About the DIV-STOCH V5 Indicator

DIV-STOCH V5 is an advanced divergence + stochastic indicator built for MT4 that helps traders identify hidden and regular divergences between price and stochastic oscillators.

It provides precise entry points by combining oscillatory momentum with overbought/oversold zones, trend strength filtering, and visual alerts.

Particularly useful for swing traders and scalpers who want confirmation beyond simple stochastic cross‐overs.

Buying and selling currency pairs with the Div Stochv5 indicator is easy to understand:

- A buy signal occurs as soon as the signal bars turn green.

- A sell signal occurs as soon as the signal bars turn red.

The Div Stochv5 indicator can be used for both trade entry and exit or to confirm trading signals issued by other strategies or systems.

Free Download

Download the “div-stochv5-indicator.mq4” indicator for MT4

Key Features

- Divergence detection: regular & hidden divergences between price peaks/troughs and stochastic vs smoothed stochastic signal.

- Adjustable stochastic settings: %K / %D periods, smoothing, overbought/oversold thresholds.

- Visual divergence arrows (bullish & bearish) directly on the chart.

- Optional trend filter (e.g., moving averages) to confirm signal direction.

- Alert system (popup/email/push) when divergence + stochastic oversold/overbought zones align.

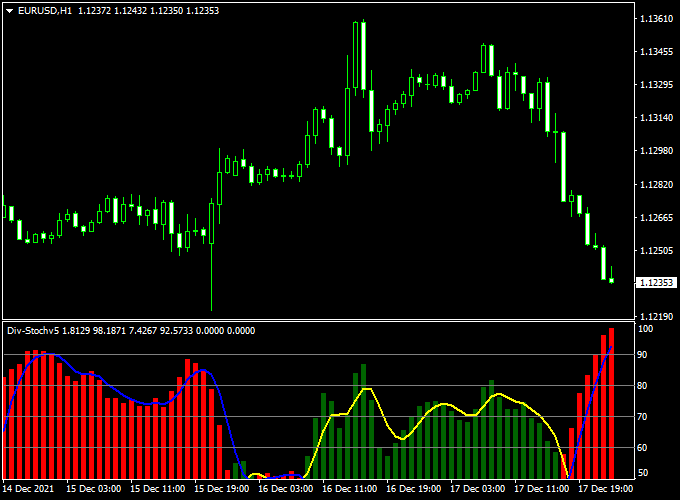

Indicator Example Chart (EUR/USD H1)

The example chart below displays the Div Stochv5 MT4 indicator in action on the trading chart.

The Div Stochv5 XP Moving Average MT4 Strategy

This strategy combines the Div Stochv5 Indicator with the XP Moving Average Indicator to create a dynamic and highly filtered trading system.

The XP Moving Average acts as the primary trend filter, giving you a clear sense of the market’s direction and providing a dynamic support or resistance level.

The Div Stochv5 is a momentum oscillator that excels at identifying divergences, which are high-probability reversal signals.

By waiting for the price to pull back to the XP Moving Average and then looking for a confirming divergence signal from the Div Stochv5, you can enter trades at optimal, low-risk points.

This system is suitable for any currency pair and is particularly effective on time frames of M30 and above.

Buy Entry Rules

- The XP Moving Average is green, indicating a bullish market.

- Price pulls back and touches or comes close to the XP Moving Average line.

- The Div Stochv5 indicator histogram is green.

- Open a buy trade.

- Stop Loss: Place it below the recent swing low.

- Take Profit: Exit the buy trade when the price closes below the XP Moving Average line.

Sell Entry Rules

- The XP Moving Average is red, indicating a bearish market.

- Price pulls back and touches or comes close to the XP Moving Average line.

- The Div Stochv5 indicator histogram is red.

- Stop Loss: Place it above the recent swing high.

- Take Profit: Exit the sell trade when the price closes above the XP Moving Average line.

Advantages

- High-Probability Entries: This strategy enters trades on a pullback with a powerful divergence filter, which often leads to very favorable risk-to-reward ratios.

- Clear Signals: The combination of a moving average and a divergence oscillator provides clear, objective rules for both entries and exits, reducing guesswork.

- Effective in Trends: The strategy excels in trending markets and helps you avoid getting caught in sideways price action.

Case Studies

Case Study 1: Buy Trade

On an M15 chart for EUR/JPY, the XP Moving Average and the Div Stochv5 indicator were green.

The price made a strong rally, followed by a pullback to the moving average line.

A buy trade was entered as a bullish engulfing candle formed, and the trade was successfully closed for a substantial profit after the XP Moving Average line turned red.

Case Study 2: Sell Trade

On a 30-minute chart for GBP/USD, the XP Moving Average and the Div Stochv5 indicator were red. The price rallied to the moving average line.

A sell trade was opened when a shooting star candle formed.

The price immediately reversed and continued to fall, allowing the trade to be closed for a significant profit.

Strategy Tips

- Confirm the Trend: Always ensure the XP Moving Average is clearly sloping up or down. Avoid trading when the moving average is flat, as it indicates a ranging market.

- Risk Management: Place your stop loss logically below or above the recent swing low/high, not at a fixed number of pips. This helps account for market volatility.

- Start with Higher Time Frames: This strategy works best on higher time frames (H1, H4), where divergence signals are more reliable and less prone to noise.

- Practice Identifying Divergence: Take your time to practice spotting divergences on a demo account before risking real money.

Download Now

Download the “div-stochv5-indicator.mq4” indicator for Metatrader 4

Indicator Specifications

| Specification | Details |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| Timeframes | All timeframes; best results on H1, H4, Daily |

| Inputs |

|

| File | DIV-STOCH_V5.ex4 |

| License | Free download — personal use only |

FAQ

1. Does the indicator repaint or lag?

DIV-STOCH V5 does not repaint divergence arrows once a bar closes.

There may be a slight lag due to stochastic smoothing, but waiting for the bar close reduces false signals significantly.

2. Can I use it for scalping on low timeframes like M5 or M15?

Yes, but with caution: low timeframes tend to have more noise.

Use higher timeframe confirmation (H1 or H4) and ensure divergence aligns with the trend to filter out false signals.

Tight stop losses are essential in scalping scenarios.

3. How should I adjust it during volatile periods or news events?

During news or high volatility, widen stop losses, perhaps increase smoothing or set stricter divergence thresholds, or simply avoid trading divergence signals alone without additional confirmation.

4. Can this indicator be used for swing trading or only intraday?

It works for both. Use it on daily timeframes for swing setups, combined with longer-term support/resistance. For intraday trades, use H1/H4 while confirming on Daily.

Bigger timeframes give stronger, more reliable divergence signals.

Summary

DIV-STOCH V5 gives you divergence + stochastic confluence — a powerful entry filter when used properly.

Best strategy: trade only in the direction of the trend (use MA 200 as trend filter) and watch for divergence when stochastic is in extreme zones.

Apply this across timeframes to adapt for both intraday and swing styles for a higher success rate.