RSI is a very popular technical forex indicator used in many forex strategies and systems.

The Breakout RSI indicator is based on the traditional RSI indicator and provides traders with bullish and bearish breakout signals.

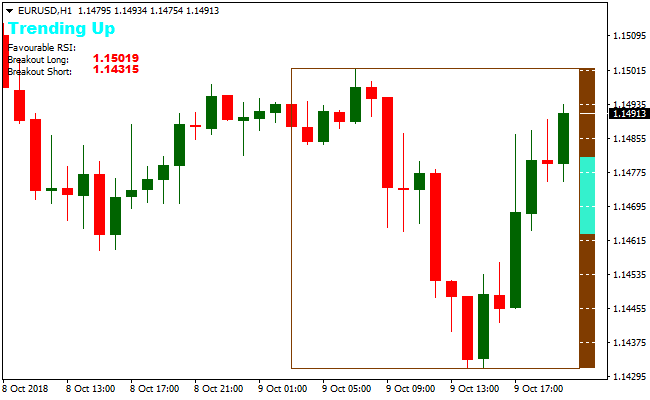

The indicator tells you whether the pair is trending up or down and displays the breakout price to go either long or short (see image below).

In order to maximize profits, confirm the breakout trade with price action or other technical tools.

The breakout RSI can be used to trade short-term breakouts off the 5-minute charts (good for scalping) or more significant breakouts off the 1-hour, 4-hour charts and daily charts (good for day trading and swing trading).

Free Download

Download the “breakout-rsi-indicator.mq4” MT4 indicator

Indicator Chart (EUR/USD H1)

The EUR/USD 1-Hour chart below displays the Breakout RSI Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the Breakout RSI MT4 forex indicator are easy to interpret and go as follows:

Buy Signal: Initiate a buy trade when price touches the “breakout long” price.

Sell Signal: Initiate a sell trade when price touches the “breakout short” price.

Trade Exit: Use your own method of trade exit.

Breakout RSI + Trend Predictor Forex Scalping Strategy for MT4

This MT4 strategy merges the breakout-based entries from the Breakout RSI Indicator with trend confirmation signals from the Trend Predictor v1.0 Indicator.

The idea is to use the breakout levels provided by Breakout RSI to trigger entries and rely on the Trend Predictor’s arrow signals to confirm momentum.

This combination works well on low to medium timeframes such as M5, M15 or even H1, and is suitable for traders who want a balance between breakout precision and trend-following strength.

By waiting for both a price action trigger (breakout level reached) and trend confirmation, the method reduces random trades and improves signal reliability.

Buy Entry Rules

- Wait until price touches the “breakout long” level defined by the Breakout RSI indicator.

- Check that the Trend Predictor shows a blue arrow indicating a bullish trend at or near that moment.

- Open a long trade on the price touch or on the next candle open if confirmation holds.

- Place the stop loss a few pips below a recent swing low or below the breakout level, whichever is tighter.

- Set take profit at the next resistance zone, or aim for a moderate gain depending on volatility (for instance, 20–40 pips).

- Optionally trail stop when price moves favorably.

Sell Entry Rules

- Wait until price touches the “breakout short” level from the Breakout RSI indicator.

- Confirm a red arrow from Trend Predictor appears around that moment signaling a bearish trend.

- Open a short trade at the price touch or next candle open if confirmation holds.

- Set stop loss a few pips above the recent swing high or above the breakout level, whichever is tighter.

- Take profit at the next support zone or aim for a defined target (e.g. 20–40 pips), or use a trailing stop if price moves in your favor.

Advantages

- Breakout RSI gives precise entry levels based on volatility and momentum breakdown.

- Trend Predictor provides simple, easy to spot trend arrows to confirm trade direction.

- Combining both reduces the chance of entering weak breakouts or fading dead trends.

- Flexible enough to work on multiple timeframes and various currency pairs.

- Can be used for both scalping (on M5/M15) or more relaxed intraday trades (on H1).

Drawbacks

- If the Trend Predictor arrow appears slightly late, the trade may miss optimal entry or enter after much of the move is done.

- In fast, volatile sessions price may trigger a breakout and then reverse quickly, hitting the stop loss before gaining momentum.

- Trailing stops or manual exits may be needed to avoid giving back profits in choppy markets, adding subjectivity.

Case Study 1

On USDCHF H1 during a moderately trending session, the pair approached the “breakout long” level defined by Breakout RSI.

As price touched that level, the Trend Predictor displayed a blue arrow.

A long position was entered at the next candle open. Stop loss was placed just below the recent swing low.

Over the next several candles the price gradually climbed, breaking through small resistance levels, and eventually reached a strong resistance zone about 35 pips above entry.

The trade was closed manually with a healthy profit.

Case Study 2

On NZDUSD M15 during a session with moderate volatility price dipped to the “breakout short” level from Breakout RSI.

The Trend Predictor gave a red arrow at almost the same time.

A short trade was opened immediately at the level touch. Stop loss was placed above the recent swing high.

Price dropped sharply over the next few candles, dipping toward the next support zone and delivering around 28 pips profit before slowing down.

Strategy Tips

- Always wait for the price to touch the breakout level and confirm with the Trend Predictor arrow. Do not trade on the breakout level only.

- Prefer trading during active periods when volatility is present, not during major news spikes or extreme market uncertainty.

- Use tight stops relative to breakout levels to limit risk, especially since breakouts can be false or reversed quickly.

- If using a higher timeframe (H1), allow slightly larger stop and profit targets because moves tend to be bigger but also slower.

- On the M5/M15 trading charts, use smaller targets and act quickly.

- Consider using a trailing stop once price moves in your favor to secure gains while allowing room for larger swings.

- Limit the number of trades per day to avoid overtrading. Only take setups with strong confirmation to maintain quality over quantity.

Download Now

Download the “breakout-rsi-indicator.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: breakout