About the EWTrend Indicator

The EWTrend Indicator for MT4 is a standalone trend trading tool designed specifically for scalpers.

It appears in a separate MT4 chart window as a blue signal line that oscillates between the -2 and 2 extreme borders.

The indicator helps traders identify short-term trend reversals and continuation moves, making it ideal for fast-paced scalping and day trading sessions.

It can be used independently for trade entries and exits or as a confirmation filter for signals from other strategies.

The EWTrend Indicator performs best during the London and U.S. trading sessions when market volatility and liquidity are higher, producing more reliable setups.

Free Download

Download the “ewtrend-indicator.mq4” indicator for MT4

Key Features

- Standalone trend indicator for MT4

- Blue signal line oscillates between -2 and 2 extremes

- Signals high-probability buy and sell trades for scalping

- Can be used for entries, exits, or confirmation with other strategies

- Best results during London and U.S. trading sessions

- Works across all currency pairs

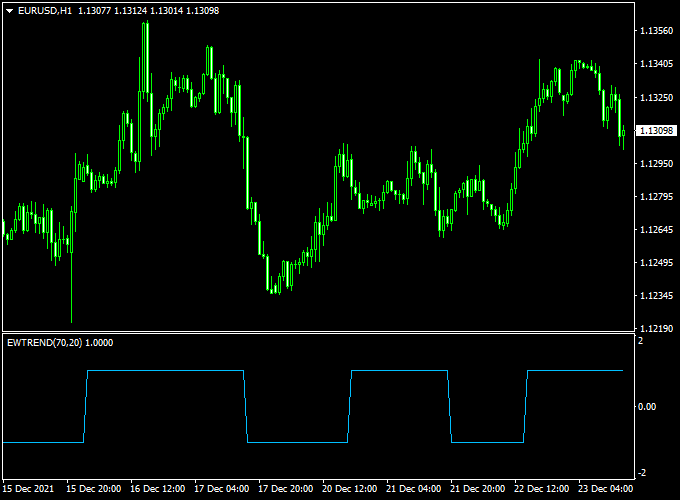

Indicator Chart

The chart below shows the EWTrend Indicator in action on an MT4 chart.

The blue signal line moves between the -2 and 2 extreme levels, providing clear trend-based cues.

Traders can enter buy trades when the line jumps above 0.00 and sell trades when it jumps below 0.00, making it simple to identify scalping opportunities.

Guide to Trade with EWTrend Indicator

Buy Rules

- Initiate a buy trade when the indicator jumps back above the 0.00 level

- Confirm the trend direction on higher timeframes if possible

- Use during active market sessions for best results

Sell Rules

- Initiate a sell trade when the indicator jumps back below the 0.00 level

- Confirm downward trend with higher timeframe analysis or other indicators

- Focus on trades aligned with active market sessions

Stop Loss

- Place a stop loss a few pips beyond recent swing highs or lows

- Adjust stop distance based on asset volatility and timeframe

- Use tighter stops for scalping and wider stops for longer trades

Take Profit

- Set the first target near the next support or resistance level

- Consider partial profits if price approaches a significant pivot point

- Exit the trade if the EWTrend line jumps back across the 0.00 level in the opposite direction

Practical Tips

- Use the indicator primarily during London and U.S. trading sessions

- Combine with other trend or momentum indicators for confirmation

- Monitor higher timeframes to avoid counter-trend scalps

- Focus on liquid currency pairs for better reliability

MT4 Day Trading Strategy: EW Trend & ZWinner Trend

This day trading strategy combines the EW Trend Indicator and ZWinner Trend Indicator for MT4 to identify high-probability trade setups.

The EW Trend Indicator helps determine trend direction based on readings: bullish when above 1.5 and bearish when below -1.5.

The ZWinner Trend Indicator confirms trend strength.

This strategy works best on M5 and M15 charts and is ideal for day traders seeking precise entries and exits.

Buy Entry Rules

- Check that the EW Trend Indicator reading is above 1.5, indicating a bullish trend.

- Confirm that the ZWinner Trend Indicator shows a green bar, indicating upward momentum.

- Enter a buy trade at the close of the confirming candle.

- Place the stop loss below the most recent swing low (e.g., risking 20 pips).

- Set a take profit at twice the risk or exit when the ZWinner indicator shows a red bar.

Sell Entry Rules

- Check that the EW Trend Indicator reading is below -1.5, indicating a bearish trend.

- Confirm that the ZWinner Trend Indicator shows a red bar, indicating downward momentum.

- Enter a sell trade at the close of the confirming candle.

- Place the stop loss above the most recent swing high (e.g., risking 20 pips).

- Set a take profit at twice the risk or exit when the ZWinner indicator shows a green bar.

Advantages

- A clear trend direction based on the EW Trend reading reduces confusion.

- Confirmation from ZWinner improves entry accuracy.

- Can be applied to multiple currency pairs and timeframes.

- Well-defined stop loss and take profit levels simplify risk management.

Drawbacks

- May produce false signals during sideways or choppy markets.

- Requires active monitoring for timely entries and exits.

Case Study 1: EUR/USD (5-Minute Chart)

The EW Trend Indicator reading reached 1.6, signaling a bullish trend.

The ZWinner Trend Indicator displayed a green bar, confirming upward momentum.

A buy trade was entered at 1.2000, with a stop loss at 1.1980 (20 pips risk) and a take profit at 1.2040 (40 pips target).

The price moved upward, hitting the take profit target successfully.

Case Study 2: GBP/USD (15-Minute Chart)

The EW Trend Indicator reading dropped to -1.7, signaling a bearish trend.

The ZWinner Trend Indicator displayed a red bar, confirming downward momentum.

A sell trade was entered at 1.3100, with a stop loss at 1.3125 (25 pips risk) and a take profit at 1.3050 (50 pips target).

The price declined and reached the take profit target, resulting in a profitable trade.

Strategy Tips

- Combine this strategy with support and resistance levels for stronger entries and exits.

- Monitor multiple timeframes: check higher timeframes (H1/H4) to understand the overall trend direction.

- Keep sessions focused on the most active trading hours for each currency pair to improve execution and reduce slippage.

- Consider using trailing stops once the trade moves in your favor to lock in profits.

- Start with smaller position sizes while you build confidence with the strategy before scaling up.

Download Now

Download the “ewtrend-indicator.mq4” indicator for Metatrader 4

FAQ

What is the EWTrend Indicator designed for?

It is a trend-based scalping indicator that helps traders identify short-term buy and sell opportunities using the signal line oscillating between -2 and 2 extremes.

Which timeframe works best?

The indicator works on all timeframes, but scalpers benefit most from lower timeframes during the London and U.S. sessions. Higher timeframes can be used for trend confirmation.

Can it be used for entries and exits?

Yes. Traders can enter trades when the signal line jumps above or below 0.00 and exit when the line crosses back across the midpoint or when a target is reached.

Summary

The EWTrend Indicator for MT4 is a simple and effective scalping tool that identifies short-term trend reversals using the blue signal line.

It is versatile enough to be used alone or combined with other strategies for confirmation.

When used during the London and U.S. trading sessions, it offers high-probability trade setups for scalpers and day traders alike.

By following its signals systematically, traders can improve timing, reduce mistakes, and increase potential profitability.