About the COGMACD Trend Indicator

The COGMACD Trend indicator is a forex trend and momentum tool built around the classic MACD concept.

It enhances the traditional MACD by adding a Center of Gravity channel that wraps around the MACD histogram.

This channel reacts to momentum shifts and helps traders judge whether the broader trend is rising or falling.

When the channel slopes upward, bullish pressure dominates the market.

When it slopes downward, bearish momentum is in control.

The MACD histogram bars change color to confirm potential entries within that trend.

This combination allows traders to align momentum signals with directional bias instead of trading MACD signals in isolation.

The indicator is especially useful for trend traders who want earlier confirmation without overloading the chart.

Free Download

Download the “cogmacd-v2-indicator.ex4” MT4 indicator

Key Features

- MACD-based histogram with dynamic color changes.

- Center of Gravity channel that reflects trend direction.

- Upward channel slope signals bullish market conditions.

- Downward channel slope signals bearish market conditions.

- Helps filter false MACD signals during sideways markets.

- Compatible with all MT4 timeframes and most currency pairs.

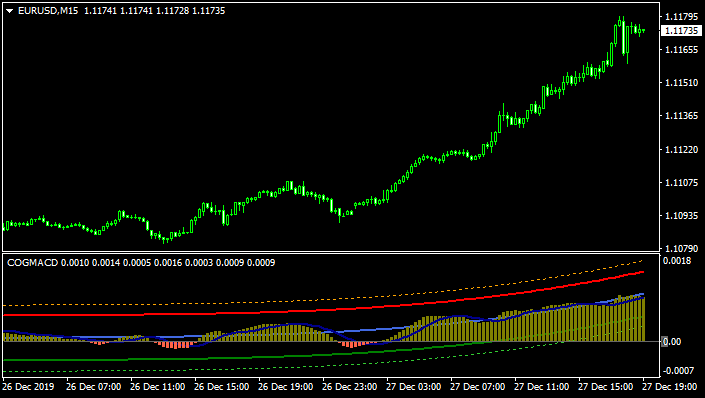

Indicator Chart

The chart displays the COGMACD Trend indicator below the main price chart, showing MACD histogram bars wrapped inside a sloping channel.

Buy and sell signals appear when the bar color changes in the direction of the channel slope, confirming trend-following momentum.

Guide to Trade with COGMACD Trend Indicator

Buy Rules

- The COGMACD channel must be sloping upward.

- MACD histogram bars change from Tomato to Olive.

- Enter a buy trade at the close of the signal candle.

Sell Rules

- The COGMACD channel must be sloping downward.

- MACD histogram bars change from Olive to Tomato.

- Enter a sell trade at the close of the signal candle.

Stop Loss

- Set the stop loss at a fixed number of pips outside the current price swing.

- Use the opposite side of the COGMACD channel as a dynamic stop level.

- Exit the trade if the MACD bars flip color against the position.

Take Profit

- Target a minimum risk-to-reward ratio of 1:2.

- Take partial profit when momentum weakens and bars reduce in size.

- Close the trade fully when the channel slope starts to reverse.

COG MACD Trend + Keltner Channel MT4 Forex Strategy

This MT4 strategy combines the COG MACD Trend indicator with the Keltner Channel with Signals.

The COG MACD Trend identifies short-term trend reversals:

Open a buy when the trend channel slopes up and the MACD bars change from Tomato to Olive, and open a sell when the channel slopes down and bars change from Olive to Tomato.

The Keltner Channel adds confirmation with blue stars for bullish trends and brown stars for bearish trends.

Combining these two gives strong trend-aligned entries suitable for M15 and H1 charts.

Buy Entry Rules

- Wait for the COG MACD Trend channel to slope upward.

- Confirm the MACD bars turn from Tomato to Olive, signaling bullish momentum.

- Look for a blue star on the Keltner Channel as additional confirmation.

- Enter a buy trade at the close of the confirming candle.

- Place a stop loss below the recent swing low or the lower Keltner line.

- Set a take profit near the next resistance level or use a 1.5:1 reward-to-risk ratio.

Sell Entry Rules

- Wait for the COG MACD Trend channel to slope downward.

- Confirm the MACD bars turn from Olive to Tomato, signaling bearish momentum.

- Look for a brown star on the Keltner Channel for additional confirmation.

- Enter a sell trade at the close of the confirming candle.

- Place a stop loss above the recent swing high or the upper Keltner line.

- Set a take profit near the next support level or use a 1.5:1 reward-to-risk ratio.

Advantages

- Combines trend slope and momentum for reliable entries.

- Keltner Channel signals provide visual confirmation of trend direction.

- Works well on multiple timeframes, including M15 and H1.

- Helps filter out counter-trend trades and reduces false signals.

- Clear visual signals make it easy to follow.

Drawbacks

- Requires patience for proper trend alignment before entering trades.

- Not ideal for scalping on very low timeframes.

- Performance may vary across different currency pairs.

Example Case Study 1

On EURUSD H1, the COG MACD Trend channel sloped upward, and the MACD bars changed from Tomato to Olive.

A blue star appeared on the Keltner Channel, confirming bullish momentum.

A buy trade was entered at 1.1120 with a stop loss at 1.1100 and a take profit at 1.1160.

Price followed the trend and reached the target, yielding +40 pips.

Example Case Study 2

On GBPJPY M15, the COG MACD Trend channel sloped downward, and the MACD bars switched from Olive to Tomato.

A brown star appeared on the Keltner Channel, confirming bearish momentum.

A sell trade was opened at 154.25 with a stop loss at 154.45 and a take profit at 153.80.

The pair moved downward and hit the target, resulting in +45 pips.

Strategy Tips

- Use higher timeframe analysis for context before taking M15 trades.

- Consider partial exits or trailing stops in strong trending moves.

- Pairs like EURUSD, GBPJPY, AUDUSD, and USDJPY often provide clear signals and good liquidity.

Download Now

Download the “cogmacd-v2-indicator.ex4” Metatrader 4 indicator

FAQ

What does the channel slope indicate?

The channel slope reflects the overall momentum of the MACD.

An upward slope signals bullish conditions, while a downward slope signals bearish conditions.

Can the settings be customized?

Yes, traders can adjust the input parameters to match different trading styles, instruments, and timeframes.

Summary

The COGMACD Trend indicator provides a refined way to trade MACD momentum with added trend confirmation.

The channel overlay simplifies trend identification and improves entry timing.

Its ease of use, adaptability, and logical signals make it suitable for both developing and experienced traders.

With thoughtful parameter tuning, it can become a reliable component of a disciplined forex trading approach.