About the DSS Averages of Momentum Indicator

The DSS Averages of Momentum Indicator is an advanced momentum oscillator designed for MetaTrader 4.

It combines the benefits of the DSS Bressert and Averages of Momentum indicators to provide accurate and timely signals.

It helps you identify potential entry and exit points, allowing you to make informed trading decisions.

Free Download

Download the “dss-averages-of-momentum.mq4” indicator for MT4

Key Features

- Combines DSS Bressert and Averages of Momentum indicators for enhanced signal accuracy.

- Displays momentum strength and direction in a separate window below the main chart.

- Easy to read buy and sell signals.

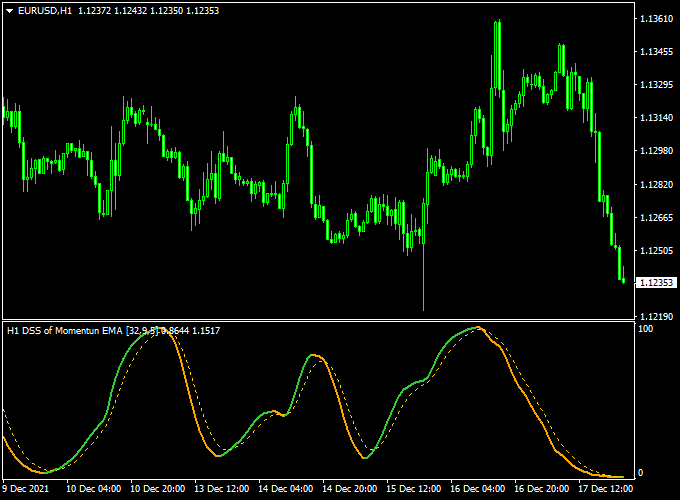

Indicator Chart (EUR/USD H1)

The DSS Averages of Momentum Indicator is displayed in a separate window below the main chart, featuring a histogram that represents the difference between the DSS Bressert and Averages of Momentum lines.

Positive values indicate upward momentum, while negative values indicate downward momentum.

The color of the histogram bars changes to reflect the strength and direction of the momentum.

Buy and Sell Trading Rules

Buy Rules

- Enter a buy position when the histogram line turns green, indicating positive momentum.

- Confirm the signal with other indicators or chart patterns for increased reliability.

- Set a stop loss below the recent swing low to manage risk.

- Take profit at the next resistance level or according to a predefined risk-reward ratio.

Sell Rules

- Enter a sell position when the histogram line turns orange, indicating negative momentum.

- Use additional indicators or chart patterns to confirm the signal.

- Place a stop loss above the recent swing high to limit potential losses.

- Take profit at the next support level or based on your risk-reward strategy.

Scalping Strategy Using DSS Averages of Momentum and Cougar Forex Indicator for MT4

This scalping strategy combines the DSS Averages of Momentum and Cougar Forex indicator to identify high-probability trade setups on lower timeframes, such as the 1-minute (M1) and 5-minute (M5) charts.

Designed for traders seeking quick, actionable signals with clear entry and exit points, this strategy aims to capitalize on short-term price movements.

Buy Entry Rules

- The DSS Averages of Momentum indicator paints a green line, indicating bullish momentum.

- The Cougar Forex indicator signals a buy entry, confirming the trend direction.

- Enter a buy position at the close of the candle that meets these conditions.

- Set your stop loss just below the most recent swing low.

- Take profit at a significant resistance level.

Sell Entry Rules

- The DSS Averages of Momentum indicator shows an orange, indicating bearish momentum.

- The Cougar Forex indicator signals a sell entry, confirming the trend direction.

- Enter a sell position at the close of the candle that meets these conditions.

- Set your stop loss just above the most recent swing high.

- Take profit at an important support level.

Advantages

- Combines momentum and a trend-following indicator for robust trade signals.

- Suitable for quick trades on lower timeframes.

- Clear entry and exit rules help maintain discipline and consistency.

Drawbacks

- The strategy may give late signals in ultra-fast-moving markets, causing smaller profits or missed entries.

- Lower timeframes can produce frequent false signals during consolidations or low volatility periods.

- Scalping requires constant attention, which can be stressful for some traders.

Example Case Studies

Case Study 1: AUD/JPY on the 1-Minute Chart

At 09:50 AM, the DSS Averages of Momentum indicator showed a green line, signaling bullish momentum.

Simultaneously, the Cougar Forex indicator signaled a buy entry.

A buy order was placed at 95.20, with a stop loss at 95.15 and a take profit just below the next resistance level at 95.30.

The position reached the take-profit zone after 6 minutes, resulting in a rapid profit

Case Study 2: NZD/USD on the 5-Minute Chart

At 3:10 PM, the DSS Averages of Momentum indicator showed an orange line, signaling bearish momentum.

Concurrently, the Cougar Forex indicator signaled a sell entry.

A sell order was placed at 0.6250, with a stop loss at 0.6260 and a take profit just above the next support level at 0.6240.

The take profit was reached in only 17 minutes, yielding a quick return.

Strategy Tips

- Always use stop-loss orders to manage risk effectively.

- Consider trading during major market sessions (e.g., London or New York) for better liquidity.

- Monitor the news calendar for high-impact events that may affect market volatility.

Download Now

Download the “dss-averages-of-momentum.mq4” indicator for Metatrader 4

Indicator Specifications

| Specification | Detail |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| File Type | MQ4 / EX4 |

| Timeframes | All timeframes (M1 to D1) |

| Pairs | All major and minor forex pairs |

| Inputs | Customizable DSS Bressert period, Averages of Momentum period, and smoothing period |

| Default Settings | DSS Bressert period = 14, Averages of Momentum period = 14, Smoothing period = 3 |

| License | Free download for personal use; redistribution rules apply |

FAQ

How does the DSS Averages of Momentum Indicator differ from the standard DSS Bressert?

The DSS Averages of Momentum Indicator combines the DSS Bressert with the Averages of Momentum indicator, providing a more comprehensive view of market momentum and potentially reducing false signals.

Can it be used for scalping and day trading?

Yes, the DSS Averages of Momentum Indicator can be applied on shorter timeframes, such as M1 or M5, for scalping strategies.

Summary

The DSS Averages of Momentum Indicator for MT4 is a powerful tool for traders seeking to identify market momentum with greater accuracy.

Its combination of the DSS Bressert and Averages of Momentum indicators provides a comprehensive view of market conditions.