About the Cronex Ichimoku Indicator

The Cronex Ichimoku indicator for MT4 is a specialized version of the classic Ichimoku Kinko Hyo system, designed to simplify trend identification and entry points.

It consists of the Tenkan, Kijun, and Senkou components, along with custom Cronex lines in gray, red, green, and orange.

Buy signals occur when the price closes above all Cronex lines, indicating a bullish trend.

Sell signals occur when the price closes below all Cronex lines, indicating a bearish trend.

This design allows traders to quickly determine the overall market direction.

Default settings (9, 26, 52) can be fully modified to match individual trading styles and timeframes.

Free Download

Download the “cronex-taichi-indicator.mq4” MT4 indicator

Key Features

- Trend-following indicator based on Ichimoku Kinko Hyo principles.

- Custom Cronex lines for easier entry and exit interpretation.

- Signals bullish and bearish trends clearly using price position.

- Fully adjustable default parameters for flexibility.

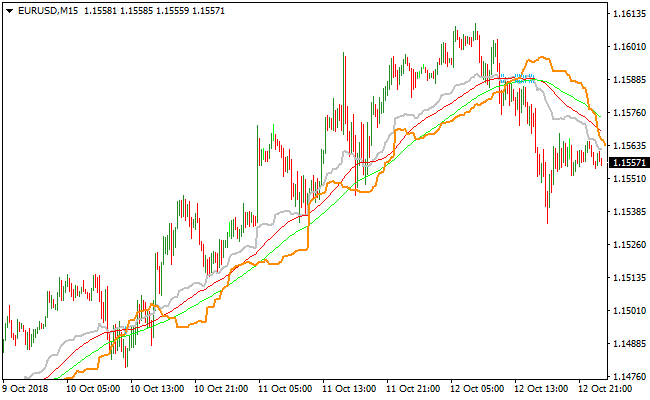

Indicator Chart

The Cronex Ichimoku indicator is displayed below, showing bullish and bearish trends in real time.

Colored lines indicate trend direction and help traders identify valid entry points.

By monitoring the relative position of price to the Cronex lines, the indicator also helps determine potential continuation or reversal zones.

Guide to Trade with the Cronex Ichimoku Indicator

Buy Rules

- Wait for the price to cross and close above all Cronex lines from below.

- Confirm the trend is bullish using additional analysis if needed.

- Enter a buy trade at the close of the confirming candle.

- Ignore buy signals that appear near strong resistance levels.

Sell Rules

- Wait for the price to cross and close below all Cronex lines from above.

- Confirm the trend is bearish using additional analysis if needed.

- Enter a sell trade at the close of the confirming candle.

- Ignore sell signals that appear near strong support levels.

Stop Loss

- For buy trades, place the stop loss below the lowest Cronex line at entry.

- For sell trades, place the stop loss above the highest Cronex line at entry.

- Exit early if price closes back within the Cronex lines against your position.

Take Profit

- Close buy trades if price starts closing below the lowest Cronex line or loses upward momentum.

- Close sell trades if price starts closing above the highest Cronex line or loses downward momentum.

- Optionally, use nearby support and resistance levels for exit confirmation.

Cronex Ichimoku and Best MT4 Scalper Signals Indicator Strategy for MT4

This strategy combines the trend power of the Cronex Ichimoku indicator with the fast and clean signals of the Best MT4 Scalper Signals.

It is designed for fast intraday moves on the M1 and M5 charts. The Cronex Ichimoku helps confirm if the market is trending up or down.

The Best MT4 Scalper Signals provides the early arrows that point to the start of the move.

This combination is ideal for traders who want simple entries and clear direction during active market sessions.

The strategy works well on major pairs and also on pairs that move with strong momentum.

This keeps the strategy disciplined and avoids bad entries during range periods.

Buy Entry Rules

- The Cronex Ichimoku bands must slope upward.

- A blue buy arrow from the Best MT4 Scalper Signals must appear.

- Enter after the signal candle closes.

- Place a stop loss below the last swing low.

- Take profit at 6 to 12 pips for M1 and 10 to 20 pips for M5.

Sell Entry Rules

- The Cronex Ichimoku bands must slope downward.

- A red sell arrow from the Best MT4 Scalper Signals must appear.

- Enter after the signal candle closes.

- Place a stop loss above the last swing high.

- Take profit at 6 to 12 pips for M1 and 10 to 20 pips for M5.

Advantages

- Clear trend direction from Cronex Ichimoku.

- Fast and simple arrow signals for quick entries.

- Works well in active sessions.

- Low stop loss distance for small risk.

- Easy rules for beginners and experienced traders.

Drawbacks

- Not ideal in slow markets.

- Requires fast execution on M1 and M5.

Case Study 1: EURGBP M5

During the London session, EURGBP showed a steady uptrend.

The Cronex Ichimoku bands sloped upward for several candles.

A blue buy arrow from the Best MT4 Scalper Signals appeared as momentum increased.

The trade was entered at the close of the signal candle at 0.8517.

Stop loss was placed below the recent swing low at 0.8509, which created an 8 pip risk.

Price moved higher and reached 0.8531. The trade closed with a gain of 14 pips.

Case Study 2: AUDCAD M1

Shortly after the New York open, AUDCAD turned bearish.

The Cronex Ichimoku bands shifted downward and a red sell arrow appeared.

The entry was taken at 0.9104 after the signal candle closed.

Stop loss was set above the high at 0.9112 for an 8 pip risk.

Price dropped during a short burst of volatility and reached 0.9093.

The trade was closed with an 11 pip profit.

Strategy Tips

- Focus on pairs with active momentum because the signals work best with steady movement.

- Wait for the candle to close before entering to avoid reacting early to spikes.

- If the Cronex Ichimoku bands flatten, skip the next signal because the market may enter a range.

- Use the M5 chart when spreads widen or when M1 becomes too fast to manage.

- Manage risk carefully on volatile pairs and use smaller position sizes if the market moves fast.

- If a signal appears near yesterday’s high or low, wait for a clear break instead of entering immediately.

- Track the first 20 minutes after the major session opens because the trend often forms during this period.

- Use this strategy only when spreads are tight because wide spreads reduce the performance on M1 and M5 charts.

Download Now

Download the “cronex-taichi-indicator.mq4” Metatrader 4 indicator

FAQ

Can the Cronex Ichimoku indicator be adjusted for different strategies?

Yes, the default settings (9, 26, 52) can be modified for scalping, day trading, or swing trading.

Traders can adjust the sensitivity to match their preferred timeframes and risk tolerance.

How can I confirm Cronex Ichimoku signals?

Signals can be confirmed using trend-following tools, moving averages, or price action patterns.

This helps reduce false entries in volatile or range-bound markets.

Summary

The Cronex Ichimoku indicator offers a streamlined approach to trading trends by combining classic Ichimoku principles with custom Cronex lines.

It clearly highlights bullish and bearish conditions, making entry and exit decisions simpler.

It is suitable for multiple trading styles, from scalping to swing trading.

With proper stop loss, take profit, and trend confirmation, the indicator helps traders align with market momentum while managing risk effectively.