About the Fan RSI Indicator

The Fan RSI Indicator for MT4 is a momentum-based trend oscillator that combines the traditional RSI with a fan calculation to spot early trend shifts.

It allows traders to detect potential market reversals before larger price movements occur.

This indicator provides a clear visual signal for both buy and sell trades, making it suitable for scalpers, day traders, and swing traders alike.

Its versatility allows it to be used independently or as a confirmation tool alongside other strategies to improve trade timing.

By using the Fan RSI, traders can quickly identify momentum changes across any currency pair, allowing them to enter trades early in the trend.

Free Download

Download the “fan-rsi-indicator.mq4” indicator for MT4

Key Features

- Momentum-based trend oscillator combining RSI and fan calculations

- Early trend detection before larger moves

- Clear buy and sell signals when crossing the 50 level

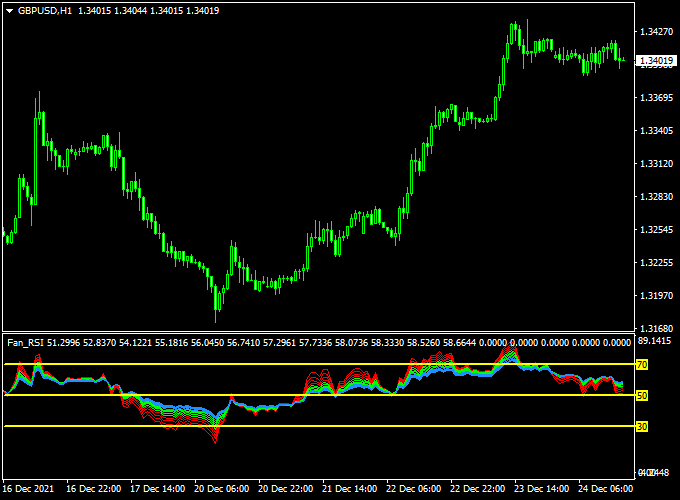

Indicator Chart

The chart below shows the Fan RSI Indicator in action on an MT4 chart.

Buy signals occur when the indicator crosses above the 50 level, while sell signals occur when it crosses below 50.

The fan structure provides a visual representation of trend momentum, helping traders spot early reversals.

Guide to Trade with Fan RSI Indicator

Buy Rules

- Enter a buy trade when the Fan RSI crosses above the 50 level from below

- Confirm the signal with trend direction on higher timeframes

- Look for alignment with overall market momentum

Sell Rules

- Enter a sell trade when the Fan RSI crosses below the 50 level from above

- Confirm downward momentum with higher timeframe analysis or other indicators

- Prefer trades aligned with the prevailing trend

Stop Loss

- Set stop loss slightly beyond recent swing highs for sells or swing lows for buys

- For short-term trades, consider tighter stops to protect capital

- Use ATR-based or volatility-adjusted stops for better flexibility

Take Profit

- Target key support or resistance zones for initial take profit

- Exit the trade if the Fan RSI crosses back across the 50 level in the opposite direction

- Use trailing stops during strong trending moves to maximize gains

Practical Tips

- Combine Fan RSI with trend indicators or moving averages for added confirmation

- Monitor higher timeframes to confirm trend strength before entering trades

- Focus on highly liquid currency pairs to reduce false signals

Fan RSI + Awesome Oscillator Forex Scalping Strategy for MT4

This scalping strategy pairs the Fan RSI (MT4) with the Awesome Oscillator (MT4).

The Fan RSI gives a clear entry when it crosses the 50 level. The Awesome Oscillator confirms momentum, so you avoid slow, choppy moves.

The system targets quick moves on short time frames.

Use 1, 5, or 15-minute charts. The best pairs are liquid majors like EURUSD, GBPUSD, USDJPY, and USDCAD.

Trade during active sessions. The overlap of London and New York is ideal.

This approach is for scalpers who want frequent, defined trades and strict risk control.

It is not for swing traders or investors who want to hold positions for days.

