About the Dolly Breakout Signals Indicator

The Dolly Breakout Signals Indicator for MT4 is a comprehensive trading system designed to identify high-probability breakout zones based on daily pivot points and historical price ranges.

It functions by calculating key support and resistance levels at the start of each trading session to define specific areas where price momentum is likely to accelerate.

The system provides a systematic approach to the markets by plotting direct entry levels on the chart.

It eliminates the guesswork involved in identifying where a breakout begins by providing specific Buy Area and Sell Area price quotes.

This indicator is particularly effective for day traders who focus on major currency pairs, as it adapts to daily volatility to find the most relevant price barriers.

By using this tool, you gain access to a structured daily plan that includes entry, stop-loss, and take-profit coordinates.

Free Download

Download the “dolly.mq4” MT4 indicator

Key Features

- Automated calculation of daily breakout zones and pivot levels.

- Specific price levels for Buy Stop and Sell Stop orders.

- Integrated risk management with suggested stop-loss and take-profit targets.

- Visual price labels that update automatically for every new trading session.

- Compatibility with all timeframes, though it excels on intraday charts.

- Focuses on price action and momentum rather than lagging mathematical averages.

Indicator Chart

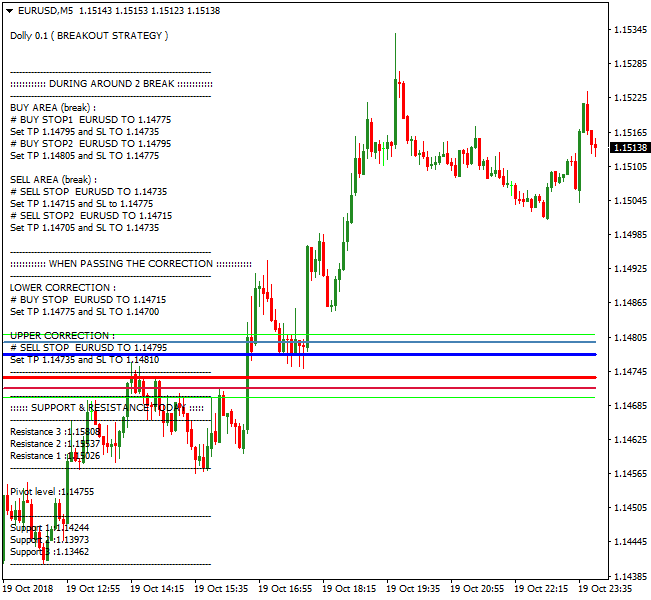

The chart displays the Dolly Breakout Signals Indicator applied to a major currency pair.

It shows the designated buy and sell areas with clear price labels for pending orders.

You can see how the price reacts to the breakout levels, triggering signals when momentum pushes past the calculated resistance or support boundaries.

Guide to Trade with Dolly Breakout Signals Indicator

Buy Rules

- Identify the Buy Area break level provided by the indicator on the chart.

- Place a Buy Stop order at the specific price level indicated, such as Buy Stop 1.

- Ensure the price is trading above the daily pivot level for additional confirmation.

- Execute the trade only when the price candle touches or penetrates the buy zone.

Sell Rules

- Locate the Sell Area break level displayed by the indicator labels.

- Set a Sell Stop order at the designated price coordinate provided by the system.

- Confirm that the overall intraday sentiment is bearish or below the central pivot.

- Enter the short position once the market price reaches the specified sell entry point.

Stop Loss

- Use the suggested stop-loss level provided by the Dolly system labels.

- Alternatively, place the stop-loss behind the middle pivot line to protect against false breakouts.

- Maintain a consistent risk-to-reward ratio based on the daily volatility.

Take Profit

- Exit the trade at the Target Level 1 or Target Level 2 shown on the chart.

- You may close half of the position at the first target and trail the remainder.

- Always close open positions before the end of the trading session to avoid overnight gaps.

MT4 Dolly Breakout and Zero Lag MA Trend Strategy

This MT4 trading strategy combines the breakout precision of the Dolly Breakout Signals Indicator with the trend filtering power of the Zero Lag Moving Average Indicator.

It is designed for traders who prefer clean directional trades based on clear levels and simple trend confirmation.

