About the Indicator

The Cumulative Forex Volume Indicator for MT4 is a scalping tool designed to gauge market momentum by analyzing cumulative trading volume.

Displayed as an oscillator in a separate chart window, it helps traders identify shifts in buying and selling pressure.

This indicator is particularly effective in volatile markets and can be applied across various timeframes and currency pairs.

Free Download

Download the “cumulative-volume-indicator.mq4” indicator for MT4

Key Features

- Oscillator Display: Visual representation of cumulative volume in a separate chart window.

- Multi-Timeframe Compatibility: Suitable for any timeframe, enhancing its versatility.

- Currency Pair Flexibility: Can be used with any currency pair, offering broad applicability.

- Non-Repainting: Once a signal is generated, it remains fixed, ensuring reliable backtesting.

- Scalping Focused: Tailored for short-term trading strategies in volatile markets.

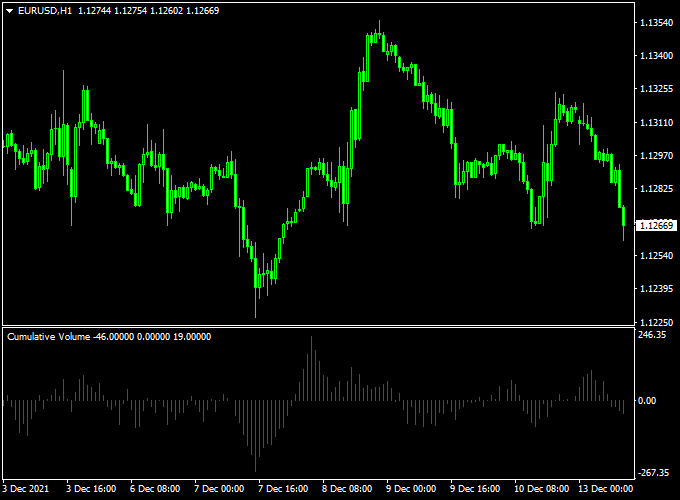

Indicator Example Chart (EUR/USD H1)

Below is an example of the Cumulative Forex Volume Indicator applied to the EUR/USD H1 chart.

How To Trade Using This Indicator

To effectively utilize the Cumulative Forex Volume Indicator:

- Entry Signals: Initiate a buy trade when the oscillator crosses above the 0.00 neutral level, indicating increasing buying pressure. Conversely, initiate a sell trade when the oscillator crosses below the 0.00 neutral level, signaling increasing selling pressure.

- Stop Loss: For buy trades, place the stop loss below the recent swing low. For sell trades, place the stop loss above the recent swing high.

- Take Profit: Set take profit levels based on a fixed risk/reward ratio, such as 1:2, or at key support/resistance zones.

- Enhance Accuracy: Combine this indicator with other tools, such as moving averages or trend lines, to confirm signals and improve trade accuracy.

Download Now

Download the “cumulative-volume-indicator.mq4” indicator for Metatrader 4

Cumulative Volume + XHMaster Formula Forex MT4 Strategy

What This Strategy Is About

This strategy combines the Cumulative Forex Volume Indicator with the XHMaster Formula Indicator to create a clear and rules-based trading system for short to medium-term trades.

The volume indicator reveals whether buyers or sellers are gaining control, while the XHMaster Formula provides precise entry signals in trending markets.

By combining these two tools, traders can avoid entering during weak moves and instead focus on moments when price direction is backed by strong market participation.

This approach can be applied to multiple currency pairs and timeframes, but it works best on the 1-hour and 4-hour charts.

Buy Rules

- Wait for the XHMaster Formula Indicator to print a buy signal (up arrow or bullish alert).

- Check the Cumulative Forex Volume Indicator. The volume line must be rising and positioned above its previous average levels, confirming buying pressure.

- Enter a buy position on the candle close.

- Place the stop loss a few pips below the last swing low.

- Target 2:1 reward-to-risk or close partial position after 50% of the target is reached.

