The Brooky OBTR Forex Signals indicator for Metatrader 4 is an oscillator that provides easy to trade buy & sell signals in a bottom window.

The indicator is very reliable, lightweight, and will not slow down your trading platform.

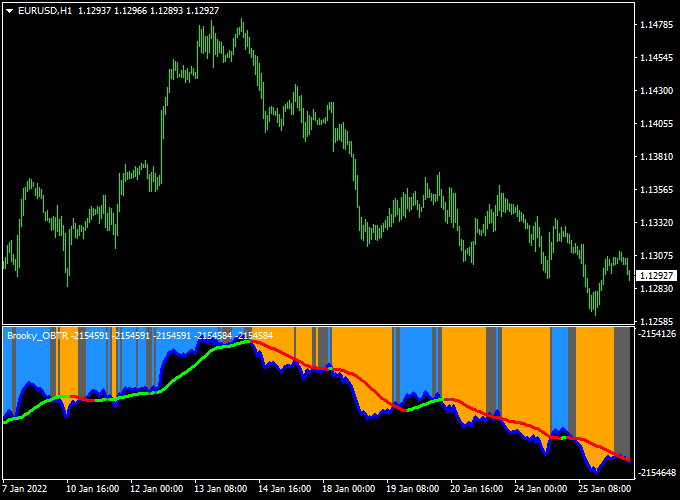

Buy & sell signal:

- A green colored signal line is a buy signal.

- A red colored signal line is a sell signal.

For scalping and day trading, the indicator performs best during the London and New York trading sessions.

It can also be used as an additional signals indicator that works together with an existing trading strategy or system of your preference.

The indicator works equally well on all currency pairs (majors, minors and exotic) and shows promising results if used correctly.

Free Download:

Download the “OBTR.mq4” indicator for MT4

Indicator Example Chart (EUR/USD H1)

The picture below shows the Brooky OBTR Forex Signals mt4 indicator in action on the trading chart.

Tips:

Feel free to use your own favorite trade entry, stop loss and take profit method to trade with the Brooky OBTR Forex Signals indicator.

As always, trade in agreement with the overall trend and practice on a demo account first until you fully understand this indicator.

Please note that even the best trading indicator cannot yield a 100% win rate over long periods.

Indicator Specifications & Inputs:

Trading Platform: Developed for Metatrader 4 (MT4)

Currency pairs: Works for any pair

Time frames: Works for any time frame

Trade Style: Works for scalping, day trading and swing trading

Input Parameters: Variable (inputs tab), color settings & style

Indicator type: Oscillator

Does the indicator repaint? No.

Download Now:

Download the “OBTR.mq4” indicator for Metatrader 4

How to install this indicator on Metatrader 4?

Open the Metatrader 4 platform

From the top menu, click on “File”

Then click on “Open Data Folder”

Then double click with your mouse button on “MQL4”

Now double click on “Indicators”

Paste the OBTR.mq4 indicator in the Indicators folder.

Finally restart the MT4 platform and attach the indicator to any chart.

How to remove the indicator?

Click with your right mouse button in the chart with the indicator attached onto it.

Select “Indicator List” from the drop down menu.

Select the indicator and press delete.

How to edit the indicator’s inputs and parameters?

Right click with your mouse button in the chart with the indicator attached onto it.

From the drop down menu, click on indicators list.

Select the indicator from the list and press edit.

Now you can edit the indicator.

Finally, press the OK button to save the updated configuration.