The setup works on all major pairs and performs best on the M15 to H1 charts, where breakouts are more reliable, and market noise is moderate.

The Dolly Breakout indicator provides precise BUY STOP1 and SELL STOP trigger levels.

The Zero Lag Moving Average acts as a filter by showing if the market has a bullish or bearish bias.

When both indicators agree, entries become more selective and the false breakouts are reduced.

The strategy suits intraday traders and swing traders who want straightforward rules and mechanical entries.

Buy Entry Rules

- Zero Lag MA must be above 0, confirming a bullish trend.

- Price must trigger the BUY STOP1 level from the Dolly Breakout indicator.

- Open a buy trade when the BUY STOP1 price is activated.

- Set stop loss at the SL level suggested by the Dolly Breakout indicator.

- Set take profit at the recommended TP level or use a 1 to 2 reward to risk ratio.

Sell Entry Rules

- Zero Lag MA must be below 0, confirming a bearish trend.

- Price must trigger the SELL STOP level from the Dolly Breakout indicator.

- Open a sell trade when the SELL STOP price is activated.

- Set stop loss at the suggested SL level from the indicator.

- Set take profit at the recommended TP level or use a fixed 1 to 2 reward to risk setup.

Advantages

- Very clear entries based on predefined breakout levels.

- The trend filter helps avoid trading against momentum.

- Works well during active sessions such as London and New York.

- Simple to trade because both indicators give direct signals.

- Reduces emotional decision making since rules are mechanical.

Drawbacks

- Ranging markets may cause false breakouts even with trend filtering.

- Needs some market movement, so very quiet sessions produce fewer signals.

- Take profit levels can be missed when volatility drops suddenly.

Case Study 1

On EURUSD M30, the Zero Lag MA stayed above 0 during the London session, showing a bullish trend.

The Dolly indicator placed its BUY STOP1 slightly above the morning range.

When the price broke through the level, a buy trade was triggered and the market pushed upward without hesitation.

The suggested take profit was reached as volatility increased after London opened.

This trade captured a smooth upward run of more than 40 pips before hitting the target.

The Zero Lag MA trend filter kept the trader aligned with market direction and prevented early entries inside the range.

Case Study 2

On GBPJPY H1, the Zero Lag MA stayed below 0, confirming a bearish environment.

The Dolly indicator plotted a SELL STOP just under the intraday support zone.

Once price broke the level, the sell order activated and moved quickly in favor of the trade.

The pair dropped sharply during the afternoon session, allowing the trade to reach the recommended take profit.

The move delivered more than 55 pips.

The combination of a clean breakout and the bearish MA filter kept the trade consistent with current momentum.

Strategy Tips

- Best used during London and New York sessions when breakouts have more strength.

- Avoid entries if the Zero Lag MA is flat around the zero line.

- Consider partial profits if price stalls before hitting full TP.

- Always avoid trading just before major news because spikes can cause fake breakouts.

- Test different time frames to find the balance between frequency and accuracy.

Download Now

Download the “dolly.mq4” Metatrader 4 indicator

FAQ

Does the Dolly Breakout Signals Indicator repaint its levels?

The indicator calculates levels based on the daily open and the previous day’s high, low, and close.

Once these levels are set at the start of the trading day, they remain fixed.

This allows you to set your pending orders with confidence, knowing the entry zones will not shift during the session.

Which currency pairs work best with this breakout system?

While the indicator works on any instrument, it is most effective on high-liquidity pairs like EURUSD, GBPUSD, and USDJPY.

These pairs tend to respect pivot levels and breakout zones more consistently during the London and New York sessions.

How does the indicator determine the Buy Stop and Sell Stop levels?

The tool uses a combination of Fibonacci levels and Pivot Point math to find the most significant exhaustion points.

It identifies the “breakout” price where a move is no longer considered a correction but a new trend leg.

Summary

The Dolly Breakout Signals Indicator offers a structured environment for traders who prefer a rules-based approach.

By providing exact price levels for entries and exits, it reduces the emotional stress often associated with manual technical analysis.

While no system is perfect, the reliance on pivot-based support and resistance makes it a reliable companion for intraday strategies.