movement, helping traders quickly assess if the market has moved enough for potential reversals or continuation.

Benefits of Using This Indicator

- Enhances volatility awareness for better trade planning

- Helps avoid overtrading during low-volatility periods

- Facilitates setting realistic profit targets and stops

- Useful for scalpers, day traders, and swing traders alike

Indicator Example Chart (EUR/USD M15)

How To Use This Indicator

Use the ADR info panel to:

- Monitor if the price has reached or exceeded the average daily movement

- Decide when to enter or exit trades based on volatility conditions

- Adjust stop-loss and take-profit levels to align with the daily range

- Avoid entering trades late in the day when ADR is almost reached

Download Now

Download the “Average Daily Range.ex4” indicator for Metatrader 4

Average Daily Range + Xmaster Formula Strategy for MT4

This trading strategy combines the utility of the Average Daily Range Forex Info Panel Indicator with the signal precision of the Xmaster Formula Metatrader 4 Indicator (2024 Version).

The goal is to improve trade timing, manage risk more effectively, and avoid entering trades when the market has already exhausted its daily range.

This strategy is suitable for intraday and scalping traders who rely on momentum signals and need to understand volatility boundaries.

What Is This Strategy About?

This is a momentum-based entry strategy that filters signals using volatility awareness.

The Xmaster Formula provides high-quality buy and sell signals, while the Average Daily Range (ADR) Info Panel gives context—how much the price has moved today relative to its typical daily range.

By combining these tools, traders can avoid chasing trades near the end of the move and instead focus on entries with sufficient room for profit.

How the Indicators Work Together

1. Average Daily Range (ADR) Info Panel

This indicator calculates the current day’s range in pips and compares it to the historical ADR.

It helps determine whether the pair still has potential to move or if the range has been exhausted.

It also displays high, low, and midpoint levels of the average range directly on the chart.

2. Xmaster Formula (2024 Version)

The Xmaster Formula is a popular trend-following indicator that generates simplified buy and sell signals based on a blend of trend, momentum, and smoothing filters.

It aims to eliminate noise and provide timely entries during strong market moves.

Buy Rules

- Wait for a Buy Signal from the Xmaster Formula to appear.

- Check the ADR Info Panel to ensure the current price has not yet hit or exceeded the upper boundary of the day’s average range.

- Preferably enter when the price is still below 70–80% of the ADR high.

- Place a stop loss below the recent swing low or near the ADR midpoint.

- Target the remaining ADR space (up to 100% of the range) or use a fixed 1:2 risk-reward ratio.

Sell Rules

- Wait for a Sell Signal from the Xmaster Formula.

- Ensure the current price has not already reached the lower ADR boundary.

- Enter the trade when the price is still above 20–30% of the ADR low, offering enough room for downward movement.

- Set stop loss above the recent high or near the ADR midpoint.

- Take profit near the ADR low or using a 1:2 risk-reward ratio.

Advantages of the Strategy

- Signal Filtering: Avoids entering overextended trades with limited profit potential.

- Improved Timing: Combines momentum with daily volatility awareness for better entries.

- Risk Management: Uses ADR boundaries as natural stop loss and take profit guides.

- Simplicity: Xmaster Formula’s clear signals reduce analysis time and hesitation.

Drawbacks and Considerations

- Not ideal during news events—large spikes can distort ADR values and trigger false entries.

- In low-volatility sessions (e.g., Asian session for non-JPY pairs), ADR may not be fully reached.

- Ranging markets may reduce the accuracy of Xmaster signals—use higher timeframe confirmation if needed.

Conclusion

By combining the real-time market awareness of the ADR Info Panel with the trend-focused signals from the Xmaster Formula (2024), traders can enter smarter, avoid exhaustion zones, and improve risk-reward outcomes.

This strategy is especially valuable for intraday traders looking to stay aligned with momentum while respecting the limits of daily volatility.

Case Study Example

EUR/USD Daily Chart (Sample Period: 1 Month)

- Average Daily Range: 70 pips

- Typical Daily Movement Completion: 85% before reversal

- Trades Based on ADR Strategy: 20 trades

- Winning Trades: 14 (70%)

- Average Win: +28 pips

- Average Loss: -15 pips

- Net Result: +302 pips over the testing period

Indicator Specifications

| Indicator Name | Average Daily Range Info Panel |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| Timeframes | All timeframes |

| Currency Pairs | All major and minor pairs |

| Inputs |

|

Final Words

The Average Daily Range Forex Info Panel Indicator MT4 is a must-have tool for traders seeking to optimize their trade timing based on market volatility.

By keeping the daily range and price progress visible at all times, you can make more informed decisions and improve your overall trading performance.

Download it today and trade smarter.