Sell Rules

- Wait for the XHMaster Formula Indicator to issue a sell signal (down arrow or bearish alert).

- Check the Cumulative Forex Volume Indicator. The volume line must be falling and below its previous average levels, confirming selling pressure.

- Enter a sell trade on the candle close.

- Place the stop loss a few pips above the last swing high.

- Use the same 2:1 reward-to-risk ratio or scale out profits halfway.

Trader Case Studies

Below are three examples of traders who applied this strategy to different currency pairs and timeframes, showing how it can work in various market conditions.

David M – France

Lucas M, a swing trader from France, applied this strategy for 28 days on the EUR/USD and GBP/JPY pairs. With consistent application of the rules, he managed to earn a total of +358 pips in one month.

Aisha K – Kenya

Aisha K, a part-time trader from Kenya, traded this setup over 5 weeks, focusing on USD/JPY and EUR/GBP. She followed strict money management and achieved a net gain of +402 pips.

Michael T – USA

Michael T, an intraday trader from the USA, tested this strategy for 10 trading days on the GBP/USD and AUD/USD pairs. His short-term trades resulted in +117 pips in profit.

Disclaimer: These case studies are for educational purposes only. Trading results will vary depending on market conditions, risk management, and individual discipline.

Advantages

- Filters weak signals by confirming with actual market volume.

- Clear, visual buy and sell alerts from the XHMaster Formula Indicator.

- Works on multiple currency pairs and timeframes.

- Suitable for both part-time and full-time traders.

Drawbacks

- Requires patience for both indicators to align, which may reduce trade frequency.

- Volume data in Forex can be broker-dependent and may slightly differ between platforms.

- Best performance seen in trending markets; may generate false signals in choppy conditions.

Conclusion and Tips

The combination of the Cumulative Forex Volume Indicator and the XHMaster Formula Indicator provides a reliable framework for trading with the backing of market participation.

The strategy reduces the likelihood of entering weak moves and focuses on momentum-driven opportunities.

To get the most out of this method, focus on major currency pairs during active trading sessions such as London and New York.

Always backtest on your preferred timeframe before going live, and never risk more than you can afford to lose.

Patience, discipline, and risk control are key to long-term success with this approach.

Indicator Specifications

| Platform | MetaTrader 4 (MT4) |

|---|---|

| Indicator Type | Volume Oscillator |

| Timeframes | Any Timeframe |

| Currency Pairs | Any |

| Signals | Crosses above/below the 0.00 level |

| Inputs | Adjustable parameters for sensitivity, color settings, and style |

FAQ

1. How does the Cumulative Forex Volume Indicator differ from standard volume indicators?

Unlike standard volume indicators that show only raw transaction data, this indicator cumulatively tracks buying and selling pressure, giving a clearer picture of market momentum over time.

2. Can this indicator be used for scalping strategies?

Yes, it is especially effective for short-term trades, as it helps identify quick shifts in buying or selling pressure that scalpers can capitalize on.

3. Which timeframes provide the most accurate signals?

The indicator works on all timeframes, but combining signals from higher timeframes (H1–D1) with lower timeframes (M5–M15) can improve signal reliability and reduce false entries.

4. How can I confirm a signal before entering a trade?

Traders often combine this indicator with trend-following tools, such as moving averages or RSI, to confirm the strength of a trend before placing trades.

5. Does it work during low liquidity periods?

While it works across all sessions, signals are more reliable during high liquidity periods, such as the London and New York sessions, when market volume is stronger.

Final Words

The Cumulative Forex Volume Indicator is more than just a volume tracker—it’s a tool that lets traders see the underlying pressure behind price movements.

To enhance results, combine it with trend indicators, candlestick patterns, or support/resistance levels.

For example, entering a trade when the oscillator crosses the neutral level while the price is above a moving average can improve the probability of a winning trade.

By integrating it into a broader trading strategy and testing on a demo account, traders can better gauge market momentum and confidently execute trades with defined risk and reward targets.