Setup

Attach both indicators to your MT4 chart. Use default settings for Fan RSI and the standard Awesome Oscillator.

Choose a timeframe based on how many trades you want.

M1 for very active scalpers, M5 for a balance, M15 for fewer trades and wider stops.

Buy Entry Rules

- Fan RSI crosses above the 50 level from below. This is the primary trigger.

- Awesome Oscillator must show a green bar above the zero level.

- Enter a market buy on the close of the confirming candle.

- Stop loss: place SL below the most recent local swing low.

- Suggested SL: M1 = 8–12 pips, M5 = 12–20 pips, M15 = 18–30 pips.

- Take profit: first target at 1× risk. Second target at 2× risk for partial exit or trailing.

- Alternative exit: close remaining position when AO turns red or Fan RSI falls back below 55.

Sell Entry Rules

- Fan RSI crosses below the 50 level from above. This is the primary trigger.

- Awesome Oscillator must show a red bar below the zero level.

- Enter a market sell on the close of the confirming candle.

- Stop loss: place SL above the most recent local swing high.

- Suggested SL: M1 = 8–12 pips, M5 = 12–20 pips, M15 = 18–30 pips.

- Take profit: first target at 1× risk. Second target at 2× risk or trail until AO shows a green bar.

- Do not hold trades overnight. This is a pure intraday scalping method.

Advantages

- Clear and simple entries reduce hesitation in fast markets.

- Momentum confirmation from the Awesome Oscillator filters weak moves.

- Short time frames create frequent opportunities.

- Defined stop and take profit rules make risk management easier.

- Works well on major pairs with tight spreads.

Drawbacks

- Many small trades increase transaction costs. Commissions and spreads matter.

- Slippage can hurt results on M1 during volatile news events.

- Not suitable for brokers with wide spreads or high latency.

Case Study 1 — EURUSD 5-Minute Scalping

During a London morning session, the Fan RSI crossed above 50.

The Awesome Oscillator printed a green bar above the zero level.

These two confirmations aligned on the same candle close. Entry was placed at 1.1020.

Stop loss was 12 pips below at 1.1008. First take profit was set at 1.1032 for a 12 pip gain.

Price hit the first target within eight candles. A second partial exit at 2× risk was taken at 1.1044.

The trade delivered 24 pips in total. The rules were followed, and risk was respected.

Case Study 2 — GBPUSD 1-Minute Quick Flip

At the New York open, the Fan RSI dipped then crossed up through 50.

The Awesome Oscillator printed a rising green bar above 0.

Entry at 1.2575 with SL at 1.2567, eight pips risk. TP1 at 1.2583 was hit within six minutes.

AO turned red shortly after, so the remaining position was closed.

The net result was 6–8 pips after spread and commission.

The trade fit the scalping plan and preserved capital when the momentum faded.

Strategy Tips

- Trade when spreads are low. Avoid trading around major economic news.

- Use a fixed fraction of account risk per trade. Typical risk is 0.5% to 1% of equity.

- Keep lot sizes small on M1 and M5 to control slippage and drawdown.

- Take partial profits to lock gains and trail the remainder with a break-even stop once price moves 1× risk in your favor.

- Backtest this strategy with your broker’s spreads and execution model before trading live.

Download Now

Download the “fan-rsi-indicator.mq4” indicator for Metatrader 4

FAQ

How does the Fan RSI generate buy and sell signals?

The indicator generates buy signals when it crosses above the 50 level and sell signals when it crosses below 50, reflecting momentum changes in the market.

Can it detect trend reversals early?

Yes. The fan component allows the indicator to signal potential trend changes before the main price movement occurs, giving traders an early entry advantage.

Summary

The Fan RSI Indicator for MT4 is a powerful momentum-based tool that helps traders detect early trend changes using a combined RSI and fan methodology.

Its multi-timeframe and multi-pair compatibility make it suitable for scalping, day trading, and swing trading.

By using the indicator’s signals systematically, traders can improve timing, enhance accuracy, and better manage risk while capturing high-probability trade opportunities.