About the Forex Awesome Breakout Box Indicator

The Forex Awesome Breakout Box indicator for MT4 is a price action tool designed to capture strong breakout moves after periods of consolidation.

It automatically draws a box around recent market activity, highlighting areas where the price has been ranging before a potential expansion.

Once the box is formed, traders wait for the price to break and close outside its boundaries.

This approach helps identify moments when market participation increases and momentum enters the market.

Because the logic is visual and rule-based, it is well suited for beginner traders while still offering value to experienced breakout traders.

The indicator performs best on actively traded currency pairs such as EUR/USD, GBP/USD, USD/JPY, and GBP/JPY, where breakout momentum tends to follow consolidation phases more reliably.

Free Download

Download the “forex-breakout-box.ex4” indicator for MT4

Key Features

- Automatically draws breakout boxes around recent price ranges

- Works on all timeframes and major Forex pairs

- Ideal for trading volatility expansion and momentum

- Easy-to-follow breakout rules with no complex settings

- Suitable for beginners and advanced traders alike

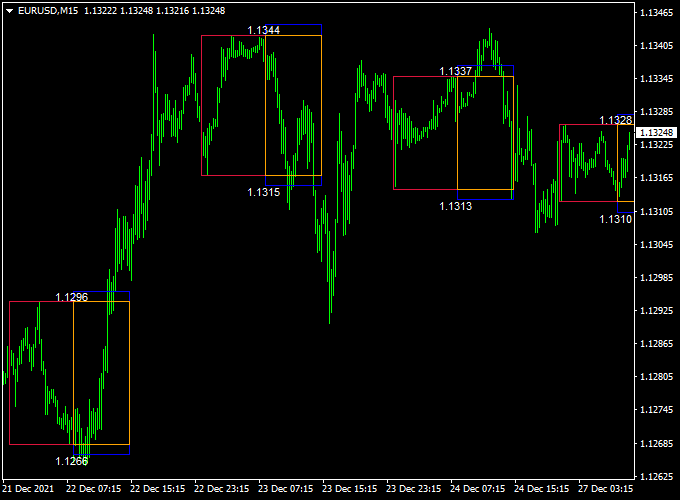

Indicator Chart

The chart shows a rectangular box drawn around recent price consolidation.

When the price closes above the upper boundary, it signals bullish breakout potential. A close below the lower boundary suggests bearish momentum entering the market.

Guide to Trade with the Forex Awesome Breakout Box

Buy Rules

- Wait for the price to break and close above the top of the breakout box.

- Enter the trade at the close of the breakout candle or on a minor pullback.

- Avoid entries if price breaks during very low volatility periods.

Sell Rules

- Wait for the price to break and close below the bottom of the breakout box.

- Enter at candle close or after a brief retest of the box boundary.

- Confirm direction with increased candle size or momentum.

Stop Loss Placement

- Buy trades: place the stop a few pips inside the breakout box, below the upper boundary.

- Sell trades: place the stop a few pips inside the breakout box, above the lower boundary.

- Optionally, use a fixed pip buffer based on the box height.

Take Profit Targets

- Project the height of the breakout box in the direction of the trade.

- Secure partial profits once the price moves one box range.

- Let the remaining positions run using candle-close or trailing logic.

Practical Trading Tips

- Focus on the London and New York sessions for stronger breakouts.

- Ignore boxes formed during major news announcements.

- Combine with a higher-timeframe trend bias for better consistency.

MT4 Intraday Strategy: Forex Awesome Breakout Box + Triple Exponential Moving Average

This intraday strategy combines the Forex Awesome Breakout Box with the Triple Exponential Moving Average (TEMA) to identify strong intraday entries.

A candlestick closing above the Breakout Box signals a bullish move, while a close below signals a bearish move.

The TEMA provides trend confirmation: the green line indicates bullish momentum, and the red line signals bearish momentum.

Combining these indicators helps traders filter out false breakouts and take high-probability intraday trades on 5-minute, 15-minute, or 30-minute charts.

Buy Entry Rules

- Candle closes above the Forex Awesome Breakout Box indicator.

- TEMA line is green, confirming bullish momentum.

- Enter a buy trade at the close of the confirming candle.

- Place a stop loss below the recent swing low or below the breakout box lower boundary.

- Set take profit at the next intraday resistance or a fixed pip target (e.g., 20–30 pips depending on volatility).

Sell Entry Rules

- Candle closes below the Forex Awesome Breakout Box.

- TEMA line is red, confirming bearish momentum.

- Enter a sell trade at the close of the confirming candle.

- Place a stop loss above the recent swing high or above the breakout box upper boundary.

- Set take profit at the next intraday support or a fixed pip target (e.g., 20–30 pips depending on volatility).

Advantages

- Breakout signals combined with TEMA trend confirmation improve accuracy.

- Clear entry and exit points reduce indecision during intraday trading.

- Effective on multiple intraday timeframes (5M, 15M, 30M).

- Flexible take profit allows adaptation to market conditions.

Drawbacks

- False breakouts can occur during low-volatility or range-bound sessions.

- Requires confirmation from both indicators, which may reduce trade frequency.

- Stop losses must be monitored carefully during volatile spikes.

Case Study 1: EUR/USD on 5-Minute Chart

During the London session, a candlestick closed above the Breakout Box while the TEMA line was green, confirming bullish momentum.

A buy trade was entered at 1.1015.

The recent swing low was 1.1005, and the stop loss was set at 1.1002 (13 pips risk).

The next intraday resistance was at 1.1040, which became the take profit target.

Price moved upward and reached the target, providing 25 pips of profit.

Case Study 2: GBP/JPY on 15-Minute Chart

During the New York session, a candlestick closed below the Breakout Box while the TEMA line was red, confirming bearish momentum.

A sell trade was entered at 164.75.

The recent swing high was 164.90, so the stop loss was placed at 164.95 (20 pips risk).

The next intraday support was at 164.50, which became the take profit target.

Price moved downward and hit the target, giving 25 pips profit.

Strategy Tips

- Trade major pairs during high-liquidity sessions for tighter spreads and stronger breakout moves.

- Confirm both the Breakout Box and TEMA line before entering trades.

- Adjust take profit levels according to nearby support/resistance or fixed pip targets for fast intraday moves.

- Consider trailing stops once the price moves in favor to lock in profits.

Download Now

Download the “forex-breakout-box.ex4” indicator for Metatrader 4

FAQ

Does the breakout box repaint once drawn?

No. Once the box is formed, its boundaries remain fixed until a new range is identified.

Can false breakouts occur?

Yes. Like all breakout systems, false moves can happen. Waiting for candle closes and momentum confirmation helps reduce this risk.

Is this indicator suitable for range traders?

No. This tool is specifically designed for breakout conditions rather than range-bound strategies.

Summary

The Forex Awesome Breakout Box indicator for MT4 offers a simple yet effective way to trade volatility expansion after consolidation.

Its straightforward rules, adaptable risk management, and compatibility with major currency pairs make it a solid addition to any breakout-based trading approach.

When combined with session timing and basic momentum confirmation, the indicator can deliver consistent trading opportunities.