About the Color Stochastic Indicator

Color Stochastic is a free MT4 (Metatrader 4) indicator that provides signals based on oversold and overbought Stochastic areas.

The indicator gets displayed in a separate MT4 chart window as a Stochastic indicator, along with green colored overbought and red colored oversold areas for ease of use.

Key Points

- A green Stochastic area is considered overbought. Look for sell trades.

- A red Stochastic area is considered oversold. Look for buy trades.

The Color Stochastic indicator can be used for both entry and exit signals or to confirm buy & sell trade setups issued by your favorite trading systems or strategies.

The indicator works equally well on all assets (Forex, CFD stocks, Indices, Cryptocurrencies, Commodities,..) and shows promising results if used correctly.

Free Download

Download the “color-stochastic-indicator.mq4” indicator for MT4

Benefits of Using the Indicator

- Enhanced Trend Identification: The color-coded lines provide a clear visual representation of market trends.

- Improved Entry and Exit Points: Helps traders pinpoint optimal moments to enter or exit trades based on overbought and oversold conditions.

- Increased Trading Confidence: Simplifies decision-making by offering straightforward trend signals.

- Versatility Across Timeframes: Effective on various timeframes, making it suitable for different trading styles.

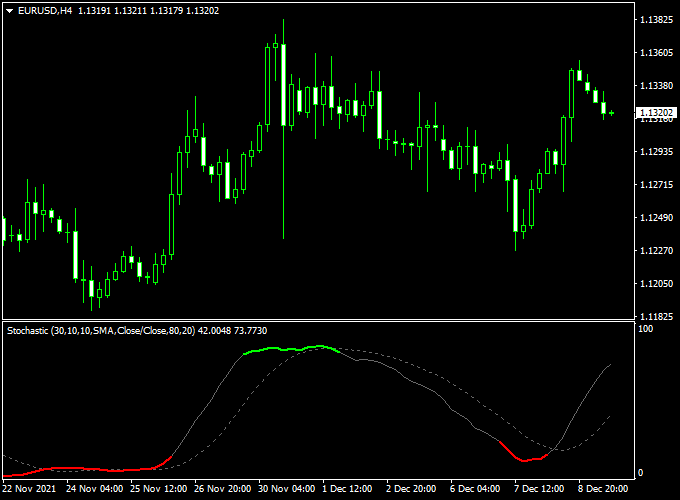

Example Chart (EUR/USD H4)

Below is an example of the Color Stochastic Indicator applied to an H1 EUR/USD chart.

The green and red lines indicate overbought and oversold conditions, respectively, assisting traders in making informed decisions.

How to Trade Using This Indicator

Entry Signals

- Buy Signal: Enter a buy trade when the %K line turns red, indicating an oversold condition, suggesting a potential upward reversal.

- Sell Signal: Enter a sell trade when the %K line turns green, indicating an overbought condition, suggesting a potential downward reversal.

Stop Loss and Take Profit Guidelines

- Stop Loss: Place a stop loss below the recent swing low for buy trades and above the recent swing high for sell trades.

- Take Profit: Aim for a risk-reward ratio of at least 1:2, adjusting based on market conditions and volatility.

Trade Management Tips

- Monitor the %K line for color changes to adjust positions accordingly.

- Use additional indicators or price action analysis to confirm signals.

- Adjust position sizes and risk management strategies based on market volatility.

Download Now

Download the “color-stochastic-indicator.mq4” indicator for Metatrader 4

Color Stochastic + Gann Trend Oscillator MTF Forex MT4 Strategy

This strategy combines the power of the Color Stochastic Forex Indicator and the Gann Trend Oscillator MTF Indicator to help traders identify high-probability trade entries.

By blending a momentum-based oscillator with a trend-following tool, this approach is designed to capture both short-term reversals and medium-term trend continuations.

What Is This Strategy About?

The Color Stochastic is used to determine overbought and oversold conditions, while also showing the direction of momentum through its color changes.

