About the DPO Indicator

The Detrended Price Oscillator (DPO) is a technical analysis tool designed to eliminate long-term trends in price data, allowing traders to focus on short-term cycles.

By removing the influence of longer-term trends, the DPO helps in identifying overbought and oversold conditions more effectively.

This indicator is particularly useful for traders looking to pinpoint precise entry and exit points based on short-term price movements.

Free Download

Download the “DPO.mq4” indicator for MT4

Key Features

- Eliminates long-term trends to highlight short-term cycles.

- Helps identify overbought and oversold conditions.

- Useful for pinpointing precise entry and exit points.

- It can be used in conjunction with other indicators for enhanced analysis.

- Available for free download and easy integration into MT4.

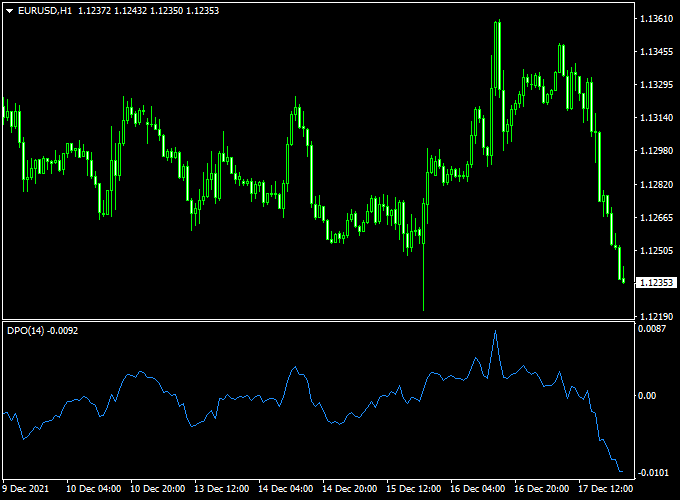

Indicator Chart (EUR/USD H1)

The DPO indicator is typically displayed in a separate window below the main chart, oscillating around a zero line.

Positive values indicate that the current price is above the detrended moving average, while negative values suggest the opposite.

Buy and Sell Trading Rules

Buy Rules

- Enter a buy position when the DPO crosses above the zero line from below, indicating a potential upward cycle.

- Confirm the signal with additional indicators or price action to increase reliability.

- Set a stop loss below the recent swing low to manage risk effectively.

- Take profit at the next significant resistance level or based on a predetermined risk-reward ratio.

Sell Rules

- Enter a sell position when the DPO crosses below the zero line from above, suggesting a potential downward cycle.

- Use additional indicators or price action for confirmation.

- Place a stop loss above the recent swing high to protect against adverse movements.

- Set a take profit target at the next support level or according to your risk-reward strategy.

DPO + Lucky Reversal MT4 Scalping Strategy

This MT4 strategy combines the Detrended Price Oscillator (DPO) with the Lucky Reversal indicator for short-term trading.

DPO shows short cycles in price, helping identify overbought and oversold conditions, while Lucky Reversal highlights turning points.

Together, they give precise entry points for scalpers and intraday traders who want quick trades with tight stops.

Intro

The method works best on M5 and M15 charts, where reversals happen frequently.

It is suited for scalpers who prefer multiple trades per session and intraday traders looking for 20–40 pip swings.

Best results are on highly liquid pairs like EURJPY, GBPUSD, or AUDUSD, where price cycles are more defined.

Buy Entry Rules

- Wait for Lucky Reversal to show a blue bullish reversal signal on M5 or M15.

- Check that DPO is below zero and turning upward, or crossing zero from below.

- Enter long at the candle close, confirming both signals.

- Stop loss 8–12 pips below the reversal marker, depending on pair volatility.

- Take profit at 15–25 pips, or use a trailing stop to catch extended intraday runs.

Sell Entry Rules

- Wait for Lucky Reversal to mark a red bearish reversal zone.

- DPO must be above zero and sloping downward or crossing zero from above.

- Sell at the candle close after confirmation.

- Stop loss 8–12 pips above the reversal marker.

- Take profit 15–25 pips, or let profits run with a trailing stop.

Advantages

- Fast signals suitable for scalpers.

- Confluence of reversal + cycle momentum reduces false entries.

- Works on multiple liquid currency pairs during active sessions.

Drawbacks

- High noise on lower timeframes can cause false reversals.

- Requires fast execution and discipline to exit quickly.

- Not ideal during news spikes or low volatility periods.

Example Case Study 1 — M5 EUR/JPY Long

During the London open, EURJPY dipped into a Lucky Reversal support zone.

DPO was negative and started turning upward.

A bullish candle closed above the reversal signal.

Entry was taken with a 10 pip stop.

Price bounced 22 pips higher within 30 minutes, hitting the profit target quickly.

Example Case Study 2 — M15 AUD/USD Short

On M15, AUDUSD formed a Lucky Reversal resistance marker during the New York session.

DPO was above zero but sloping down.

A bearish candle closed right below the signal zone.

Trade entered short with a 12 pip stop. Within two hours, the price dropped 28 pips, reaching the target level smoothly.

Strategy Tips

- Focus on active trading hours: London and New York sessions for volatility.

- Use tighter stops since signals occur often—keep risk small per trade.

- Check spreads: scalping works best on pairs with low transaction costs.

- Filter trades with higher timeframe DPO (M30 or H1) to align with short-term moves.

Download Now

Download the “DPO.mq4” indicator for Metatrader 4

Indicator Specifications

| Specification | Detail |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| File Type | MQ4 / EX4 |

| Timeframes | All timeframes (M1 to D1) |

| Pairs | All major and minor forex pairs |

| Inputs | Lookback period, alert options, display settings |

| Default Settings | Optimized for major currency pairs |

| License | Free download |

FAQ

Can the DPO detect market cycles?

Yes, the DPO isolates short-term cycles by removing long-term trends, making it easier to identify periodic market movements.

Is the DPO suitable for both forex and commodities?

Yes, it works on any market where price oscillations are present, including forex, commodities, and indices.

Can I use DPO with other oscillators?

Absolutely. Combining DPO with RSI, Stochastic, or MACD can provide additional confirmation and reduce false signals.

Does the DPO indicator repaint?

No, the DPO uses historical data to calculate its values, ensuring that past signals remain accurate and reliable.

Summary

The Detrended Price Oscillator is a valuable tool for traders seeking to isolate short-term price cycles and identify overbought or oversold conditions.

Removing the influence of long-term trends allows for more precise entry and exit points.

When used in conjunction with other indicators and proper risk management techniques, the DPO can enhance trading strategies and improve decision-making processes.