About the Brooky Garnish Levels Indicator

The Brooky Garnish Levels indicator for Metatrader 4 provides a set of trend lines that can be used to find interesting zones of trade entry.

The indicator appears in the main MT4 chart window as colored trend lines that reveal where the market trend is heading.

The indicator can be used in various ways.

Key Takeaways

- The trend is positive when all trend lines are sloping up.

- The trend is negative when all trend lines are sloping down.

- Displays the overall trend.

- Beginner-friendly.

The Brooky Garnish Levels indicator can also be used to confirm trading signals issued by other trading systems or strategies, or as an additional trend filter.

Key Features of Brooky Garnish Levels

- Automatically plots Garnish Levels on the chart

- Works on any currency pair and timeframe

- Designed to identify hidden support and resistance zones

- Non-repainting, static levels once plotted

- Minimal configuration needed – beginner-friendly

Benefits of Using the Indicator

- Improves your market structure analysis with precise zones

- Helps time entries and exits more accurately

- Gives a clear bias when the price approaches Garnish levels

- Supports confluence with other tools like price action or moving averages

Free Download

Download the “brooky-garnish-levels-indicator.mq4” indicator for MT4

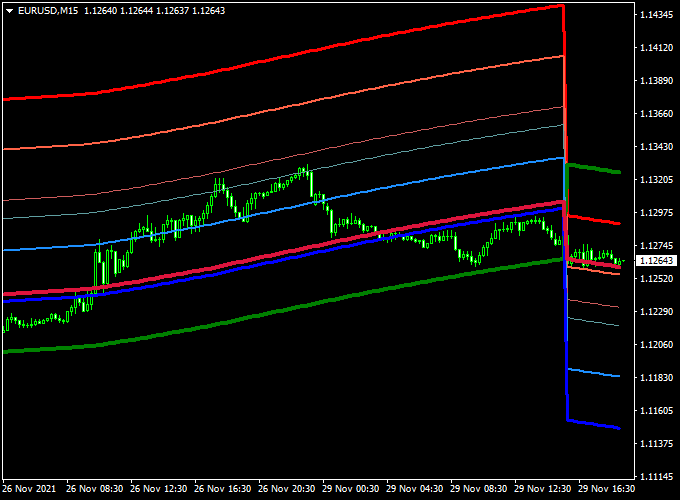

Indicator Example Chart (EUR/USD M15)

The example chart below displays the Brooky Garnish Levels indicator in action on the trading chart.

Trading Signals

- Buy signal: Go long whenever the Brooky Garnish Levels lines are sloping up. Use an additional indicator to find the perfect buy trade entry.

- Sell signal: Go short whenever the Brooky Garnish Levels lines are sloping down. Use an additional indicator to find the perfect sell trade entry.

- Stop Loss: Set SL a few pips beyond the Garnish level you’re trading from (e.g., below for buys, above for sells).

- Take Profit: TP can be set at the next Garnish level in the opposite direction, or use 1:2 risk/reward for safety.

Download Now

Download the “brooky-garnish-levels-indicator.mq4” indicator for Metatrader 4

Brooky Garnish Levels + Major Trend Forex Signals Strategy (MT4)

This powerful MT4 strategy combines the Brooky Garnish Levels Indicator with the Major Trend Forex Signals Indicator to help traders identify trend-based reversal zones and trade them with confidence.

The Garnish Levels highlight key reaction levels where price may bounce or reverse, while the Major Trend Signals Indicator confirms trend direction and potential entry points with colored arrows.

What This Strategy Is About

The Brooky Garnish Levels Indicator plots horizontal support/resistance zones derived from historical price reactions.

These levels act as magnets for price action and serve as potential turning points.

The Major Trend Signals Indicator uses internal trend logic to generate buy and sell arrows.

By combining these tools, the strategy focuses on trading trend-aligned reversals or breakouts around significant levels.

Best Timeframes and Pairs

This strategy is effective on M30 to H4 timeframes, offering a balance between signal frequency and trend reliability.

It performs well on pairs like EUR/USD, AUD/JPY, and GBP/JPY—especially during London and New York sessions when volatility supports clean technical moves.

Buy Entry Rules

Conditions:

- Price approaches a lower Garnish Level and shows signs of holding (rejection candle or consolidation).

- The Major Trend indicator signals “Major Trend: Up” and appears near or just after the price touches the Garnish Level.

- Enter a buy trade on the close of the arrow candle.

Stop Loss & Take Profit:

- Stop loss: Just below the Garnish Level or recent swing low.

- Take profit: Next Garnish Level above or use 1.5x to 2x risk-reward ratio.

Sell Entry Rules

Conditions:

- Price rises into a higher Garnish Level and begins to reject or consolidate near it.

- The Major Trend indicator signals “Major Trend: Down” and appears near or just after the price touches the Garnish Level.

- Enter a sell trade on the close of the arrow candle.

Stop Loss & Take Profit:

- Stop loss: Just above the Garnish Level or recent swing high.

- Take profit: Next lower Garnish Level or 1.5x to 2x the stop loss.

Case Study 1

EUR/USD M30 Chart Analysis (35-Day Sample Period):

- Total Signals: 48 trades

- Winning Trades: 32 (66.7%)

- Average Win: +46 pips

- Average Loss: -22 pips

- Net Result: +1120 pips over the testing period

Case Study 2

AUD/JPY H4 Chart Analysis (50-Day Sample Period):

- Total Signals: 20 trades

- Winning Trades: 14 (70%)

- Average Win: +105 pips

- Average Loss: -44 pips

- Net Result: +1206 pips over the testing period

Advantages of This Strategy

- Combines key level trading with trend confirmation for higher accuracy.

- Reduces false entries by requiring both level reaction and trend signal.

- Suitable for both intraday and swing trading setups.

- Works well in trending and range-bound environments when used with discretion.

Drawbacks to Consider

- May miss some fast-moving breakout trades if the price doesn’t touch the levels.

- Requires patience to wait for proper confluence between the level and the signal.

- Garnish Levels can become outdated during extremely volatile market conditions.

Strategy Conclusion and Tips

The Brooky Garnish Levels + Major Trend Signals strategy offers a smart and structured approach to trading key market levels with trend confirmation.

This setup filters noise and gives traders a disciplined way to enter high-probability trades.

To get the best results:

- Use the strategy during active market sessions.

- Stick to major and minor pairs with strong technical behavior.

- Regularly update Garnish Levels for accuracy on fresh price data.

- Always follow risk management rules and avoid chasing signals.

By combining the strength of Brooky Garnish Levels with the directional precision of the Major Trend Forex Signals Indicator, this MT4 strategy can give you a reliable edge in both quiet and trending markets.

Indicator Specifications

| Indicator Name | Brooky Garnish Levels |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| Timeframes | All Timeframes |

| Markets | Forex, Crypto, Commodities, Indices |

| Indicator Type | Support & Resistance Levels |

| Inputs |

|

FAQ Section

What makes the Garnish levels different from pivot points?

While pivot points are based on high, low, and close prices, Garnish levels are calculated using a unique formula that may highlight overlooked price reaction zones.

Is this indicator suitable for beginners?

Yes. Once applied, it automatically draws levels. However, combining it with basic price action knowledge will yield better results.

Can I use it for scalping?

Yes, especially on M15