The Gann Trend Oscillator MTF acts as a confirmation filter, showing the prevailing trend from higher timeframes.

When both indicators align, traders have a clear signal to enter a trade with confidence.

This combination works well for intraday trading on M15 and H1 charts, as well as for swing trading on H4 and Daily charts. The key is to wait for both indicators to signal in the same direction before entering a trade.

Buy Rules

- Wait for the Color Stochastic to move up from the oversold zone and turn green.

- Confirm that the Gann Trend Oscillator MTF is also showing a blue upward histogram trend.

- Enter a long trade at the close of the confirming candle.

- Place a stop loss below the recent swing low.

- Take profit at a risk-to-reward ratio of 1:2 or trail the stop as the trade moves in your favor.

Sell Rules

- Wait for the Color Stochastic to move down from the overbought zone and turn red.

- Confirm that the Gann Trend Oscillator MTF is also showing a magenta downward histogram trend.

- Enter a short trade at the close of the confirming candle.

- Place a stop loss above the recent swing high.

- Take profit at a risk-to-reward ratio of 1:2 or use a trailing stop.

Trader Case Studies

Below are three examples of traders who applied this strategy to different currency pairs and timeframes, showing how it can work in various market conditions.

Elena M – Europe

Elena M, a swing trader from Spain, applied this strategy on the EUR/USD and GBP/JPY pairs over 28 days. She followed the rules strictly, securing a total of +356 pips in net gains.

Victor T – USA

Victor T, an intraday trader from New York, focused on the USD/JPY and AUD/USD pairs on M15 charts. Over three weeks, he achieved +298 pips by carefully combining both indicators for entries and exits.

Khalid R – Middle East

Khalid R, a part-time trader from the UAE, used the strategy on the EUR/CHF and GBP/USD pairs for two weeks. His disciplined approach resulted in +184 pips in profits.

Disclaimer: These case studies are for educational purposes only. Trading results will vary depending on market conditions, risk management, and individual discipline.

Advantages

- Combines momentum and trend confirmation for higher accuracy.

- Works on multiple timeframes, suitable for intraday and swing traders.

- Clear visual signals make it easier for beginners to follow.

Drawbacks

- May produce fewer trades due to strict confirmation rules.

- Requires patience to wait for both indicators to align.

- It can give false signals during highly volatile news events.

Strategy Conclusion and Tips

This strategy is best for traders who prefer a balanced approach between momentum trading and trend following.

The Color Stochastic offers early entry opportunities when price momentum shifts, while the Gann Trend Oscillator MTF acts as a filter to ensure trades follow the dominant trend.

For optimal results, avoid trading during major economic news releases and stick to pairs with moderate to high liquidity.

Always use a proper stop loss and risk no more than 2% of your capital on a single trade.

With discipline and patience, this strategy can be a reliable addition to any trader’s toolkit.

Indicator Specifications

| Platform | MetaTrader 4 (MT4) |

|---|---|

| Indicator Type | Oscillator (Stochastic with Color Coding) |

| Timeframes | All timeframes (M1 to D1) |

| Currency Pairs | All major and minor pairs |

| Inputs |

|

| Repainting | No |

FAQ

Does the Color Stochastic Indicator repaint?

No, the Color Stochastic Indicator does not repaint. Once a signal is generated, it remains on the chart, providing reliable analysis.

Can I use this indicator for scalping?

Yes, the Color Stochastic Indicator is suitable for scalping, especially when combined with other tools like the Forex Trend Reversal Signals indicator for precise entry points.

Is this indicator compatible with all currency pairs?

Yes, the Color Stochastic Indicator works with all major and minor currency pairs. However, it’s essential to test it on a demo account to understand its behavior with different pairs.

Final Words

The Color Stochastic Forex Indicator for MT4 offers traders a straightforward and effective tool for trend analysis.

By providing clear buy and sell signals through color-coded stochastic lines, it simplifies decision-making and enhances trading strategies.