The Day Candle indicator for MT4 wraps all candlesticks into one bigger candlestick, and it provides overall trend direction.

At a glance, the indicator reveals where the overall trend is heading to.

From the indicator’s inputs, you can choose the day candlestick time frame yourself (default: daily).

Key Features

- Reveals overall trend direction

- Good for breakout trading

- Pure price action, no lag

- Well worth adding to your indicator collection

This indicator can work together with any existing trading strategy or system as a buy/sell trend confirmation tool.

Free Download

Download the “ytg_Day_candle.mq4” MT4 indicator

Trading Chart

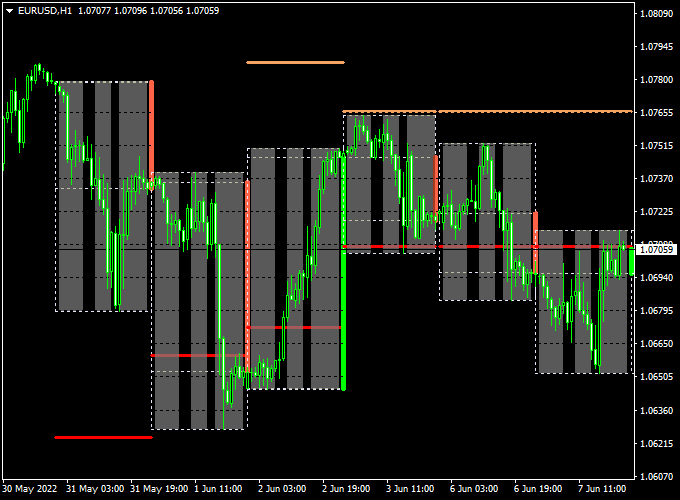

The EUR/USD 1-hour chart below shows the Day Candle Forex indicator in action.

Trading Signals From The Day Candle Indicator

BUY:

- A buy signal is given when the overall trend is going up and the price breaks above the previous day’s high.

- Set the stop loss a few pips below the previous swing low support.

- Exit the buy trade for a predetermined profit target or close for a risk-to-reward ratio of 1.5 or better.

SELL:

- A sell signal is given when the overall trend is going down and the price breaks below the previous day’s low.

- Set the stop loss a few pips above the previous swing high resistance.

- Exit the sell trade for a predetermined profit target or close for a risk-to-reward ratio of 1.5 or better.

Download Now

Download the “ytg_Day_candle.mq4” MT4 indicator

Day Candle and BOS/CHoCH MT4 Strategy

Overview

This strategy integrates the Day Candle Forex Indicator with the BOS & CHoCH Metatrader 4 Indicator to identify potential entry and exit points in the forex market.

It’s designed for traders who prefer short-term trading and scalping techniques.

Indicators Used

- Day Candle Forex Indicator – Displays a larger timeframe candle (e.g., daily) on lower timeframe charts to provide an overview of the market trend.

- BOS & CHoCH Metatrader 4 Indicator – Identifies Break of Structure (BOS) and Change of Character (CHoCH) points, indicating potential trend continuations or reversals.

Timeframes and Pairs

- Timeframes: M15 (15-minute) and H1 (1-hour)

- Currency Pairs: Major pairs (e.g., EUR/USD, GBP/USD)

Buy Entry Conditions

- The Day Candle Indicator shows a bullish candle, indicating an upward trend.

- The BOS & CHoCH Indicator identifies a Break of Structure (BOS) to the upside, confirming the continuation of the upward trend.

- Price retraces to a previous resistance level that has turned into support.

Sell Entry Conditions

- The Day Candle Indicator shows a bearish candle, indicating a downward trend.

- The BOS & CHoCH Indicator identifies a Break of Structure (BOS) to the downside, confirming the continuation of the downward trend.

- Price retraces to a previous support level that has turned into resistance.

Exit Strategy

- Stop Loss: Place below the recent swing low for buy trades or above the recent swing high for sell trades.

- Take Profit: Aim for a risk-to-reward ratio of at least 1:2.

Additional Strategy Tips

- Ensure that the trade direction aligns with the overall market trend indicated by the Day Candle.

- Use the BOS & CHoCH Indicator to confirm entry points and avoid false signals.

- Backtest the strategy on historical data to assess its performance before live trading.

Adjustable Indicator Parameters & Settings

Time frame, colors, style

Feel free to explore the indicator’s different parameters and settings to create your own personalized indicator setup.

More Info About This Tool

Currency Pairs: works on any currency pair

Trading Platform: developed for Metatrader 4 (MT4)

Time Frames: any

Indicator Type: candlestick

Final Thoughts

The Day Candle Forex Indicator for MT4 is a straightforward tool designed to provide traders with a clear overview of the market’s daily trend.

By consolidating all intraday price movements into a single, larger candlestick, it offers a simplified representation of the day’s price action.

This approach helps traders quickly assess the market’s direction without the clutter of multiple smaller candles.

The indicator is particularly useful for identifying breakout opportunities when the price moves beyond the previous day’s high or low.

Its simplicity and clarity make it an excellent addition to any trader’s toolkit, especially for those who prefer a clean and direct approach to market analysis.