About the Indicator

The Currency Power Indicator for MT4 is a professional tool that allows traders to measure the relative strength of major currencies in real-time.

Suitable for all timeframes, the indicator is ideal for intraday, swing, and position traders who want to improve entry timing and risk management.

Its intuitive dashboard displays a visual ranking of currencies, making it easy to identify potential trading opportunities at a glance.

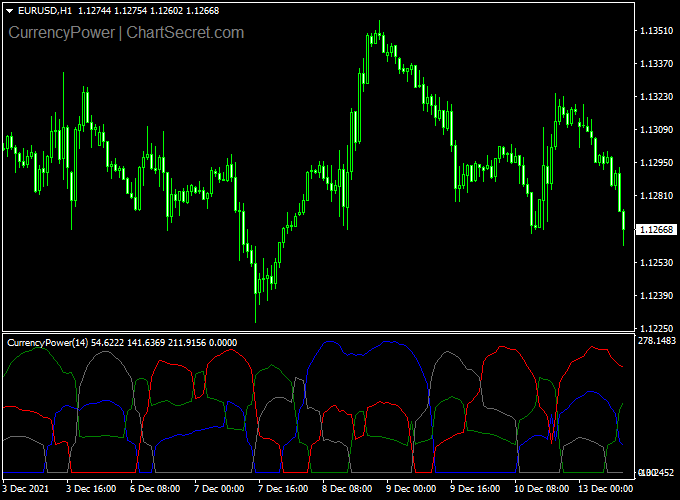

The indicator appears in a separate MT4 chart window in the form of colored lines that display currency strength for each of the supported currencies.

The Basics

- Buy a strong currency versus a weak currency.

- Sell a weak currency versus a strong currency.

The Currency Power indicator can be used for both entry and exit signals or to confirm buy & sell trade setups issued by your favorite trading systems or strategies.

Free Download

Download the “currency-power-indicator.ex4” indicator for MT4

Key Features

- Real-Time Currency Strength Analysis: Displays the strength of major currencies instantly.

- Multi-Currency Pair Monitoring: Simultaneously tracks multiple pairs for comprehensive analysis.

- Customizable Dashboard: Adjust colors, display preferences, and update intervals to suit trading style.

- Non-Repainting Signals: Signals are fixed once displayed, ensuring reliable backtesting.

- Compatible Across All Timeframes: Works for short-term and long-term trading strategies.

Indicator Example Chart (EUR/USD H1)

The example chart below displays the Currency Power MT4 indicator in action on the trading chart.

How To Trade Using This Indicator

To trade effectively with the Currency Power Indicator:

- Identify Strong vs Weak Currencies: Look for pairs where one currency is ranked strong and the other weak. For example, a strong EUR against a weak USD signals a potential EUR/USD buy.

- Confirm with Trend Indicators: Use tools like moving averages, trend lines, or RSI to validate the direction of the trend.

- Entry Points: Enter a trade when currency strength aligns with confirmed trend direction.

- Stop Loss: For buy trades, set below the recent swing low; for sell trades, set above the recent swing high.

- Take Profit: Use key support/resistance zones or a fixed risk/reward ratio, e.g., 1:2.

Download Now

Download the “currency-power-indicator.ex4” indicator for Metatrader 4

Forex Strategy: Currency Power Indicator + Viper Signals

What This Strategy Is About

This method combines two powerful MT4 tools. The Currency Power Indicator shows the strength and weakness of major currencies in real-time.

It allows traders to quickly identify which currencies are gaining momentum and which are losing it.

The Viper Signals Indicator provides simple, color-based trend confirmation.

A green trend line signals bullish conditions, red signals bearish momentum, and orange marks a ranging market.

Using both together ensures trades are taken only when strength and trend are aligned.

Buy Rules

- Use the Currency Power Indicator to find a strong currency paired with a weak currency.

- Check the Viper Signal line — it must be green, showing a bullish trend.

- Enter a buy trade at the close of the confirmation candle.

- Place the stop loss just below the most recent swing low.

- Exit when the Viper Signal turns red or when your profit target is reached.

Sell Rules

- Identify a weak currency paired against a strong one using the Currency Power Indicator.

- Wait for the Viper Signal to turn red, confirming a bearish trend.

- Enter a sell trade on the candle close.

- Stop loss goes above the latest swing high.

- Close the trade when the Viper Signal turns green or your target is met.

Trader Case Studies

Below are three examples of traders from different regions applying this system to various pairs and timeframes.

Oliver B – United Kingdom

Oliver B, a day trader from London, used this strategy on GBP/USD and EUR/JPY during the London session. Over 20 trading days, his disciplined application of the rules brought in +295 pips in total.

Sofia R – Brazil

Sofia R, a part-time trader from São Paulo, focused on USD/JPY and AUD/USD. By filtering trades through currency strength first and then acting on Viper’s trend confirmation, she earned +142 pips in three weeks.

Arjun P – India

Arjun P, a swing trader from Mumbai, applied the method to EUR/GBP and GBP/CHF on the 4-hour chart. Over one month, he gained +410 pips by catching sustained moves confirmed by both indicators.

Disclaimer: These case studies are for educational purposes only. Actual results will vary based on market conditions, risk control, and trader discipline.

Advantages

- Combines directional strength with trend confirmation for higher accuracy.

- Simple visual tools make it beginner-friendly.

- Adaptable to scalping, day trading, or swing trading.

- Works across all major currency pairs.

Drawbacks

- Requires patience for both indicators to align, which may reduce trading frequency.

- Orange (range) signals can keep traders out of potential breakout moves.

- Performance can drop in very low-volatility markets.

Conclusion and Tips

The Currency Power Indicator identifies which currencies are worth trading, and the Viper Signals tells you exactly when to enter based on the prevailing trend.

This combination helps avoid low-quality setups and focus on strong, directional opportunities.

Trade during active sessions like London or New York for better momentum.

Always use stop losses, and consider demo testing before committing real funds.

Above all, maintain consistent discipline because the strategy works best when followed precisely.

Indicator Specifications

| Platform | MetaTrader 4 (MT4) |

|---|---|

| Indicator Type | Currency Strength Meter |

| Timeframes | All timeframes (M1 to D1) |

| Currency Pairs | All major and minor pairs |

| Signals | Real-time currency strength ranking |

| Inputs | Customizable colors, update interval, display settings |

FAQ

1. How does the indicator calculate currency strength?

It measures relative changes in multiple currency pairs to rank each currency in real-time, giving an accurate view of momentum across the forex market.

2. Can I use this indicator for scalping?

Yes, especially on lower timeframes like M5 and M15. Look for strong divergences between currencies to identify quick, high-probability trades.

3. Which currency pairs are best for this indicator?

Pairs with the largest liquidity, such as EUR/USD, GBP/USD, and USD/JPY, are ideal, as they provide clearer strength signals and reduce noise.

4. Should I combine it with other indicators?

Yes, combining with trend indicators like moving averages or oscillators like RSI can filter false signals and improve entry timing.

5. Is it suitable for beginners?

Yes, the dashboard provides a simple visual ranking of currencies. Beginners should pair it with basic trend analysis and always use proper risk management.

Final Words

The Currency Power Indicator is a practical tool to identify high-probability trading pairs by showing which currencies are strong and weak.

To enhance results, combine it with moving averages, trend lines, or RSI for confirmation.

Always use proper stop loss and take profit levels to manage risk effectively.

Practicing these strategies on a demo account before trading live ensures you understand how to leverage currency strength for consistent results.